- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:TRIP

The Bull Case for Tripadvisor (TRIP) Could Change Following Launch of New Interactive Map Experience

Reviewed by Simply Wall St

- Earlier this month, Tripadvisor announced the launch of its redesigned interactive map experience powered by Mapbox, offering enhanced 3D visuals and personalized travel planning features across its website and mobile app.

- This update included the revamp of the app's 'Nearby' feature, now enabling real-time discovery and access to over 330 million global points of interest, underscoring Tripadvisor's push to elevate user engagement through digital innovation.

- We'll examine how Tripadvisor's enhanced map-driven discovery tools may influence its competitive positioning and underlying investment outlook.

Rare earth metals are the new gold rush. Find out which 29 stocks are leading the charge.

Tripadvisor Investment Narrative Recap

To own shares of Tripadvisor, you need to believe the company can reinvigorate consistent, high-margin user engagement while countering mounting competition and slowing organic traffic. The recent launch of Tripadvisor's interactive 3D map experience shows movement toward boosting engagement, yet its true impact on reversing core revenue declines or reducing paid marketing reliance remains to be seen in the near term, so the catalyst’s influence may not be material just yet.

Of Tripadvisor’s recent announcements, the accelerated rollout of personalized, AI-powered recommendations stands out as most relevant to this new map experience. Both initiatives underscore a bigger shift to deepen user engagement, which could address some pressure on paid acquisition costs and, if successful, support future margin stability and earnings improvement.

But on the other hand, investors should be aware that persistent headwinds in free traffic acquisition and the risk of ongoing declines in core revenue remain unresolved...

Read the full narrative on Tripadvisor (it's free!)

Tripadvisor's outlook anticipates $2.3 billion in revenue and $144.6 million in earnings by 2028. This assumes a 7.1% annual revenue growth rate and a $79.6 million increase in earnings from the current $65.0 million level.

Uncover how Tripadvisor's forecasts yield a $18.16 fair value, a 4% upside to its current price.

Exploring Other Perspectives

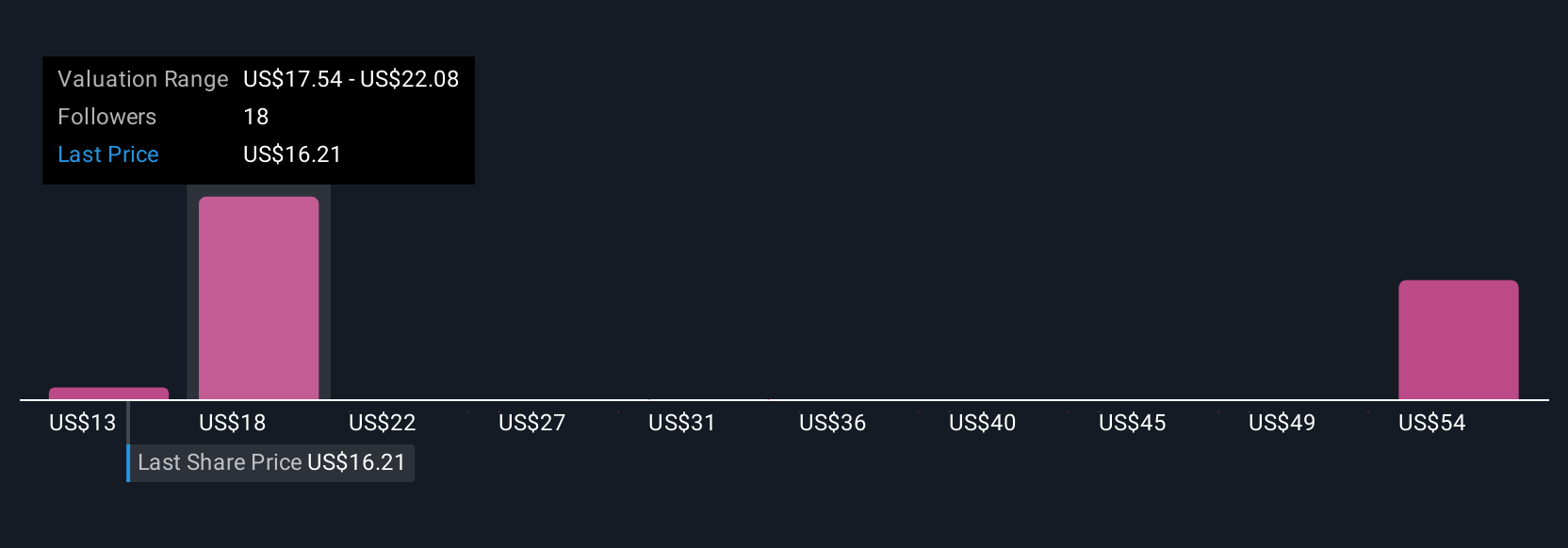

Seven fair value estimates from the Simply Wall St Community range widely from US$13.50 up to US$55.10 per share. Persistent competitive pressure and reliance on paid marketing raise questions about whether engagement-driven innovations can translate into sustainable profit, explore how different market participants weigh these risks and opportunities.

Explore 7 other fair value estimates on Tripadvisor - why the stock might be worth 22% less than the current price!

Build Your Own Tripadvisor Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tripadvisor research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Tripadvisor research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tripadvisor's overall financial health at a glance.

Curious About Other Options?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tripadvisor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TRIP

Tripadvisor

TripAdvisor, Inc., an online travel company, engages in the provision of travel guidance products and services worldwide.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026