- United States

- /

- Media

- /

- NasdaqGS:SIRI

SiriusXM (SIRI): Fresh Satellite Powers Broader Reach—How Does Its Valuation Stack Up?

Reviewed by Simply Wall St

Most Popular Narrative: 52.7% Undervalued

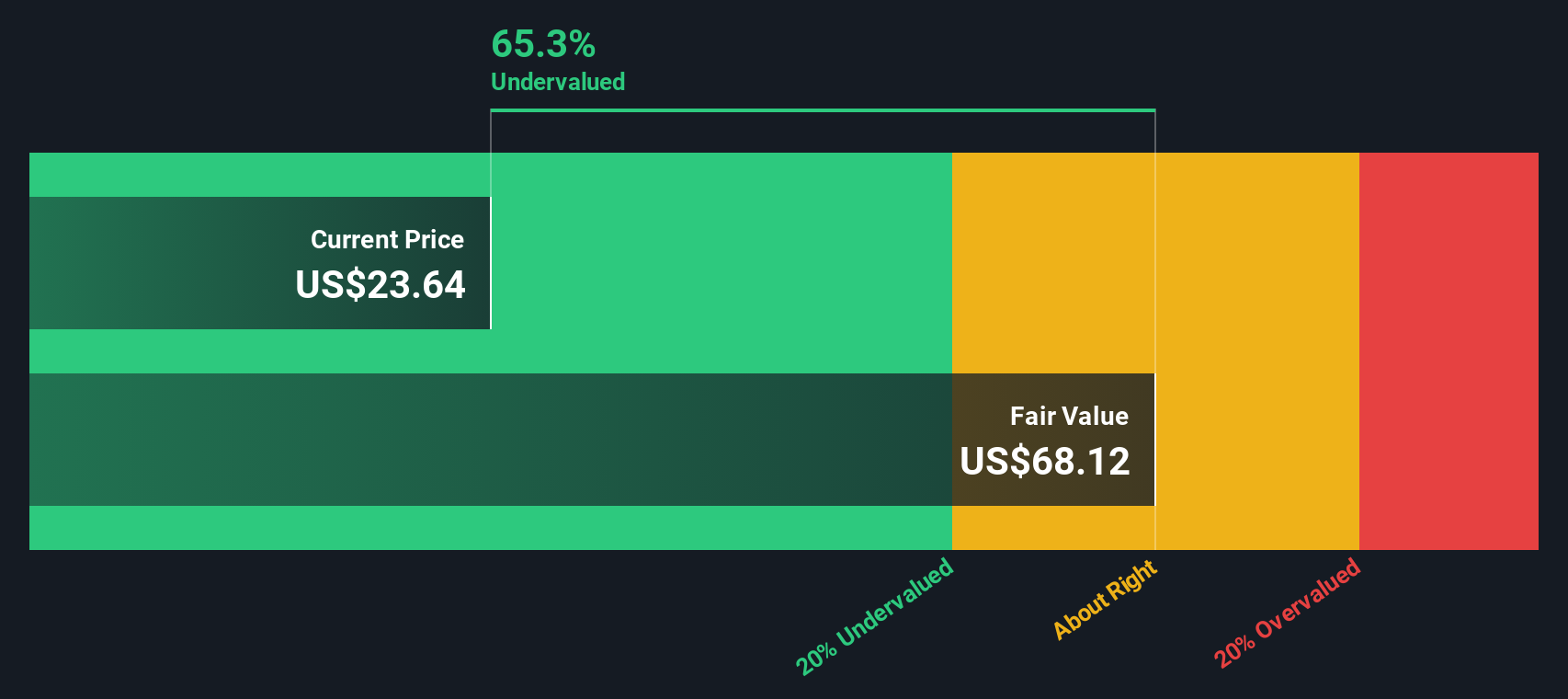

According to the narrative by ValueMan, Sirius XM Holdings may be trading far below its estimated fair value and could present a significant upside for investors.

Just think to yourself, "Let's build a satellite, send it to space, and maintain it." Their debt is a cost of operation, which by the way is, on average per year, a good ratio to their operating income. Everything that is leftover is given to shareholders. They keep no capital and have the shareholders completely in mind. Also, their telecommunication assets are worth a lot of money. If they were to fail as a company, major telecommunications firms could easily buy this company for its assets. Evaluate their competitive advantage!

Want to see what’s fueling this bold estimate for Sirius XM? The foundation of the story is a dramatic profit turnaround, reliance on unique industry advantages, and a future multiple that signals strong breakout potential. Which surprising financial levers did ValueMan use in their forecast model? Click in to uncover the hidden mechanics of this high-conviction fair value assessment.

Result: Fair Value of $50.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, there are still notable risks, such as heightened competition from streaming or an unexpected downturn in auto sales, that could challenge Sirius XM’s outlook.

Find out about the key risks to this Sirius XM Holdings narrative.Another View

A different approach uses the SWS DCF model, which also points to the stock being undervalued based on its fundamentals. However, are these projections too optimistic, or is there more potential for upside than skeptics believe?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Sirius XM Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Sirius XM Holdings Narrative

If you have a different perspective or want to dive deeper into your own analysis, you can craft a unique narrative for Sirius XM in just a few minutes: Do it your way.

A great starting point for your Sirius XM Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Standout Investment Opportunities?

Make the most of your next move by checking out tailored investing ideas, each powered by the Simply Wall Street Screener. If you want to stay ahead, you should be reviewing these fresh possibilities before everyone else does.

- Capitalize on overlooked value by targeting companies trading well below their true worth in our list of undervalued stocks based on cash flows.

- Ride the wave of healthcare innovation and pinpoint promising breakthroughs among tomorrow’s leaders in healthcare AI stocks.

- Boost your portfolio’s income potential by finding steady plays offering yields above 3% with our selection of dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGS:SIRI

Sirius XM Holdings

Operates as an audio entertainment company in North America.

Good value average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion