- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:TRIP

Tripadvisor (TRIP) Stock: Evaluating Valuation After Recent Share Price Decline

Reviewed by Kshitija Bhandaru

Tripadvisor (TRIP) shares have been under pressure lately, with the stock slipping around 16% over the past month. Investors are evaluating how recent headwinds and shifting travel trends could affect Tripadvisor’s strategy and valuation going forward.

See our latest analysis for Tripadvisor.

Tripadvisor’s share price has lost momentum lately, sliding 15.9% over the past month as investors react to shifting travel patterns and macroeconomic uncertainty. Even so, its 1-year total shareholder return remains just in positive territory. Longer-term results underscore ongoing volatility and market skepticism about sustainable growth and value.

If you’re weighing your next move, this could be the perfect time to broaden your search and discover fast growing stocks with high insider ownership

But with Tripadvisor’s stock now trading at a notable discount to analyst targets and shares off their recent highs, is this a hidden value play for investors, or is the market correctly factoring in all future growth?

Most Popular Narrative: 17.9% Undervalued

Tripadvisor’s most closely watched narrative suggests the fair value sits well above the $14.91 last close, pointing to strong upside potential for the stock if consensus assumptions play out. This sets the stage for a detailed look behind the high expectations driving the valuation.

"Expansion into experiential travel and new B2B offerings is strengthening growth, improving cash flow predictability, and increasing Tripadvisor's long-term addressable market. Investment in AI, personalized recommendations, and loyalty programs is driving deeper user engagement, enhancing margins, and reducing dependence on expensive third-party channels."

Think the price target is optimistic? The narrative’s core rests on ambitious revenue growth, margin expansion, and a future profit multiple that could surprise the skeptics. Want the exact projections and controversial assumptions behind this bold valuation? See what analysts are betting on, available only in the complete narrative.

Result: Fair Value of $18.16 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent declines in organic traffic and intensifying competition from travel super-apps could still threaten Tripadvisor’s ability to grow profitably in the years ahead.

Find out about the key risks to this Tripadvisor narrative.

Another View: Multiples Paint a Cautious Picture

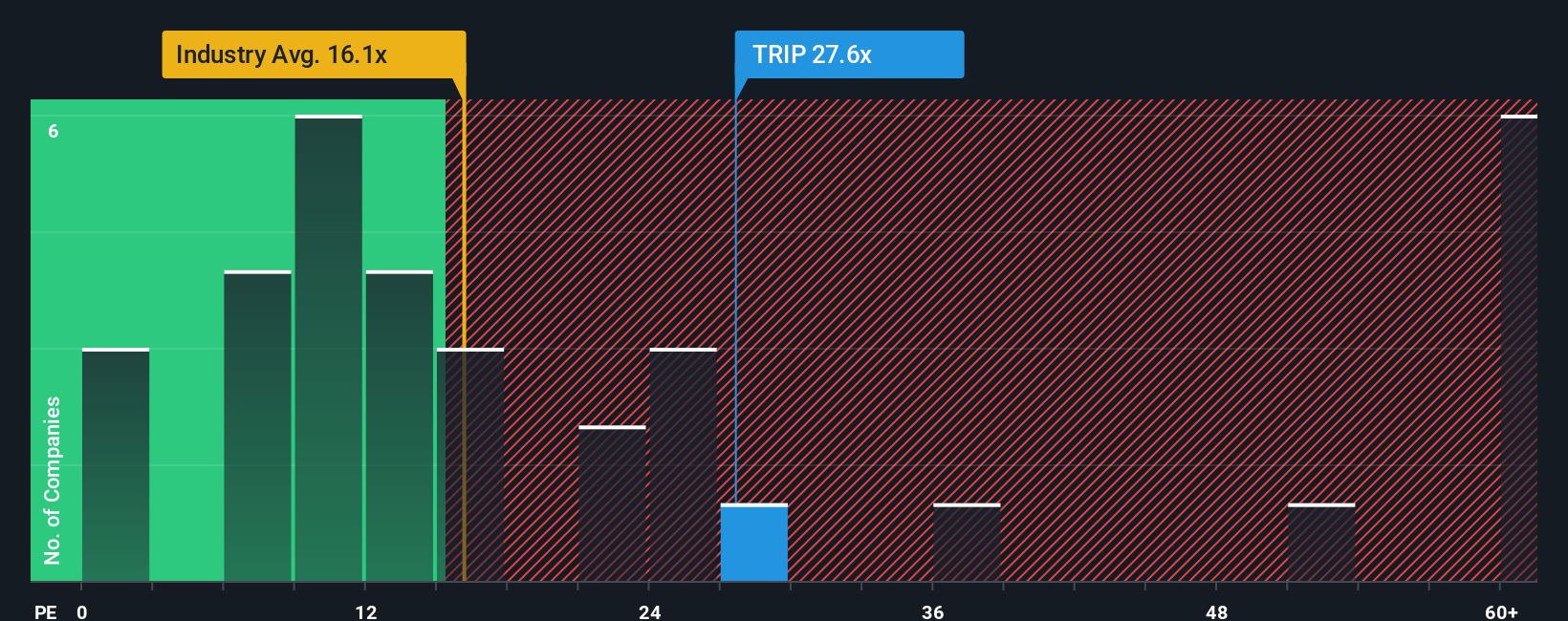

While some see upside based on fair value, the market’s most familiar lens, the price-to-earnings ratio, tells a different story. Tripadvisor trades at 26.6x earnings, noticeably higher than both its peer average of 14.2x and the industry’s 15.3x. Even compared to our fair ratio of 21.6x, shares appear pricey. This suggests there may be valuation risk if expectations falter. Which view provides the clearest signal for your next move?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Tripadvisor Narrative

If you see things differently or want to dive deeper into the numbers yourself, the tools are here for you to build your own perspective in just a few minutes, your way. Do it your way

A great starting point for your Tripadvisor research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Opportunities extend far beyond Tripadvisor. Some of the market’s most exciting plays are just a click away. Don’t miss your chance to get ahead by checking out these handpicked themes for your portfolio:

- Supercharge your returns by tapping into these 897 undervalued stocks based on cash flows, where the market may have overlooked deep value opportunities.

- Catch the next wave of innovation and growth by targeting these 25 AI penny stocks, which are shaping the future with artificial intelligence.

- Secure reliable income streams by reviewing these 19 dividend stocks with yields > 3%, offering strong yields and financial resilience, even in uncertain times.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tripadvisor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TRIP

Tripadvisor

TripAdvisor, Inc., an online travel company, engages in the provision of travel guidance products and services worldwide.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.