- United States

- /

- Media

- /

- NasdaqGM:TTD

Why Investors Shouldn't Be Surprised By The Trade Desk, Inc.'s (NASDAQ:TTD) 37% Share Price Surge

The Trade Desk, Inc. (NASDAQ:TTD) shareholders have had their patience rewarded with a 37% share price jump in the last month. The last 30 days bring the annual gain to a very sharp 47%.

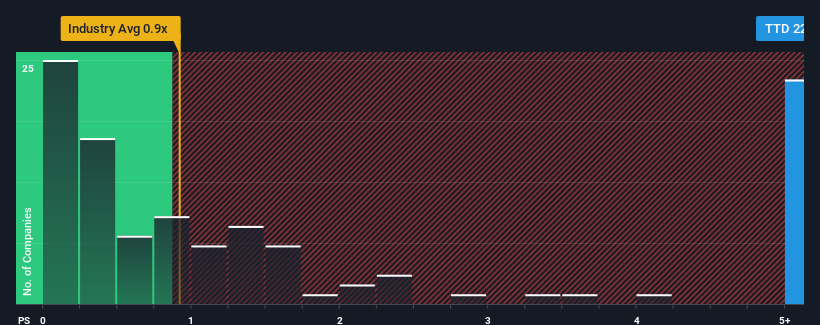

Following the firm bounce in price, given around half the companies in the United States' Media industry have price-to-sales ratios (or "P/S") below 0.9x, you may consider Trade Desk as a stock to avoid entirely with its 22.3x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for Trade Desk

How Trade Desk Has Been Performing

With revenue growth that's superior to most other companies of late, Trade Desk has been doing relatively well. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. If not, then existing shareholders might be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Trade Desk.Is There Enough Revenue Growth Forecasted For Trade Desk?

The only time you'd be truly comfortable seeing a P/S as steep as Trade Desk's is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered an exceptional 23% gain to the company's top line. The latest three year period has also seen an excellent 133% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 23% per annum during the coming three years according to the analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 5.3% per annum, which is noticeably less attractive.

In light of this, it's understandable that Trade Desk's P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

Shares in Trade Desk have seen a strong upwards swing lately, which has really helped boost its P/S figure. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our look into Trade Desk shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless these conditions change, they will continue to provide strong support to the share price.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for Trade Desk with six simple checks on some of these key factors.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Trade Desk might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:TTD

Trade Desk

Operates as a technology company in the United States and internationally.

Flawless balance sheet with high growth potential.