- United States

- /

- Media

- /

- NasdaqGS:SATS

Should EchoStar's (SATS) Softer Earnings Amid Sector Headwinds Prompt a Rethink of Its Risk Profile?

Reviewed by Sasha Jovanovic

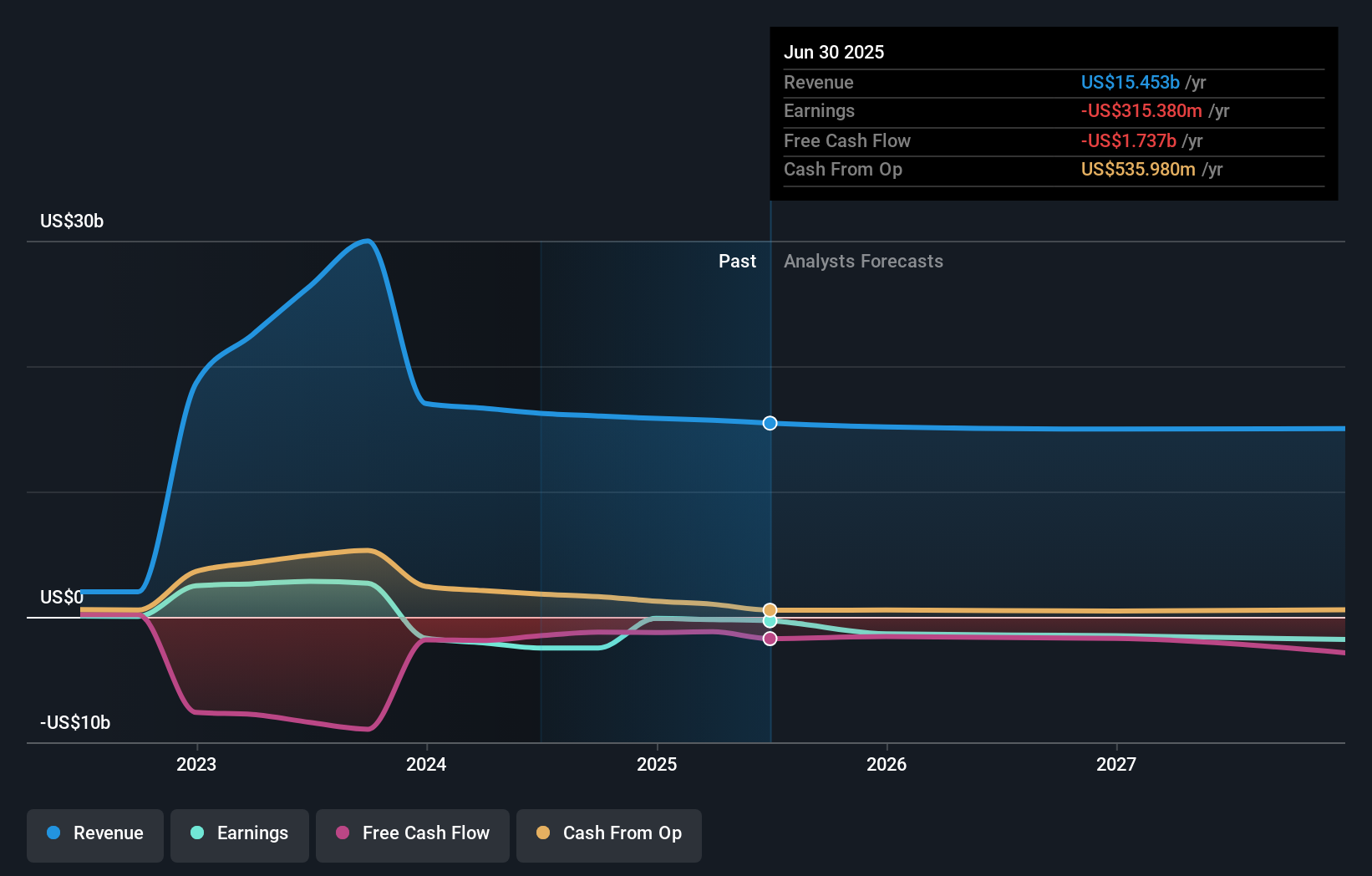

- EchoStar recently reported a softer quarter, with revenues falling 5.8% year over year and missing analyst expectations by 2.2%.

- This signal of underperformance comes as the traditional media and publishing sector faces structural hurdles such as the ongoing shift in advertising spend toward digital channels.

- We'll examine how EchoStar's weaker earnings, set against sector headwinds, may influence its longer-term investment thesis and risk profile.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

EchoStar Investment Narrative Recap

To be a shareholder in EchoStar today, you need to believe in the long-term potential of its direct-to-device satellite constellation and spectrum asset monetization, while accepting ongoing regulatory, sector, and liquidity challenges. The recent revenue miss is a short-term set-back, but does not directly alter the primary near-term catalyst: monetizing spectrum assets. The biggest risk remains the company's significant near-term debt maturities, which could constrain flexibility if capital markets remain tight.

While some company news has focused on retail partnerships like Boost Mobile’s new iPad Pro offering, a more impactful recent event is EchoStar’s agreement to sell key spectrum licenses to AT&T for US$23 billion, still pending approval. This announcement is central given the company's focus on spectrum monetization as a crucial catalyst to address liquidity constraints and enable continued investment in strategic initiatives.

On the other hand, investors should keep a close eye on how EchoStar manages its upcoming debt maturities and the potential risk of…

Read the full narrative on EchoStar (it's free!)

EchoStar's narrative projects $16.0 billion in revenue and $1.6 billion in earnings by 2028. This requires 1.3% yearly revenue growth and a $1.9 billion earnings increase from current earnings of -$315.4 million.

Uncover how EchoStar's forecasts yield a $84.29 fair value, a 14% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provide fair value estimates for EchoStar ranging from just US$2.98 to US$84.29, based on 2 perspectives. With major debt maturities looming, investor views differ widely on how such financial risks might affect EchoStar’s future performance and resilience.

Explore 2 other fair value estimates on EchoStar - why the stock might be worth less than half the current price!

Build Your Own EchoStar Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your EchoStar research is our analysis highlighting 4 important warning signs that could impact your investment decision.

- Our free EchoStar research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate EchoStar's overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EchoStar might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SATS

EchoStar

Provides networking technologies and services in the United States and internationally.

Slight risk and overvalued.

Similar Companies

Market Insights

Community Narratives