- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:TRIP

After Leaping 27% Tripadvisor, Inc. (NASDAQ:TRIP) Shares Are Not Flying Under The Radar

Despite an already strong run, Tripadvisor, Inc. (NASDAQ:TRIP) shares have been powering on, with a gain of 27% in the last thirty days. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

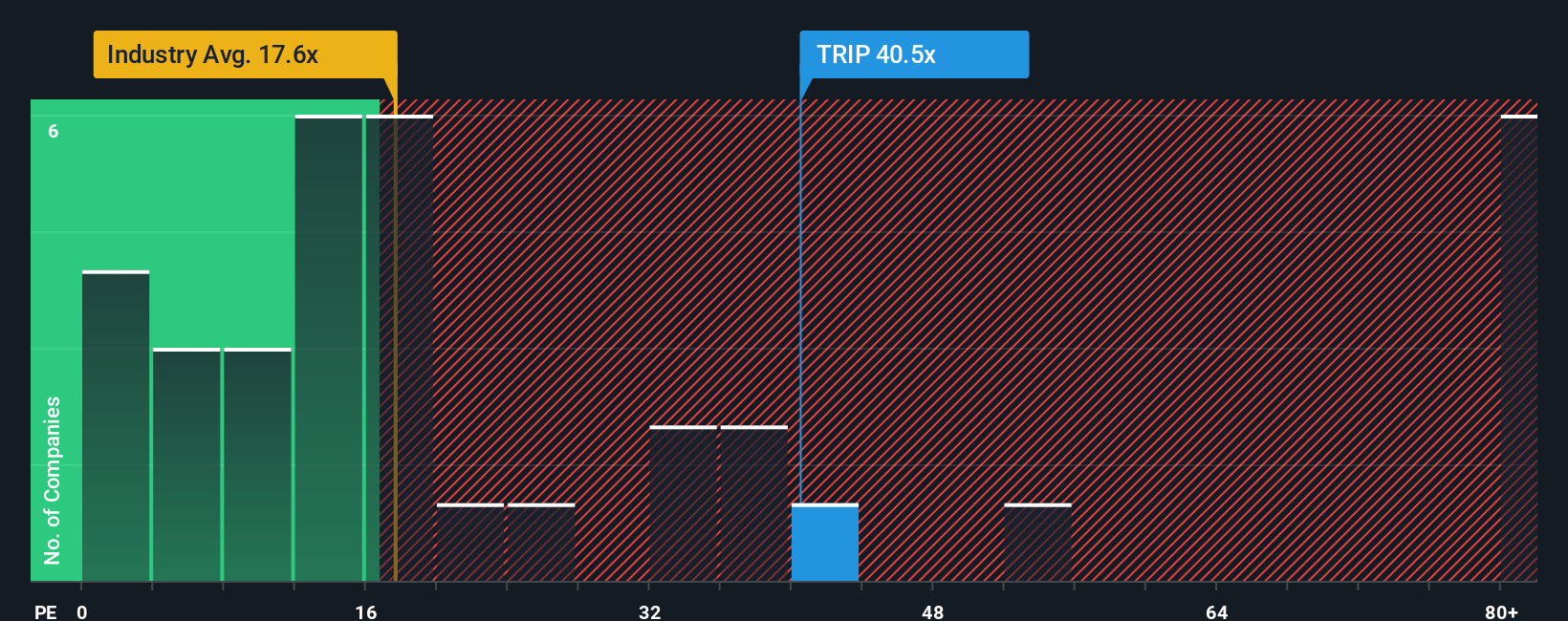

Since its price has surged higher, Tripadvisor may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 40.5x, since almost half of all companies in the United States have P/E ratios under 18x and even P/E's lower than 11x are not unusual. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Recent times have been advantageous for Tripadvisor as its earnings have been rising faster than most other companies. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Tripadvisor

How Is Tripadvisor's Growth Trending?

Tripadvisor's P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

Retrospectively, the last year delivered an exceptional 119% gain to the company's bottom line. Although, its longer-term performance hasn't been as strong with three-year EPS growth being relatively non-existent overall. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Looking ahead now, EPS is anticipated to climb by 41% per annum during the coming three years according to the analysts following the company. Meanwhile, the rest of the market is forecast to only expand by 10% per year, which is noticeably less attractive.

In light of this, it's understandable that Tripadvisor's P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

Tripadvisor's P/E is flying high just like its stock has during the last month. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Tripadvisor's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Tripadvisor, and understanding them should be part of your investment process.

You might be able to find a better investment than Tripadvisor. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Tripadvisor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:TRIP

Tripadvisor

TripAdvisor, Inc., an online travel company, engages in the provision of travel guidance products and services worldwide.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026