- United States

- /

- Media

- /

- NasdaqGS:SBGI

Sinclair (SBGI): A Fresh Look at Valuation as Investors Weigh Recent Trends

Reviewed by Kshitija Bhandaru

Sinclair (SBGI) is catching some investor attention lately, although no single event seems to be driving the move. Sometimes, these periods without a clear catalyst can be just as interesting, prompting questions about whether the market is sensing something beneath the surface. If you are considering what to do with your Sinclair shares or thinking of an entry point, this may be a good moment to take stock of where things stand and what could come next.

Over the past year, Sinclair has delivered a modest positive return, up around 5%, but the picture is mixed when you zoom out. Short-term momentum has been a bit uneven, with recent months seeing both losses and gains, but the longer view still shows the stock trailing its three-year and five-year marks. Other company developments have tended to play a supporting role, with no major news dominating the landscape, which may explain why the stock’s performance has been somewhat subdued.

With all this in mind, is Sinclair an undervalued media play waiting to be discovered, or has the market already factored in all the growth it expects from here?

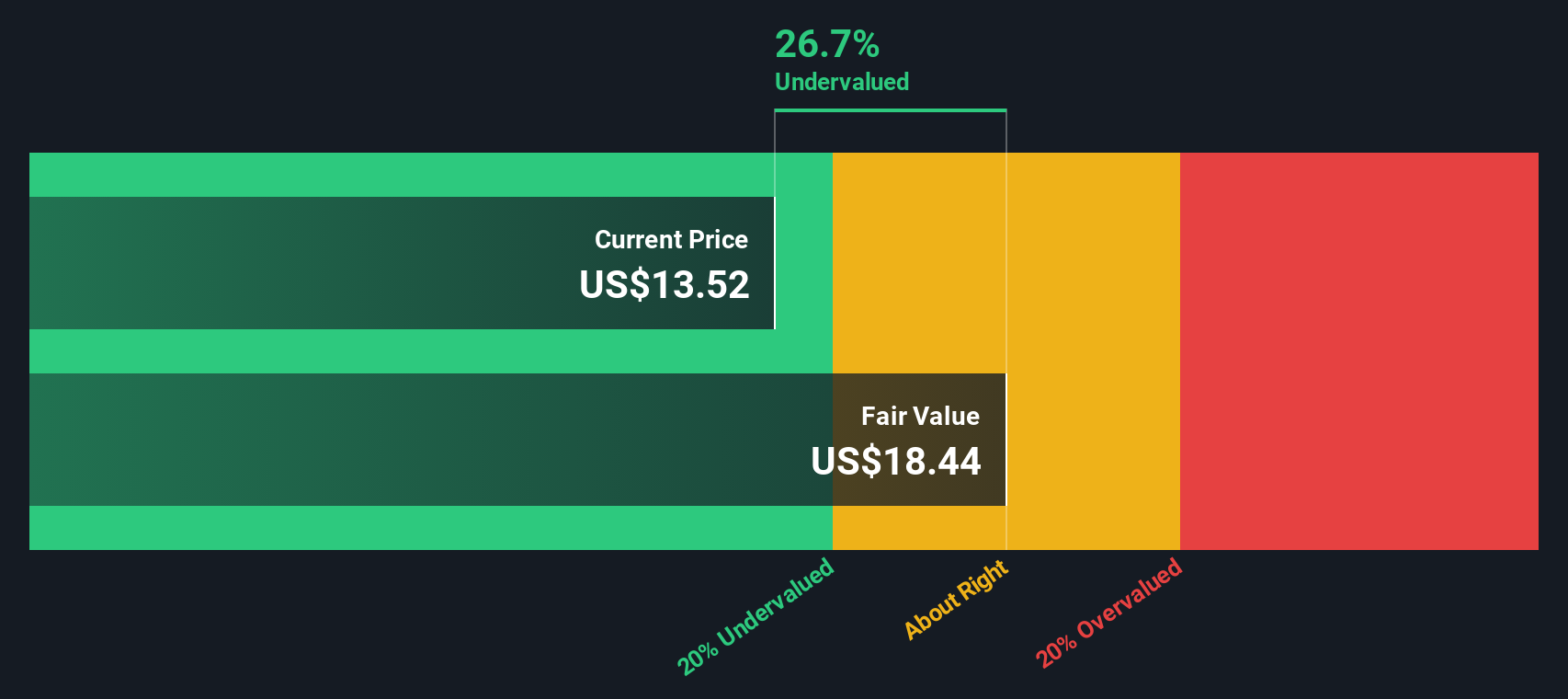

Most Popular Narrative: 13% Undervalued

According to the most followed analyst consensus, Sinclair is currently being valued 13% below its estimated fair value. This suggests untapped upside based on forecasts and business drivers.

Recent deregulatory moves by the FCC, including the elimination of ownership restrictions and multicast stream limitations, have enabled Sinclair to pursue highly accretive M&A, market swaps, and consolidation. These actions are expected to drive operational synergies, scale advantages, and EBITDA growth.

Curious what's fueling this near double-digit upside target? The narrative bets on ambitious earnings growth and future profit multiples typically reserved for industry disruptors. Wondering what mix of market projections and margin expectations could justify the headline price target? Keep reading to uncover the strategic assumptions and bold financial moves that put Sinclair's fair value in the spotlight.

Result: Fair Value of $16.21 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent declines in core TV ads or failure for Sinclair's digital ventures to gain scale could quickly challenge even the most optimistic expectations.

Find out about the key risks to this Sinclair narrative.Another View: What Does Our DCF Model Say?

Looking at the big picture, our SWS DCF model suggests the market may be overvaluing Sinclair. This leads to a notably different conclusion from analyst price targets. Which approach better captures the company's true long-term value?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Sinclair for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Sinclair Narrative

If you see the story differently or want to dig into the numbers for yourself, you can build a custom Sinclair scenario in just a few minutes. Do it your way

A great starting point for your Sinclair research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Opportunities?

Don’t limit your watchlist to just one company. Plenty of stocks offer exciting potential and some might surprise you with their momentum or long-term edge. Take your investment game to the next level by checking out these handpicked ideas:

- Spot potential gems with strong earnings power by zeroing in on undervalued stocks based on cash flows poised for future growth, before the rest of the market catches up.

- Boost your portfolio’s income with reliable choices. See which companies consistently reward investors with dividend stocks with yields > 3% and robust track records.

- Get ahead of the curve by jumping into the fast-paced world of AI penny stocks driving artificial intelligence breakthroughs and shaping tomorrow’s industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SBGI

Sinclair

A media company, provides content on local television stations and digital platforms in the United States.

Established dividend payer with moderate growth potential.

Similar Companies

Market Insights

Community Narratives