- United States

- /

- Media

- /

- NasdaqGS:STGW

Could Stagwell's (STGW) Polish Retail Data Push Reveal Its Next Competitive Edge?

Reviewed by Simply Wall St

- Earlier this month, Zabka Polska announced a joint venture with Stagwell to introduce In-Pulse, a consumer analytics and engagement tool tailored for the Polish retail market that leverages Zabka's retail reach and Stagwell's expertise in data-driven marketing.

- This collaboration stands out by combining vast real-world retail data with advanced analytics, enabling Polish businesses to understand consumer behavior in real time and refine marketing strategies accordingly.

- To assess the impact of this new joint venture, we'll consider how Stagwell's expanded access to first-party retail data could reshape its investment narrative.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Stagwell Investment Narrative Recap

Stagwell’s investment case centers on its ability to harness data-driven marketing and digital transformation to drive recurring, higher-margin growth. The recent joint venture with Zabka Polska appears to bolster this narrative, granting Stagwell valuable access to first-party retail data in Poland. While this move strengthens its analytics platform and expands its European exposure, the most pressing short-term catalyst, effective platform integration and realization of AI-driven efficiencies, remains unchanged, as does the lingering risk around execution and integration complexity from recent acquisitions.

Among recent developments, the appointment of Slavi Samardzija as Chief Data and Platforms Officer is particularly relevant in context. His extensive history building data-focused teams and platforms at global agencies aligns closely with the expanded access to consumer data offered by In-Pulse, potentially reinforcing Stagwell’s ambitions to leverage proprietary analytics for operational improvements and differentiation in crowded markets.

In contrast, investors should also remain conscious of the persistent integration risk that could slow the benefit of new ventures like In-Pulse...

Read the full narrative on Stagwell (it's free!)

Stagwell's narrative projects $3.4 billion in revenue and $363.8 million in earnings by 2028. This requires 6.4% yearly revenue growth and a $365.5 million increase in earnings from the current level of -$1.7 million.

Uncover how Stagwell's forecasts yield a $8.19 fair value, a 57% upside to its current price.

Exploring Other Perspectives

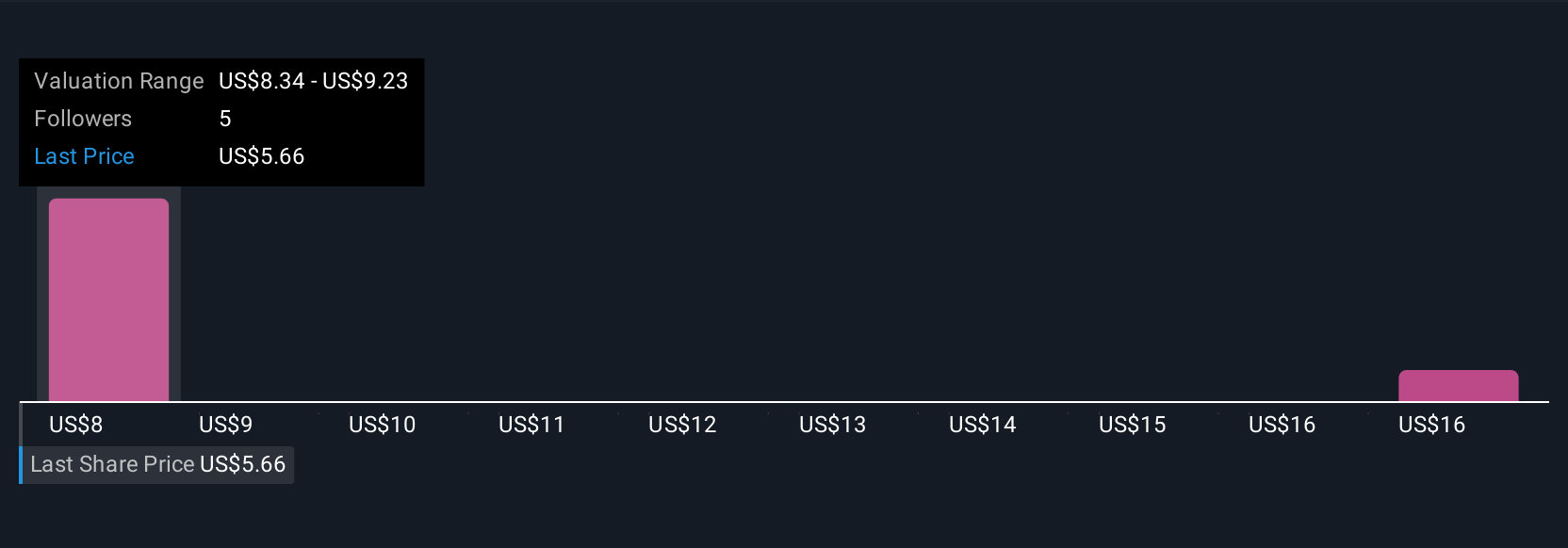

Simply Wall St Community members provided two fair value estimates for Stagwell stock, ranging from US$8.19 to US$17.83 per share. These differing viewpoints underscore the importance of assessing ongoing integration and platform execution risks when considering the company’s longer-term potential.

Explore 2 other fair value estimates on Stagwell - why the stock might be worth just $8.19!

Build Your Own Stagwell Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Stagwell research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Stagwell research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Stagwell's overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:STGW

Stagwell

Provides digital transformation, performance media and data, consumer insights and strategy, and creativity and communications services in the United States, the United Kingdom, and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives