- United States

- /

- Media

- /

- NasdaqGM:TTD

Trade Desk (NasdaqGM:TTD) Stock Drops 10% Over the Last Week

Reviewed by Simply Wall St

The Trade Desk (NasdaqGM:TTD) experienced significant changes recently, including the resignation of board member David Wells and the appointment of Will Platt-Higgins as Executive Vice President of Business Development. While last week's 10% decline in the company's share price might seem concerning, it's vital to consider it within the context of broader market movements and sector trends. The tech sector, including prominent companies like Nvidia and Microsoft, faced pressure from U.S.-China trade tensions and broader macroeconomic uncertainties. Therefore, Trade Desk's decline aligns with these broader market challenges rather than being solely driven by company-specific events.

Every company has risks, and we've spotted 1 weakness for Trade Desk you should know about.

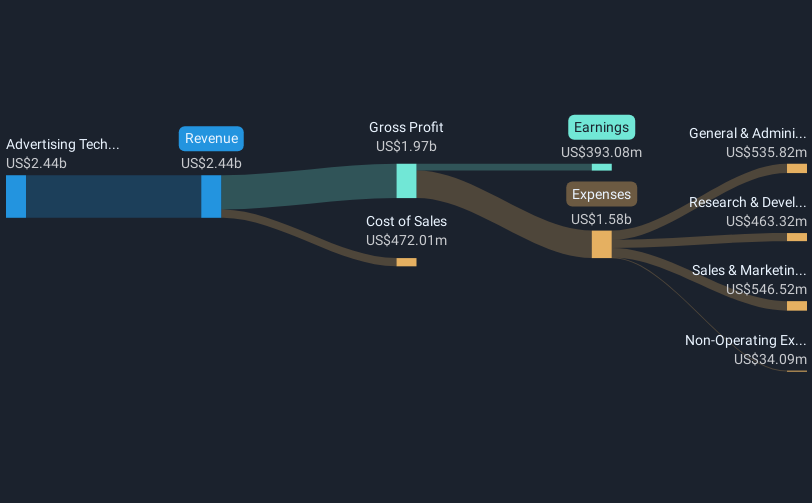

The recent changes at The Trade Desk, including the departure of David Wells and the appointment of Will Platt-Higgins, suggest a potential shift in focus within the company's leadership structure. This could impact the delivery on their narrative of enhancing AI capabilities and reorganizing for growth. While recent news partly explains last week's 10% decline in share price, it is essential to recognize the company's remarkable total return of 98.41% over the last five years, despite underperforming the US market with a 4.6% increase in the past year.

Compared to the broader tech sector's challenges, The Trade Desk's long-term performance remains strong. However, these leadership changes may bring short-term uncertainty to revenue and earnings forecasts. Analysts forecast revenue to reach $4.1 billion and earnings to jump significantly to $844 million by 2028, contingent on effective implementation of planned strategies.

With a current share price of $45.27, a substantial disparity exists between today's value and the consensus price target of $96.81. This gap indicates potential appreciation if the company's restructuring and AI initiatives successfully enhance operational efficiency. Investors should observe how the company's realignment with these new appointments might impact its trajectory toward expected targets.

Examine Trade Desk's earnings growth report to understand how analysts expect it to perform.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trade Desk might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:TTD

Trade Desk

Operates as a technology company in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives