- United States

- /

- Media

- /

- NasdaqGM:TTGT

TechTarget Shareholders Have Enjoyed An Impressive 148% Share Price Gain

When you buy a stock there is always a possibility that it could drop 100%. But on the bright side, you can make far more than 100% on a really good stock. One great example is TechTarget, Inc. (NASDAQ:TTGT) which saw its share price drive 148% higher over five years. Also pleasing for shareholders was the 16% gain in the last three months.

Check out our latest analysis for TechTarget

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

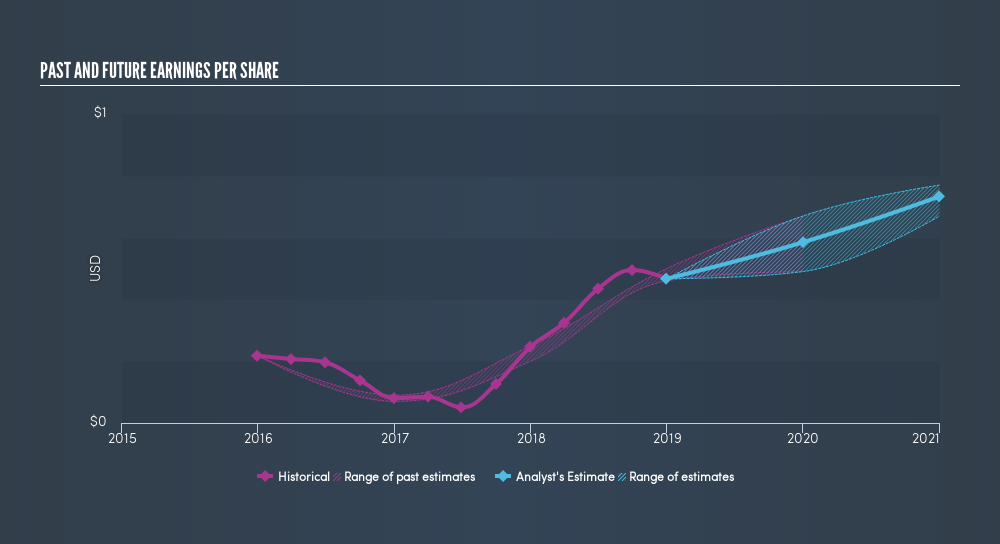

During the last half decade, TechTarget became profitable. Sometimes, the start of profitability is a major inflection point that can signal fast earnings growth to come, which in turn justifies very strong share price gains. Since the company was unprofitable five years ago, but not three years ago, it's worth taking a look at the returns in the last three years, too. We can see that the TechTarget share price is up 125% in the last three years. Meanwhile, EPS is up 29% per year. That makes the EPS growth rather close to the annualized share price gain of 31% over the same period. So one might argue that investor sentiment towards the stock hss not changed much over time. There's a strong correlation between the share price and EPS.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We know that TechTarget has improved its bottom line lately, but is it going to grow revenue? This freereport showing analyst revenue forecasts should help you figure out if the EPS growth can be sustained.

A Different Perspective

While the broader market gained around 3.5% in the last year, TechTarget shareholders lost 11%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 20% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. Before spending more time on TechTarget it might be wise to click here to see if insiders have been buying or selling shares.

We will like TechTarget better if we see some big insider buys. While we wait, check out this freelist of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGM:TTGT

TechTarget

Provides marketing and sales services that deliver business impact for business-to-business technology companies in North America and internationally.

Moderate growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives