- United States

- /

- Entertainment

- /

- NasdaqGS:TTWO

Take-Two Interactive Software (NasdaqGS:TTWO) Pursues Acquisitions with US$1B Equity Offering

Reviewed by Simply Wall St

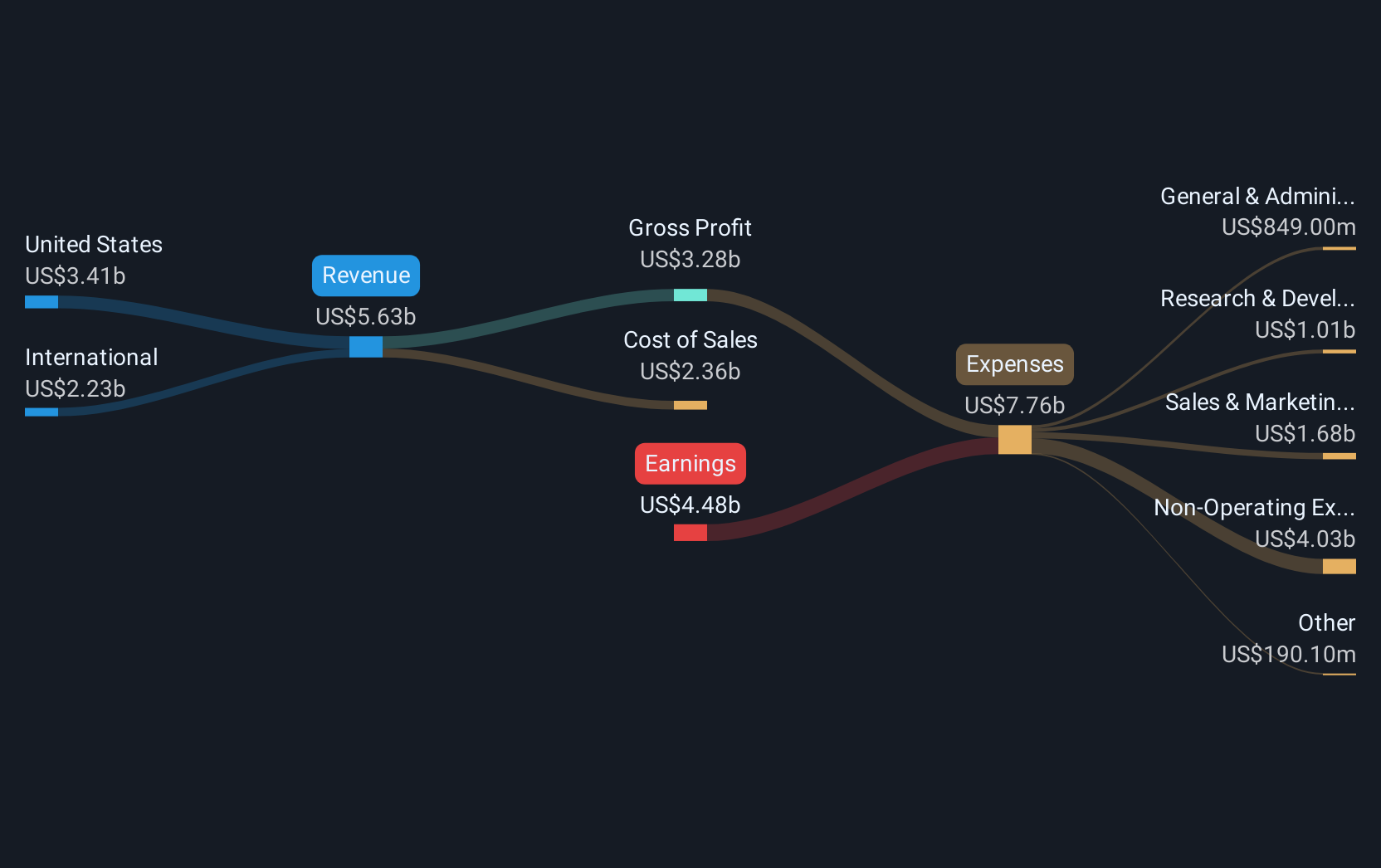

Take-Two Interactive Software (NasdaqGS:TTWO) recently pursued acquisition opportunities and completed a significant follow-on equity offering of $1.07 billion, indicating an active strategic focus. These corporate moves appeared concurrent with an 11.62% price increase over the last month. While the broader market saw slight fluctuations with the S&P 500 slightly down and Nasdaq Composite gaining marginally, Take-Two's efforts might have reinforced investor confidence. Despite reported impairments and a wider net loss, the company’s intention to utilize public offering proceeds for acquisitions and debt repayment, alongside a new game launch, may have supported its price rise amidst generally cautious market sentiment.

Outshine the giants: these 28 early-stage AI stocks could fund your retirement.

The recent acquisition activities and the completion of a follow-on equity offering by Take-Two Interactive Software highlight their focus on growth and debt management. While these strategic actions have contributed to a recent share price increase of 11.62%, it's essential to analyze their potential impact on the company's broader narrative of growth through new game releases and enhanced marketing. Analysts forecast that recent moves, including increased financing for acquisitions and debt repayment, will potentially bolster revenue growth and earnings as new titles launch.

Over the past three years, Take-Two's total shareholder returns, inclusive of share price movements and dividends, reached 93.58%. This impressive longer-term performance contrasts with the company's one-year results, which show that Take-Two matched the US Entertainment industry's return of 56.4%. The consistency in performance underscores the company's ability to leverage its gaming portfolio effectively.

The anticipation surrounding upcoming titles like Grand Theft Auto VI and other key releases is expected to influence revenue forecasts positively. Despite currently posting earnings losses, the strategic infusion of new capital, and the focus on expanding franchises such as NBA 2K, could drive substantial revenue and earnings growth. Analysts have set a consensus price target of US$223.96, close to the present share price of US$231.84, indicating a belief that the company is fairly valued. Investors should consider these developments when assessing potential risks and growth opportunities within Take-Two's broader business strategy.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Take-Two Interactive Software might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TTWO

Take-Two Interactive Software

Develops, publishes, and markets interactive entertainment solutions for consumers worldwide.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion