- United States

- /

- Media

- /

- NasdaqGM:TTD

Trade Desk (NasdaqGM:TTD) Sees 13% Price Surge Last Week

Reviewed by Simply Wall St

Trade Desk (NasdaqGM:TTD) recently experienced significant leadership shifts, including David Wells' decision to leave the board in April 2025 and the new appointment of Will Platt-Higgins as EVP of Business Development for North America. Despite the broader market downturn with indices like the Nasdaq Composite declining, Trade Desk saw a 13% price increase last week, aligning positively with this executive transition. Meanwhile, tech stocks broadly faced challenges, with major players like Nvidia and Tesla dragging the sector lower. These internal changes at Trade Desk may suggest investor confidence amidst mixed market signals for tech companies.

Trade Desk has 1 risk we think you should know about.

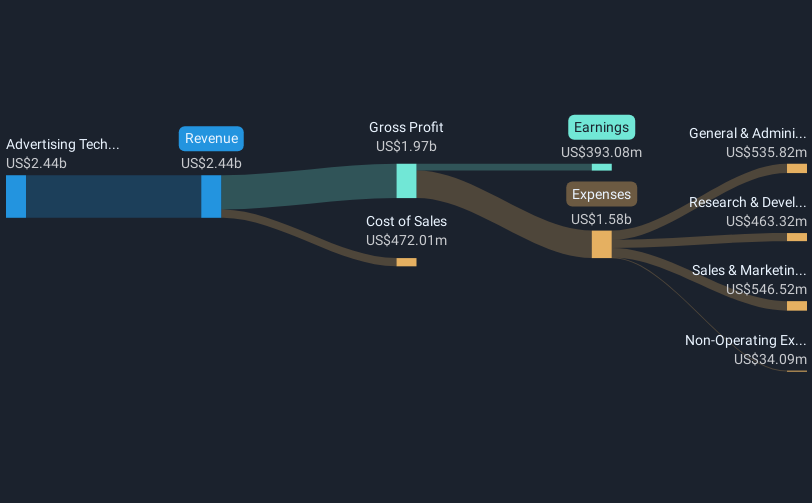

The recent leadership changes at Trade Desk, including high-profile appointments and departures, come at a time of mixed investor sentiment. While the short-term share price surged by 13%, reflecting a positive market reaction, the long-term total return over the past five years stands at 85.77%, illustrating a robust overall growth trajectory. This performance is noteworthy against a backdrop of broader market difficulties, where Trade Desk underperformed the U.S. Media industry with a -4.3% return over the past year compared to the market growth of 7.5%.

These executive shifts could significantly impact the company's forward-looking strategies, potentially influencing revenue growth and earnings forecasts. The focus on AI integration and company restructuring aims to enhance operational efficiencies and foster stronger client relationships, which may support improved financial outcomes. Analysts forecast a revenue growth of 18.2% annually over the next three years, suggesting confidence in these internal changes positively affecting performance metrics.

In terms of valuation, the current share price of US$48.66 represents a discount to the analyst consensus price target of US$91.92. This gap reflects potential upside based on anticipated earnings growth, with expectations that earnings will reach US$833.9 million by 2028. Such projections hinge on the successful implementation of strategic initiatives, the ability to overcome competitive pressures, and the impact of increased expenses on net margins. Investors will closely monitor how these factors evolve, ensuring alignment with the bullish outlook embedded in the current price target.

Take a closer look at Trade Desk's potential here in our financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trade Desk might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:TTD

Trade Desk

Operates as a technology company in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives