- United States

- /

- Media

- /

- NasdaqGS:SIRI

Is Sirius XM a Value Play After Management Repositioning and 5% Year-to-Date Drop?

Reviewed by Bailey Pemberton

- Ever wondered if Sirius XM Holdings could present untapped value, or if it is just another media stock flying under the radar? Let’s dig beneath the surface to see what the numbers really say.

- After a slight bump of 0.9% in the last week, Sirius XM’s stock has drifted lower by 3.3% over the past month and is down 5.4% year-to-date. This has amplified questions around its potential direction and risk profile.

- Industry chatter recently picked up after reports that Sirius XM’s management is actively repositioning the company to respond to evolving audio streaming competition and shifting consumer habits. This follows broader media sector volatility, intensifying discussions about the company's resilience amid ongoing changes.

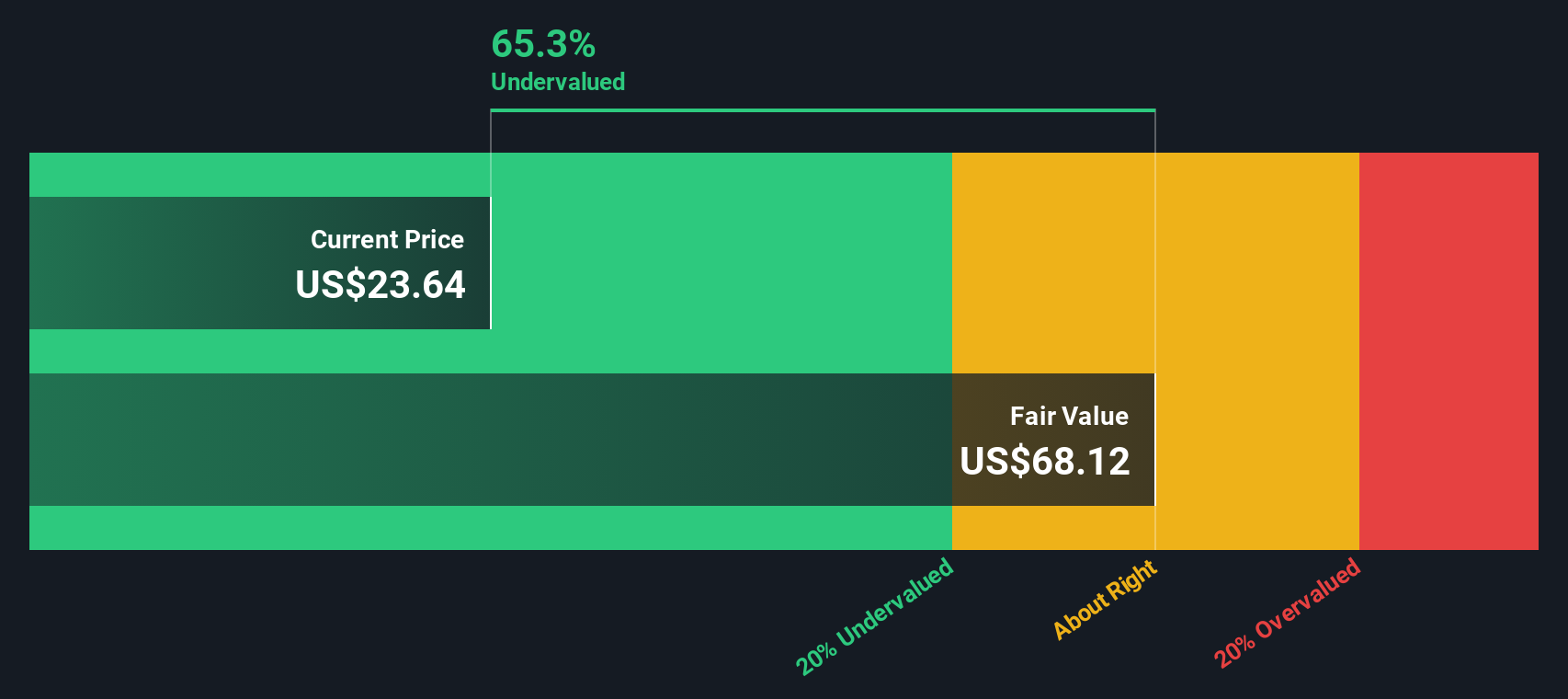

- Sirius XM currently scores a 4 out of 6 on our valuation checks, suggesting there are several areas where it might still be undervalued. Next, we’ll unpack the different methods of valuing the company and why the best answer might not come from the traditional models.

Approach 1: Sirius XM Holdings Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a common method for estimating the intrinsic value of a business by projecting future cash flows and discounting them to reflect today's dollars. For Sirius XM Holdings, the DCF approach uses Free Cash Flow (FCF) projections to estimate what the company is worth now based on its ability to generate cash in the years ahead.

Currently, Sirius XM reports Free Cash Flow of $1.24 billion, with analyst forecasts predicting steady growth over the coming years. By 2029, projected FCF is expected to reach $1.57 billion, with estimates continuing to climb just above that mark through 2035 according to Simply Wall St’s extrapolations. These projections, converted to today’s value using standard discount rates, reflect both near-term analyst insights and longer-term model assumptions.

Based on this analysis, the DCF model calculates an intrinsic fair value of $72.75 per share. With Sirius XM’s stock trading at a 71.3% discount to this estimated value, the model indicates the shares are significantly undervalued at their current price.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Sirius XM Holdings is undervalued by 71.3%. Track this in your watchlist or portfolio, or discover 927 more undervalued stocks based on cash flows.

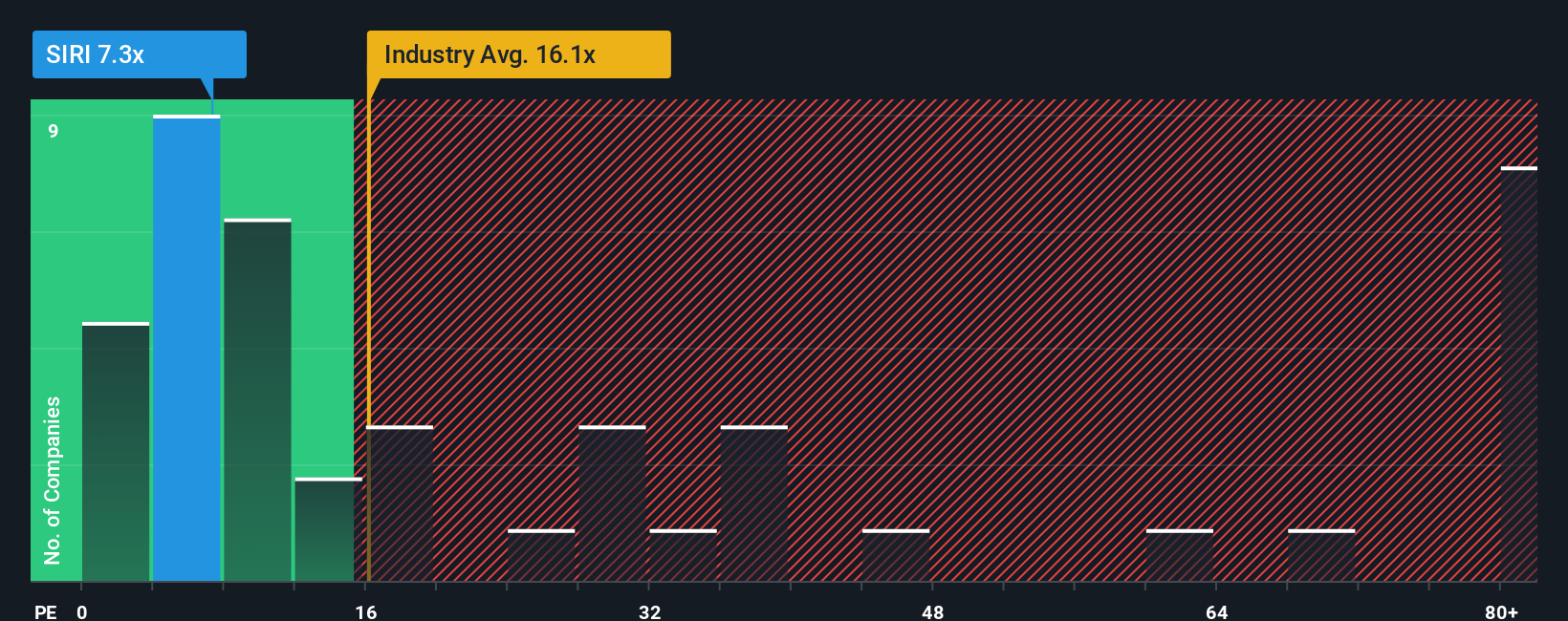

Approach 2: Sirius XM Holdings Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is a widely used valuation metric, particularly for profitable companies like Sirius XM Holdings. Since it directly relates a company’s share price to its per-share earnings, the PE ratio reflects what investors are willing to pay for each dollar of current profit. This makes it a strong benchmark for evaluating firms generating steady profits and looking to balance price with actual performance.

A "normal" or "fair" PE ratio is influenced by expectations for future earnings growth, as well as potential risks faced by the business. Higher anticipated growth or lower risk typically justifies a higher PE, while lower growth or greater risk points to a lower one. For context, Sirius XM Holdings currently trades at a PE ratio of 7.1x. This stands above the peer average of 5.3x, but far below the industry average PE of 16.4x. Benchmarking in this way gives a sense of relative value, but it can miss unique company-specific factors.

To address this, Simply Wall St’s proprietary Fair Ratio provides a more tailored perspective. Factoring in elements such as Sirius XM’s earnings growth projections, profit margin, industry dynamics, company size and risk profile, the Fair Ratio proposes what the “right” PE should be for Sirius XM: 17.5x. This is a more precise measure than just using peer or industry averages, as it considers specifics that truly drive a company’s long-term value.

Comparing the Fair Ratio of 17.5x to Sirius XM’s actual 7.1x PE, the stock appears significantly undervalued based on its underlying fundamentals and growth outlook.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1433 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Sirius XM Holdings Narrative

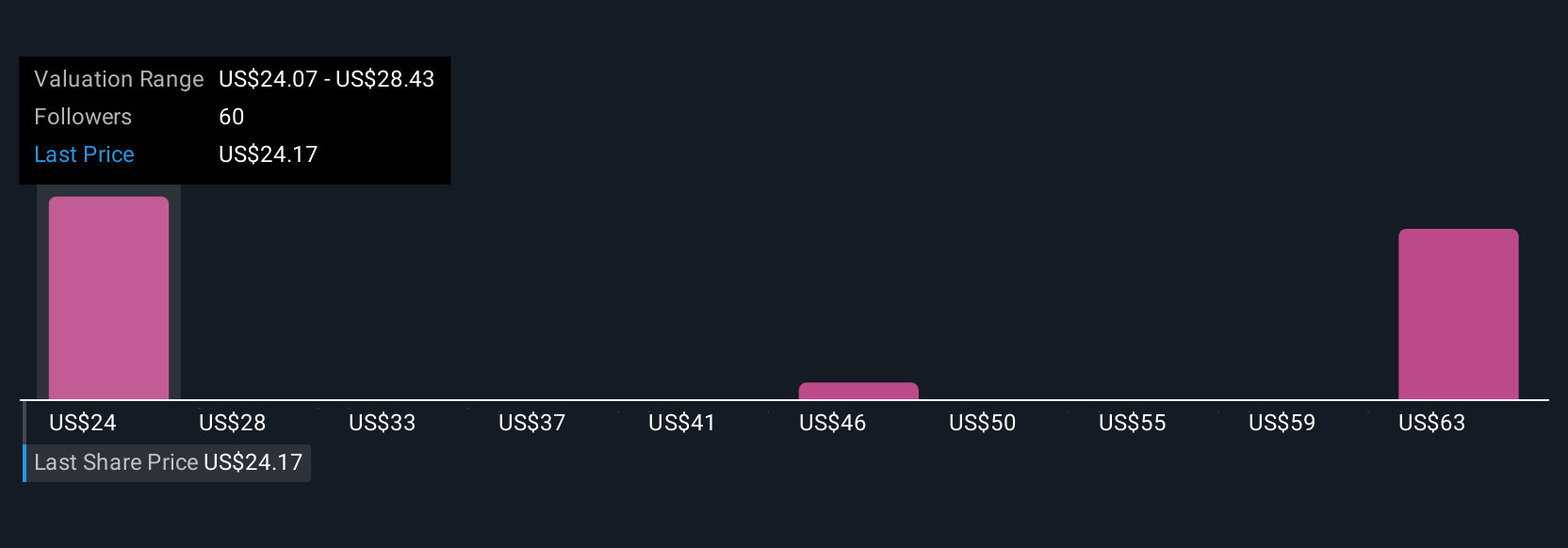

Earlier we mentioned that there is an even better way to understand valuation. Let’s introduce you to Narratives. A Narrative is your personal story or perspective on a company, connecting what you believe about its future (such as revenue, profit margins, and growth) with the numbers and turning that into a custom fair value estimate. Narratives let you translate the company’s story into a financial forecast and ultimately a fair value, making your investment thesis more concrete and actionable.

On Simply Wall St’s Community page, used by millions of investors, Narratives are an accessible tool that empowers you to clearly lay out your view, compare it to others, and see exactly how your assumptions stack up against real market data. Because Narratives are dynamically updated whenever new news or financial results arrive, your decision making can keep pace with what’s happening right now, helping you decide if it’s time to buy, sell, or simply watch by weighing your Fair Value against the current Price.

For example, one investor might view Sirius XM Holdings’ debt as an operational necessity supporting strong cash flow and assign a fair value of $50. Another, focusing on streaming competition and slower growth, estimates the fair value closer to $24. This demonstrates how Narratives help everyone invest with confidence, using both numbers and real-world context.

Do you think there's more to the story for Sirius XM Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SIRI

Sirius XM Holdings

Operates as an audio entertainment company in North America.

Good value average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success