- United States

- /

- Interactive Media and Services

- /

- NasdaqCM:SLE

It's Down 33% But Super League Enterprise, Inc. (NASDAQ:SLE) Could Be Riskier Than It Looks

To the annoyance of some shareholders, Super League Enterprise, Inc. (NASDAQ:SLE) shares are down a considerable 33% in the last month, which continues a horrid run for the company. For any long-term shareholders, the last month ends a year to forget by locking in a 84% share price decline.

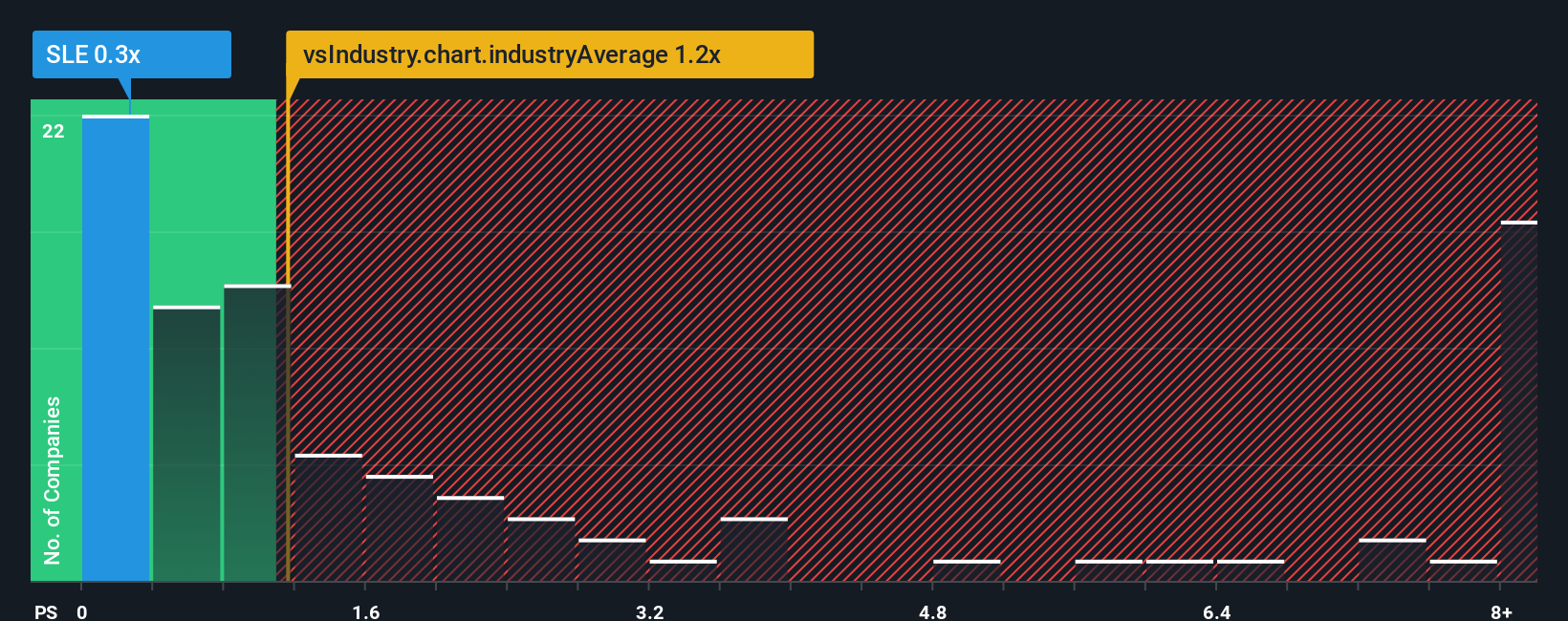

Since its price has dipped substantially, Super League Enterprise may be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.3x, since almost half of all companies in the Interactive Media and Services industry in the United States have P/S ratios greater than 1.2x and even P/S higher than 4x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Super League Enterprise

How Super League Enterprise Has Been Performing

Super League Enterprise hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Super League Enterprise.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as low as Super League Enterprise's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a frustrating 43% decrease to the company's top line. This has erased any of its gains during the last three years, with practically no change in revenue being achieved in total. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Turning to the outlook, the next year should generate growth of 11% as estimated by the dual analysts watching the company. That's shaping up to be similar to the 12% growth forecast for the broader industry.

With this information, we find it odd that Super League Enterprise is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Key Takeaway

Super League Enterprise's P/S has taken a dip along with its share price. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've seen that Super League Enterprise currently trades on a lower than expected P/S since its forecast growth is in line with the wider industry. The low P/S could be an indication that the revenue growth estimates are being questioned by the market. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Plus, you should also learn about these 5 warning signs we've spotted with Super League Enterprise (including 4 which don't sit too well with us).

If you're unsure about the strength of Super League Enterprise's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:SLE

Super League Enterprise

Super League Enterprise, Inc. creates and publishes content experiences and media solutions across immersive platforms in the United States and internationally.

Moderate risk and fair value.

Similar Companies

Market Insights

Community Narratives