- United States

- /

- Media

- /

- NasdaqGS:SSP

Take Care Before Diving Into The Deep End On The E.W. Scripps Company (NASDAQ:SSP)

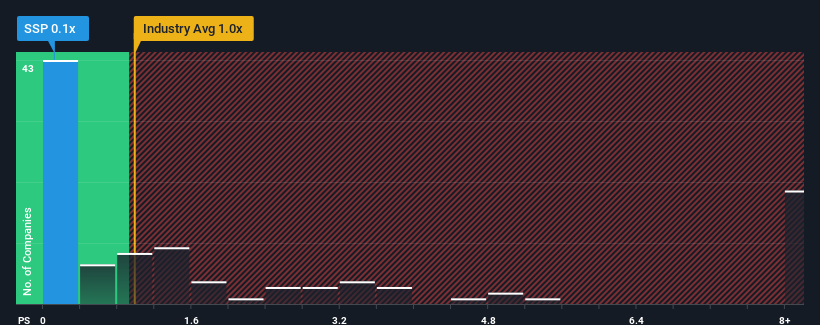

With a price-to-sales (or "P/S") ratio of 0.1x The E.W. Scripps Company (NASDAQ:SSP) may be sending bullish signals at the moment, given that almost half of all the Media companies in the United States have P/S ratios greater than 1x and even P/S higher than 4x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for E.W. Scripps

What Does E.W. Scripps' Recent Performance Look Like?

E.W. Scripps could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Keen to find out how analysts think E.W. Scripps' future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The Low P/S Ratio?

E.W. Scripps' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 3.7%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 17% in total. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Turning to the outlook, the next three years should generate growth of 5.0% each year as estimated by the five analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 4.3% per year, which is not materially different.

With this in consideration, we find it intriguing that E.W. Scripps' P/S is lagging behind its industry peers. It may be that most investors are not convinced the company can achieve future growth expectations.

The Final Word

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of E.W. Scripps' revealed that its P/S remains low despite analyst forecasts of revenue growth matching the wider industry. The low P/S could be an indication that the revenue growth estimates are being questioned by the market. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for E.W. Scripps that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if E.W. Scripps might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SSP

E.W. Scripps

Operates as a media enterprise through a portfolio of local television stations, national news, and entertainment networks in the United States.

Undervalued with acceptable track record.

Similar Companies

Market Insights

Community Narratives