- United States

- /

- Software

- /

- NasdaqGM:RPD

High Growth Tech Stocks to Watch in November 2024

Reviewed by Simply Wall St

The United States market has remained flat over the last week, yet it has shown significant growth of 31% over the past year with earnings expected to rise by 15% annually. In this context, identifying high growth tech stocks involves looking for companies that demonstrate strong innovation and adaptability, aligning with these positive market trends.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 23.83% | 24.32% | ★★★★★★ |

| Sarepta Therapeutics | 23.90% | 42.65% | ★★★★★★ |

| Clene | 78.50% | 60.70% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.48% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.45% | 70.66% | ★★★★★★ |

| Blueprint Medicines | 25.47% | 68.62% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 249 stocks from our US High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

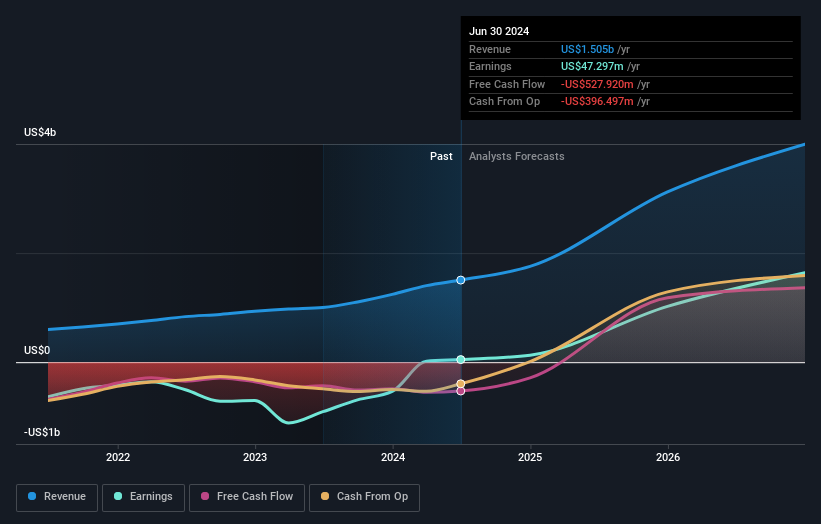

Rapid7 (NasdaqGM:RPD)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Rapid7, Inc. offers cybersecurity solutions through its Rapid7, Nexpose, and Metasploit brands with a market cap of approximately $2.60 billion.

Operations: The company generates revenue primarily from its Security Software & Services segment, amounting to $833.01 million.

Rapid7's recent pivot to enhance its Managed Extended Detection and Response (MXDR) service underscores a strategic alignment with prevalent cybersecurity needs, integrating seamlessly with Microsoft's security tools—a move reflecting a 21.1% forecasted annual earnings growth. This integration not only broadens threat detection capabilities but also customizes defenses, crucial as organizations increasingly rely on digital infrastructures. Despite a revenue growth projection of 6.7%, slightly trailing the broader U.S. market, Rapid7’s R&D commitment remains robust, dedicating significant resources to innovation in cybersecurity solutions—a sector where staying ahead technologically is critical for maintaining competitive edge and client trust.

- Click here to discover the nuances of Rapid7 with our detailed analytical health report.

Evaluate Rapid7's historical performance by accessing our past performance report.

Sarepta Therapeutics (NasdaqGS:SRPT)

Simply Wall St Growth Rating: ★★★★★★

Overview: Sarepta Therapeutics, Inc. is a commercial-stage biopharmaceutical company specializing in RNA-targeted therapeutics and gene therapies for rare diseases, with a market cap of $10.59 billion.

Operations: Sarepta Therapeutics focuses on discovering, developing, manufacturing, and delivering RNA-targeted therapeutics and gene therapies for rare diseases, generating $1.64 billion in revenue.

Sarepta Therapeutics has shown a remarkable turnaround, transitioning from a net loss to reporting a net income of $33.61 million in Q3 2024, up from a loss of $40.94 million the previous year. This shift is underscored by robust revenue growth, up 41% year-over-year to $467.17 million for the quarter, reflecting strong market demand for their biotechnological innovations. Notably, R&D expenses remain integral to Sarepta's strategy; investment in this area is crucial as it supports sustained innovation and competitive advantage in the rapidly evolving biotech landscape. With an impressive revenue forecast growth rate of 23.9% per year outpacing the U.S market average and earnings expected to surge by 42.6% annually, Sarepta is positioning itself as a formidable entity in high-growth biotechnology sectors.

- Click here and access our complete health analysis report to understand the dynamics of Sarepta Therapeutics.

Explore historical data to track Sarepta Therapeutics' performance over time in our Past section.

Taboola.com (NasdaqGS:TBLA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Taboola.com Ltd. operates an artificial intelligence-based algorithmic engine platform across various countries including Israel, the United States, the United Kingdom, and Germany, with a market cap of approximately $1.21 billion.

Operations: The company generates its revenue primarily from advertising, amounting to $1.69 billion. Its operations leverage an AI-based algorithmic engine platform to serve various international markets.

Taboola.com, navigating through a challenging landscape, forecasts a revenue growth of 13.2% annually, slightly outpacing the U.S. market average of 9%. Despite current unprofitability, the company's strategic R&D investment remains robust, crucial for transitioning into profitability within three years—a prospect above average market growth expectations. Recent developments underscore this trajectory; notably, Taboola introduced 'Abby,' an AI-driven tool enhancing advertising efficiency significantly—advertiser campaigns with Abby are estimated to launch 75% faster than those set up manually. This innovation not only streamlines operations but also positions Taboola at the forefront of applying generative AI in digital advertising, potentially revolutionizing engagement strategies in this sector.

- Navigate through the intricacies of Taboola.com with our comprehensive health report here.

Examine Taboola.com's past performance report to understand how it has performed in the past.

Seize The Opportunity

- Explore the 249 names from our US High Growth Tech and AI Stocks screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:RPD

Rapid7

Provides cybersecurity solutions under the Rapid7, Nexpose, and Metasploit brand names.

Reasonable growth potential slight.