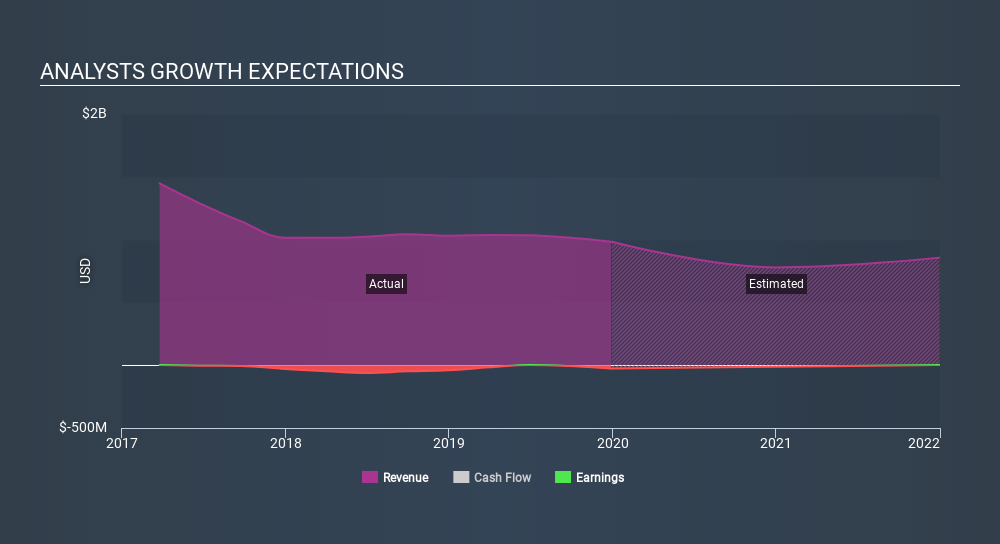

Market forces rained on the parade of Tribune Publishing Company (NASDAQ:TPCO) shareholders today, when the analysts downgraded their forecasts for this year. Both revenue and earnings per share (EPS) estimates were cut sharply as the analysts factored in the latest outlook for the business, concluding that they were too optimistic previously.

Following the latest downgrade, the twin analysts covering Tribune Publishing provided consensus estimates of US$778m revenue in 2020, which would reflect a sizeable 21% decline on its sales over the past 12 months. The loss per share is anticipated to greatly reduce in the near future, narrowing 54% to US$0.35. Previously, the analysts had been modelling revenues of US$905m and earnings per share (EPS) of US$0.63 in 2020. So we can see that the consensus has become notably more bearish on Tribune Publishing's outlook with these numbers, making a measurable cut to this year's revenue estimates. Furthermore, they expect the business to be loss-making this year, compared to their previous forecasts of a profit.

See our latest analysis for Tribune Publishing

The consensus price target fell 6.5% to US$14.50, implicitly signalling that lower earnings per share are a leading indicator for Tribune Publishing's valuation. There's another way to think about price targets though, and that's to look at the range of price targets put forward by analysts, because a wide range of estimates could suggest a diverse view on possible outcomes for the business. Currently, the most bullish analyst values Tribune Publishing at US$17.00 per share, while the most bearish prices it at US$12.00. Analysts definitely have varying views on the business, but the spread of estimates is not wide enough in our view to suggest that extreme outcomes could await Tribune Publishing shareholders.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the Tribune Publishing's past performance and to peers in the same industry. Over the past five years, revenues have declined around 14% annually. Worse, forecasts are essentially predicting the decline to accelerate, with the estimate for a 21% decline in revenue next year. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to see their revenue grow 3.3% per year. So it's pretty clear that, while it does have declining revenues, the analysts also expect Tribune Publishing to suffer worse than the wider industry.

The Bottom Line

The biggest low-light for us was that the forecasts for Tribune Publishing dropped from profits to a loss this year. Unfortunately analysts also downgraded their revenue estimates, and industry data suggests that Tribune Publishing's revenues are expected to grow slower than the wider market. After such a stark change in sentiment from analysts, we'd understand if readers now felt a bit wary of Tribune Publishing.

So things certainly aren't looking great, and you should also know that we've spotted some potential warning signs with Tribune Publishing, including the risk of cutting its dividend. Learn more, and discover the 1 other warning sign we've identified, for free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Q3 Outlook modestly optimistic

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion