- United States

- /

- Entertainment

- /

- NasdaqGS:TTWO

Assessing Take-Two Interactive Software (TTWO) Valuation As Recent Share Price Momentum Softens

Stock performance snapshot and recent context

Take-Two Interactive Software (TTWO) has seen mixed recent performance, with the share price near US$240.61, a small gain over the past day but declines over the past week, month and past 3 months.

See our latest analysis for Take-Two Interactive Software.

Looking beyond the latest move, Take-Two’s recent share price returns over 1 day, 7 days and 3 months have softened, while its 1 year and 3 year total shareholder returns remain much stronger. This suggests that earlier optimism has cooled recently as investors reassess growth potential and risk.

If you are comparing Take-Two with other gaming and media names, it can also be useful to step back and see how broader tech and content related trends are playing out across high growth tech and AI stocks.

With the share price near US$240.61, strong multi year returns but a reported net loss of US$3,997.2m, are you looking at an undervalued games publisher here, or is the market already pricing in future growth?

Most Popular Narrative: 13.3% Undervalued

Against the last close of US$240.61, the most followed narrative points to a fair value near US$277.40, drawing on detailed growth, margin and valuation forecasts.

Strategic investments in technology, AI, and content pipeline efficiency, alongside a strong release slate with multiple high-profile launches (including Borderlands 4, NBA 2K26, and Mafia: The Old Country), support management's outlook for record net bookings and enhanced profitability in the coming years.

Curious how record net bookings, rising margins, and a premium future P/E are all incorporated into one price tag? The earnings curve and revenue mix doing the heavy lifting here might surprise you. If you want to see which assumptions have to align for that fair value to hold, the full narrative lays it all out.

Result: Fair Value of $277.40 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this hinges on major franchises like Grand Theft Auto and NBA 2K delivering, and on rising development costs not eroding the margin story.

Find out about the key risks to this Take-Two Interactive Software narrative.

Another View: Market Pricing Looks Full

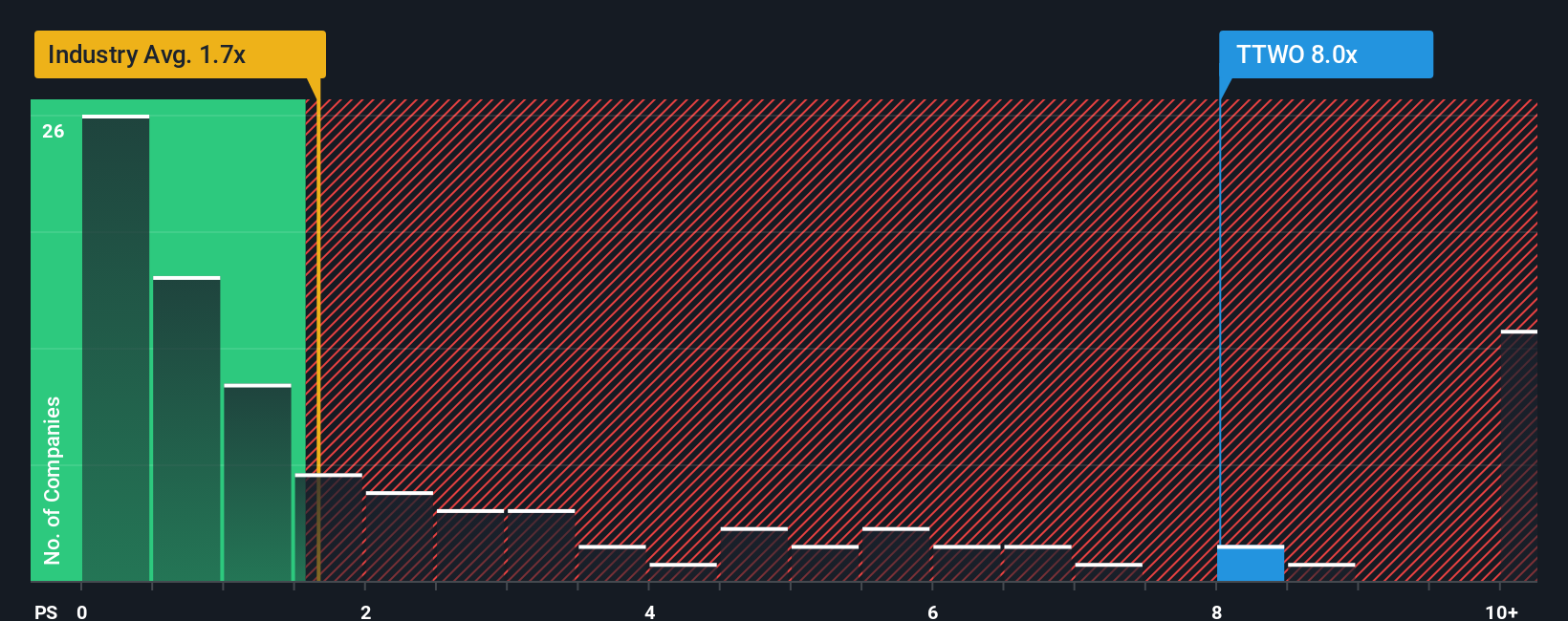

That 13.3% undervalued narrative sits uncomfortably beside how the market is actually pricing Take Two today. On a P/S of 7.1x, the stock trades well above the US Entertainment average of 1.6x and above an estimated fair ratio of 4.5x, suggesting limited margin for error if growth or margins slip.

That gap can be read as confidence in future earnings power or as valuation risk that could unwind if expectations reset. Which side of that trade do you feel more comfortable on?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Take-Two Interactive Software Narrative

If your view differs or you would rather weigh the numbers yourself, you can pull the data, stress test your own assumptions, and Do it your way in a few minutes.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Take-Two Interactive Software.

Looking for more investment ideas?

If you stop with just one stock, you might miss other opportunities entirely, so take a few minutes to scan the wider market for ideas that better fit your style.

- Target potential bargains first by reviewing these 872 undervalued stocks based on cash flows that appear cheap relative to their cash flows and might suit a value focused watchlist.

- Tap into future facing themes through these 24 AI penny stocks that link artificial intelligence with companies already listed and ready for deeper fundamental work.

- Boost your income watchlist by checking these 13 dividend stocks with yields > 3% that combine higher yields with the transparency of listed equities.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Take-Two Interactive Software might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TTWO

Take-Two Interactive Software

Develops, publishes, and markets interactive entertainment solutions for consumers worldwide.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

An Undervalued 3.3Moz Gold Project in Canada

SoFi Technologies: The Apex Aggregator and the Infrastructure of the Modern Financial System

CSL: The Dip Is the Opportunity

DHT Holdings, inc: Strait of Hormuz Risk Amidst US-Israel vs Iran Tensions Spikes VLCC Rates.

Recently Updated Narratives

Near zero debt, Japan centric focus provides future growth

Wesfarmers Limited is a high-quality, stable long-term compounder, though it often trades at a premium valuation.

IonQ: Exceptional Technology but Valuation Far Ahead of Financial Reality

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks