- United States

- /

- Entertainment

- /

- NasdaqGS:TTWO

Market is Growing Impatient With Take-Two Interactive Software, Inc. (NASDAQ:TTWO)

While COVID-19 lockdowns sent ripples through the markets, some sectors rode the tidal wave to a new high. In 2020, global gaming sales rose 20%, reaching US$180 billion.

Take-Two Interactive Software (NASDAQ: TTWO) thrived in this environment, quickly reversing the losses to rally almost 80%, but in 2021 the stock ran out of steam, dipping 20% in the red year-to-date.

Today, we will examine the return on equity (ROE) to uncover how effective the company is in reinvesting its capital.

The Latest Earnings Results

- GAAP EPS of US$1.30 (beat by US$0.27)

- Net bookings US$ 711.4m (beat by US$261m)

- 2022 guidance – net bookings from US$3.2 to US$3.3b (consensus US$3.43b)

The company remains elusive about its future releases, and that doesn't bode well with the investors, who are hungry for any information about Grand Theft Auto VI. The latest game in the franchise sold over 145 million copies worldwide, including 20 million in 2020, even though the game is almost 8 years old.

Meanwhile, the company keeps expanding, acquiring HB Studios, the developer of PGA Tour but also signing a multi-year deal with Tiger Woods to ensure that the game that sold over 2 million copies continues to thrive.

Yet, investors are growing restless, punishing the company for not delivering more robust guidance and pushing back the schedule for 2022.

See our latest analysis for Take-Two Interactive Software

How Is ROE Calculated?

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Take-Two Interactive Software is:

18% = US$653m ÷ US$3.6b (Based on the trailing twelve months to June 2021).

The "return" is the income the business earned over the last year. Another way to think of that is that for every $1 worth of equity, the company was able to earn $0.18 in profit.

What Is The Relationship Between ROE And Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. We now need to evaluate how much profit the company reinvests or "retains" for future growth, which gives us an idea about the company's growth potential. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the company's growth rate compared to companies that don't necessarily bear these characteristics.

A Side By Side comparison of Take-Two Interactive Software's Earnings Growth And 18% ROE

At first glance, Take-Two Interactive Software seems to have a decent ROE. On comparing with the average industry, ROE of 12%, the company's ROE looks pretty remarkable.

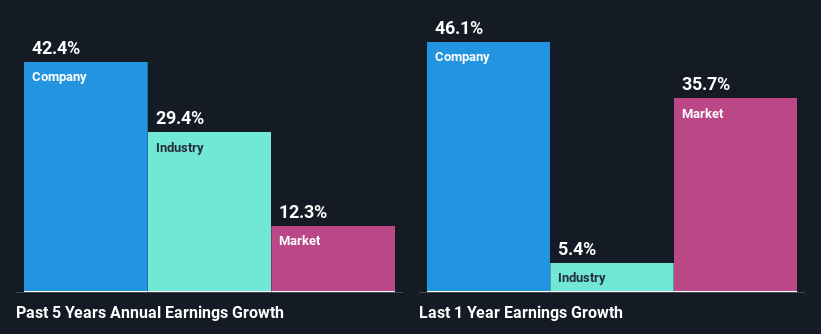

This probably laid the ground for Take-Two Interactive Software's significant 42% net income growth seen over the past five years. We reckon that there could also be other factors at play here. For example, it is possible that the company's management has made some good strategic decisions or that the company has a low payout ratio.

As a next step, we compared Take-Two Interactive Software's net income growth with the industry, and pleasingly, we found that the growth seen by the company is higher than the average industry growth of 29%.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth.

Is Take-Two Interactive Software fairly valued compared to other companies? These 3 valuation measures might help you decide.

Summary

On the whole, we feel that Take-Two Interactive Software's performance has been quite good. Notably, we like that the company is reinvesting heavily into its business and at a high rate of return. Unsurprisingly, this has led to impressive earnings growth.

With that said, the latest industry analyst forecasts reveal that the company's earnings growth is expected to slow down, which is not surprising given where we are in the life cycle of some of their biggest franchise games.

To know more about the company's future earnings growth forecasts, take a look at this free report on analyst forecasts to find out more.

Valuation is complex, but we're here to simplify it.

Discover if Take-Two Interactive Software might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NasdaqGS:TTWO

Take-Two Interactive Software

Develops, publishes, and markets interactive entertainment solutions for consumers worldwide.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives