- United States

- /

- Media

- /

- NasdaqGM:TTD

Trade Desk (NasdaqGM:TTD) Drops 10% After Securities Fraud Class Action Lawsuit News

Reviewed by Simply Wall St

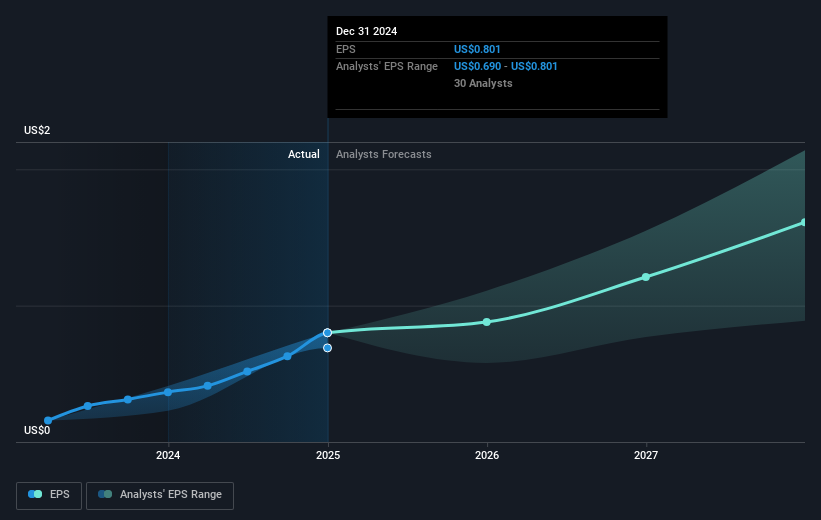

Following the announcement of a securities fraud class action lawsuit regarding undisclosed issues with the AI tool Kokai, The Trade Desk (NasdaqGM:TTD) saw its share price decline by 10% over the past week. Despite reporting strong fourth quarter results with a sales increase to $741 million and net income rising to $182 million, the legal challenges seem to overshadow these achievements. Additionally, political and economic uncertainty surrounding new tariffs, which contributed to the tech-heavy Nasdaq's 4% slide, likely exacerbated the pressure on Trade Desk's share price. Within a market that experienced a 4.6% drop amidst fears of broad economic impacts, The Trade Desk's new board member appointment and ongoing stock buyback appear to be insufficient mitigants to investor concerns influenced by macroeconomic trends and internal legal issues.

Navigate through the intricacies of Trade Desk with our comprehensive report here.

The Trade Desk, over the past five years, delivered a total return of 275.79%, indicating significant growth despite recent headwinds. Notably, 2024 and early 2025 have been challenging due to legal proceedings regarding their AI platform, Kokai. However, these challenges didn't fully eclipse the company's achievements in forming partnerships, such as with iHeartMedia and Ezoic, which strengthened their digital advertising capabilities. Additionally, client adoptions of Unified ID 2.0 bolstered their market presence.

Financially, The Trade Desk has seen robust earnings growth, evidenced by their strong earnings announcements showing remarkable revenue and net income increases. This financial momentum was supported by extensive share buybacks, including a US$564 million expansion of their equity repurchase plan, signaling confidence in their long-term prospects. Overall, these elements collectively contributed to the 275.79% return over the five years, despite underperformance compared to broader market trends over the past year.

- See whether Trade Desk's current market price aligns with its intrinsic value in our detailed report

- Uncover the uncertainties that could impact Trade Desk's future growth—read our risk evaluation here.

- Already own Trade Desk? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trade Desk might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:TTD

Trade Desk

Operates as a technology company in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives