- United States

- /

- Media

- /

- NasdaqGS:SATS

EchoStar Corporation (NASDAQ:SATS) Stock Catapults 28% Though Its Price And Business Still Lag The Industry

Despite an already strong run, EchoStar Corporation (NASDAQ:SATS) shares have been powering on, with a gain of 28% in the last thirty days. Taking a wider view, although not as strong as the last month, the full year gain of 15% is also fairly reasonable.

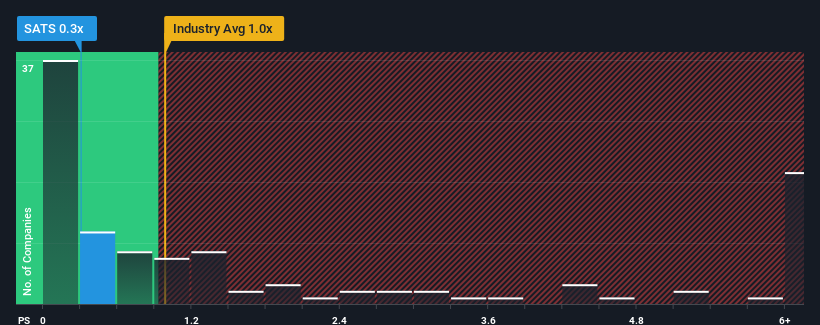

In spite of the firm bounce in price, EchoStar's price-to-sales (or "P/S") ratio of 0.3x might still make it look like a buy right now compared to the Media industry in the United States, where around half of the companies have P/S ratios above 1x and even P/S above 3x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for EchoStar

How Has EchoStar Performed Recently?

While the industry has experienced revenue growth lately, EchoStar's revenue has gone into reverse gear, which is not great. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on EchoStar.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should underperform the industry for P/S ratios like EchoStar's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 26%. In spite of this, the company still managed to deliver immense revenue growth over the last three years. Accordingly, shareholders will be pleased, but also have some serious questions to ponder about the last 12 months.

Looking ahead now, revenue is anticipated to slump, contracting by 1.0% per annum during the coming three years according to the nine analysts following the company. With the industry predicted to deliver 4.8% growth per year, that's a disappointing outcome.

With this in consideration, we find it intriguing that EchoStar's P/S is closely matching its industry peers. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

What We Can Learn From EchoStar's P/S?

EchoStar's stock price has surged recently, but its but its P/S still remains modest. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that EchoStar's P/S is on the lower end of the spectrum. As other companies in the industry are forecasting revenue growth, EchoStar's poor outlook justifies its low P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with EchoStar, and understanding them should be part of your investment process.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if EchoStar might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:SATS

EchoStar

Provides networking technologies and services in the United States and internationally.

Fair value with worrying balance sheet.

Similar Companies

Market Insights

Community Narratives