- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:TBLA

Taboola (NasdaqGS:TBLA) Valuation in Focus After Launch of DeeperDive AI with India Today Group

Reviewed by Kshitija Bhandaru

Taboola.com (NasdaqGS:TBLA) just announced a collaboration with India Today Group to launch DeeperDive, its generative AI-powered answer engine, across the APAC region. This move is designed to enhance reader engagement and create new ad opportunities directly on publisher platforms.

See our latest analysis for Taboola.com.

Taboola.com’s launch of DeeperDive comes as the company’s 1-year total shareholder return stands at -7.5%, while its three-year total shareholder return remains an impressive 86.1%. Although recent weeks saw share price pressure, momentum could shift if innovation like DeeperDive drives new growth and engagement.

If you’re on the lookout for what else is gaining traction, this is the perfect moment to discover fast growing stocks with high insider ownership.

With shares trading at a notable discount to analyst price targets, even as the company reports steady revenue and net income growth, investors are left to consider whether Taboola.com is truly undervalued or if the market has already factored in its future growth potential.

Most Popular Narrative: 25.8% Undervalued

Taboola.com’s narrative places fair value notably higher than the last close of $3.09, projecting potential upside as the company executes on platform expansion and key partnerships.

The launch of Realize, Taboola's new performance advertising platform, is enabling entry into a much larger pool of display and social ad budgets. This positions the company to capture incremental revenue growth outside of traditional native ad formats and is expected to materially expand the addressable market, driving a return to double-digit revenue growth in the coming years.

What’s fueling this bullish price target? The narrative leans on a bold assumption: expansion into untapped markets and untold revenue streams. The projection is a step change in earnings, powered by fresh partnerships and upgraded technology. Want to know the precise growth and profit targets this narrative is banking on? Click in to see the full roadmap behind this forecast.

Result: Fair Value of $4.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slower core growth rates and unproven adoption of new platforms could challenge Taboola.com’s bullish outlook if these catalysts fail to deliver.

Find out about the key risks to this Taboola.com narrative.

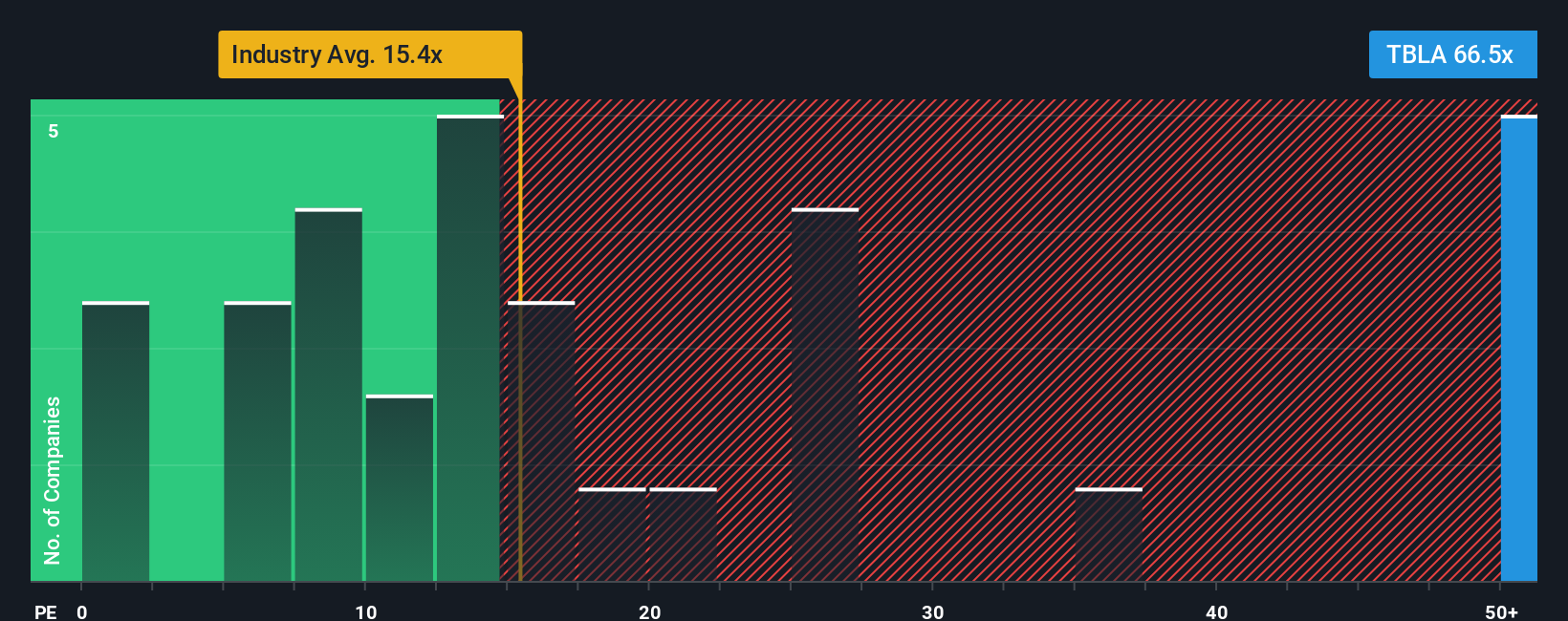

Another View: Looking at Valuation Multiples

While the analyst narrative suggests significant upside, Taboola.com’s price-to-earnings ratio tells a different story. Shares currently trade at 67.4 times earnings, which is far steeper than the US Interactive Media and Services industry average of 16.1x and a peer average of 12.7x. Even when compared to the fair ratio of 21.7x, Taboola.com looks expensive. This gap suggests potential valuation risk if growth does not materialize as expected. So is the market seeing something that these numbers miss, or could price momentum reverse?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Taboola.com Narrative

Don’t see eye to eye with these viewpoints or want to dig into the figures yourself? You can spin your own narrative in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Taboola.com.

Looking for More Smart Investment Moves?

If you want to stay ahead and spot opportunities others miss, take action now with ideas backed by sharp numbers and honest analysis from Simply Wall Street.

- Tap into massive yield potential by checking out these 19 dividend stocks with yields > 3% with strong payouts above 3% and see which companies deliver consistent income growth.

- Ride the next wave of innovation by starting with these 24 AI penny stocks, where artificial intelligence is fueling performance breakthroughs for tomorrow’s winners.

- Uncover hidden value and grab your edge in the market using these 898 undervalued stocks based on cash flows to zero in on stocks trading below their fair value based on real cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Taboola.com might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TBLA

Taboola.com

Operates an artificial intelligence-based algorithmic engine platform in Israel, the United States, the United Kingdom, Germany, and internationally.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.