- United States

- /

- Media

- /

- NasdaqGS:SBGI

Sinclair (SBGI): Digging Into Valuation as Shares Trade Near Recent Levels

Reviewed by Kshitija Bhandaru

See our latest analysis for Sinclair.

While Sinclair’s share price has slipped so far this year, recent fluctuations have been modest, with the latest close at $14.61. Over the past twelve months, total shareholder returns are down slightly, which suggests that investor sentiment is still searching for a catalyst such as stronger earnings growth or a shift in market momentum.

If you’re reviewing the shifting landscape of media stocks, it is a smart move to broaden your search and discover fast growing stocks with high insider ownership

With the stock trading just below analyst price targets and mixed signals from recent financial results, the real question is whether Sinclair is undervalued right now or if the market has already priced in any future rebound.

Most Popular Narrative: 9.9% Undervalued

Sinclair's consensus fair value target stands above the recent share price, hinting at unrealized potential if certain strategic drivers play out as expected. Enthusiasm around regulatory changes and digital expansion continues to fuel optimism among market-watchers. Let's see what's driving their view in their own words.

Recent deregulatory moves by the FCC, including the elimination of ownership restrictions and multicast stream limitations, have enabled Sinclair to pursue highly accretive M&A, market swaps, and consolidation, which are expected to drive operational synergies, scale advantages, and EBITDA growth.

What is the secret sauce behind this optimistic target? There’s a controversial mix of ambitious profit growth, margin gains, and bold revenue assumptions lurking in the details. Wondering which numbers really move the needle for Sinclair’s fair value? Uncover the complete narrative to see what’s behind the curtain.

Result: Fair Value of $16.21 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained declines in core advertising and ongoing subscriber losses could remain headwinds. These factors may challenge Sinclair’s path to robust earnings growth in the near term.

Find out about the key risks to this Sinclair narrative.

Another View: High Price Compared to Peers

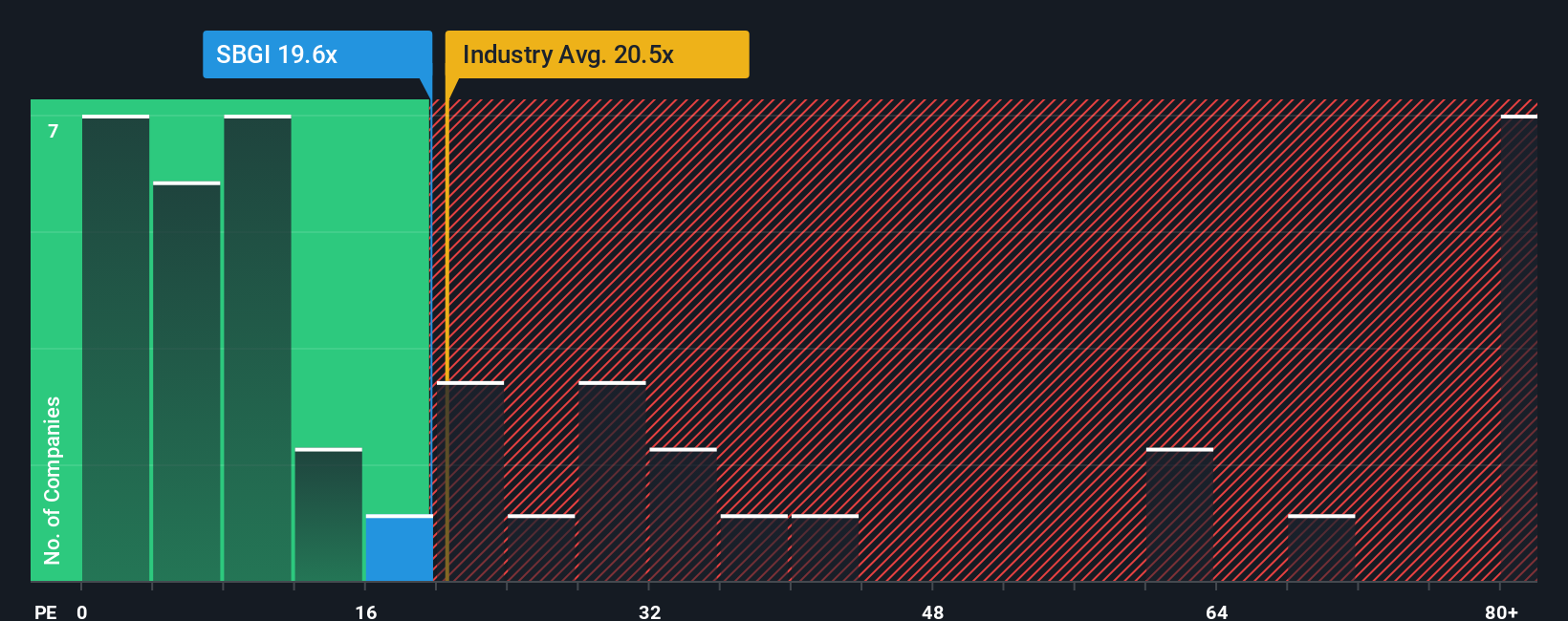

From a different angle, Sinclair’s valuation appears less compelling when compared to peers. Its current price-to-earnings ratio of 20.4x is more than three times the average of similar companies, which is just 6.5x. Although this matches its fair ratio, it is also slightly above the industry average of 20.2x. This premium could suggest investors are paying for future growth, or that there is heightened risk if earnings do not meet expectations. Is the market too optimistic about Sinclair, or is there hidden value that the ratios do not reveal?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sinclair Narrative

If you see things differently, or you’re inclined to dig into the numbers yourself, you can craft your own story in just a few minutes, Do it your way

A great starting point for your Sinclair research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Make your next smart move and uncover high-potential stocks across unique themes using these powerful tools, trusted by investors aiming to stay ahead of the curve.

- Target new sources of steady returns by tracking yield leaders with these 19 dividend stocks with yields > 3% offering attractive income in a low-rate world.

- Seize the coming wave of disruptive technology by jumping into these 26 quantum computing stocks shaping the future of computation and innovation.

- Capitalize on undervalued gems others might overlook by searching for opportunities in these 909 undervalued stocks based on cash flows where market mispricings could unlock your next big win.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SBGI

Sinclair

A media company, provides content on local television stations and digital platforms in the United States.

Established dividend payer with moderate growth potential.

Similar Companies

Market Insights

Community Narratives