- United States

- /

- Media

- /

- NasdaqGS:SIRI

Does Sirius XM's (SIRI) Steady Dividend Reflect Strategic Confidence or Mask Growing Industry Headwinds?

Reviewed by Sasha Jovanovic

- Earlier this month, Sirius XM Holdings Inc. declared a quarterly cash dividend of US$0.27 per share, payable to shareholders on November 21, 2025, with a record date of November 5, 2025.

- An interesting aspect is that the company maintained its dividend despite experiencing prolonged subscriber declines, mounting competition from streaming services, and a debt burden exceeding US$10 billion.

- We'll examine how the decision to sustain dividend payments amid ongoing financial pressures impacts Sirius XM's current investment narrative.

We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Sirius XM Holdings Investment Narrative Recap

Owning shares of Sirius XM Holdings means believing that its unique satellite radio and content partnerships can sustain or grow value, even as subscriber losses and rising competition challenge its core model. The recent decision to maintain a US$0.27 quarterly dividend is unlikely to materially impact the most pressing near-term concern: persistent subscriber declines under pressure from streaming alternatives, and it does little to address the largest headwind of shrinking revenue bases.

One recent highlight that ties directly to short-term catalysts is the July 2025 launch of SiriusXM Play, a lower-cost, ad-supported package positioned to target price-sensitive listeners and potentially offset some subscriber churn. The success of this plan could help counteract underlying trends, but does not yet alter the imperative to diversify revenue and strengthen the core subscriber proposition.

In contrast, investors should also keep a close watch on the company’s substantial debt burden of over US$10,000,000,000, as it means...

Read the full narrative on Sirius XM Holdings (it's free!)

Sirius XM Holdings is projected to reach $8.6 billion in revenue and $1.1 billion in earnings by 2028. This outlook assumes a slight annual revenue decline of 0.1% and an earnings increase of $2.9 billion from current earnings of -$1.8 billion.

Uncover how Sirius XM Holdings' forecasts yield a $23.64 fair value, a 10% upside to its current price.

Exploring Other Perspectives

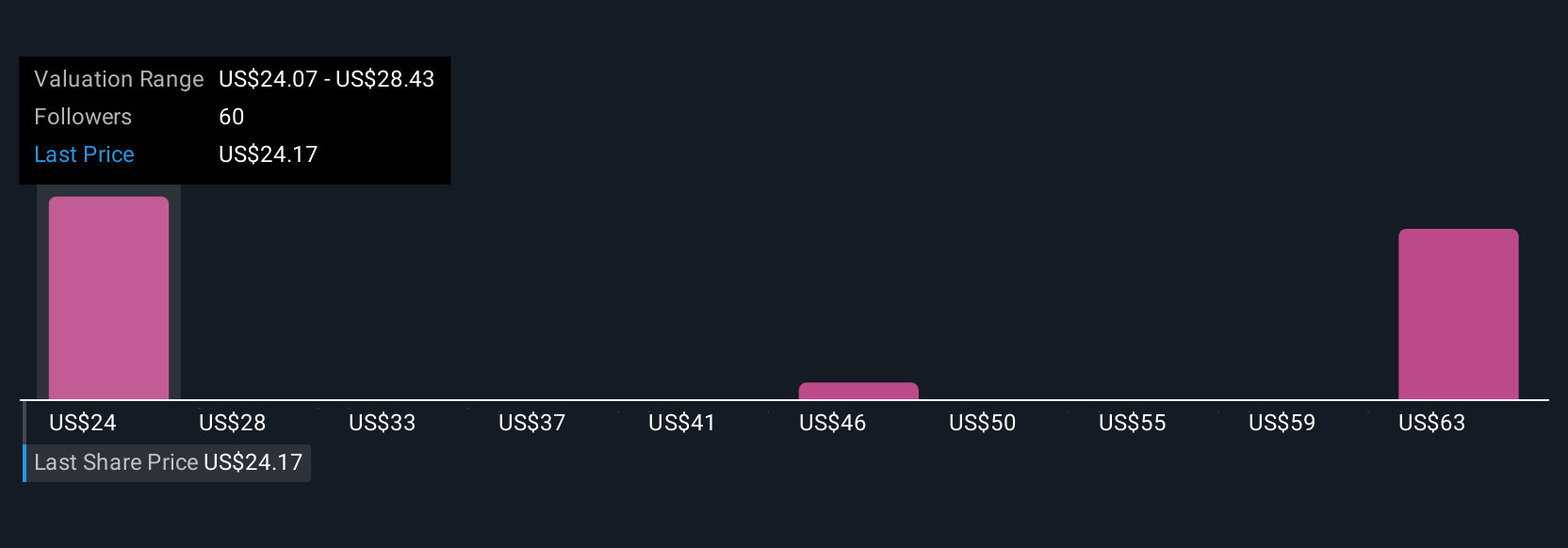

Simply Wall St Community members put forward five fair value estimates for Sirius XM ranging from US$23.64 to US$66.13 per share. Subscriber declines remain a central theme for many, highlighting wide differences in how participants assess Sirius XM’s future prospects and the potential for sustaining its dividend policy.

Explore 5 other fair value estimates on Sirius XM Holdings - why the stock might be worth just $23.64!

Build Your Own Sirius XM Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sirius XM Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Sirius XM Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sirius XM Holdings' overall financial health at a glance.

Seeking Other Investments?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SIRI

Sirius XM Holdings

Operates as an audio entertainment company in North America.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives