- United States

- /

- Media

- /

- NasdaqGS:SIRI

Sirius XM Holdings (SIRI) Introduces Low-Cost US$7 Subscription with Advanced Ad Features

Reviewed by Simply Wall St

Sirius XM Holdings (SIRI) launched SiriusXM Play, its first low-cost, ad-supported subscription package, offering more accessibility with over 130 channels. This move strengthens its position in the ad-supported market. The company saw an 18.8% price rise this quarter, likely influenced by product expansions and its addition to various indices. While market volatility persisted, driven by geopolitical uncertainties and Fed policy discussions, SiriusXM’s advancements counteracted broader market flatness. Its expansion into economical and diversified offerings, like the subscription bundle with FOX Nation, may have helped bolster its shares amidst varying market conditions.

The introduction of SiriusXM's low-cost, ad-supported subscription package, SiriusXM Play, may offer significant potential to attract budget-conscious consumers, potentially reducing customer churn. This new offering could impact the revenue trajectory, possibly enhancing subscription revenue amid pricing tensions and a competitive market landscape. The expansion to include a bundle with FOX Nation indicates an emphasis on diversified content, which may further bolster subscriber loyalty and engagement. This focus on content variation and affordability could align with their narrative focused on core in-car audiences and could mitigate some risks posed by tariff issues and flat advertising revenues.

Over the past year, SiriusXM's total shareholder return was a decline of 35.90%. This long-term performance contrasts with the recent quarterly upswing in share price observed due to product expansions and inclusion in various indices, highlighting fluctuations driven by both innovation and broader economic conditions. The company underperformed the US Media industry, which saw a decline of 6.9% over the past year, reflecting challenges at both company and industry levels.

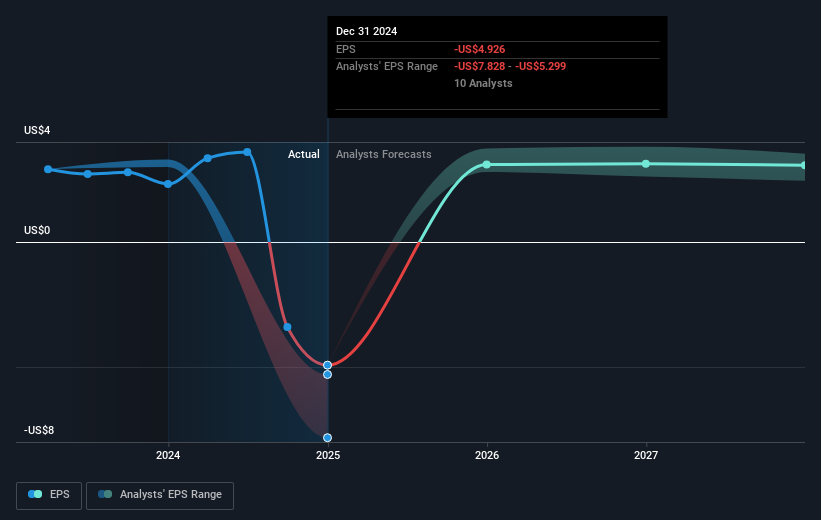

Currently trading at US$23.85, close to the consensus price target of US$24.01, suggests market sentiment aligns with the analysts' expectations of fair valuation based on future earnings growth and revenue forecasts. Analysts foresee revenue declining slightly, while earnings are expected to improve significantly over the next few years. These projections imply a potential recovery in profitability, although revenue growth may face hurdles from external pressures like the digital ad market's softness. The minimal share price discount to current targets indicates limited immediate upside, but the company's initiatives may underpin a longer-term positive outlook.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SIRI

Sirius XM Holdings

Operates as an audio entertainment company in North America.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives