- United States

- /

- Interactive Media and Services

- /

- NasdaqGM:RUM

Rumble (RUM): Evaluating Valuation as Browns Partnership Expands Cloud Footprint in NFL

Reviewed by Simply Wall St

Rumble (RUM) has entered into a new partnership with the Cleveland Browns to deliver cloud infrastructure and video storage services. This move makes the Browns the third NFL team to adopt Rumble’s cloud solutions and highlights growing demand for its technology.

See our latest analysis for Rumble.

Despite some recent setbacks in earnings, Rumble’s stock has seen brisk swings this year. The share price is down 55% year-to-date but has rallied 31% following its Northern Data acquisition. Short-term momentum remains choppy, but a modest 1-year total shareholder return suggests that many investors are still waiting to see if these bold partnerships and AI moves will pay off over the longer term.

If you’re curious about where the next wave of tech momentum could come from, now is a perfect time to explore See the full list for free..

The market’s strong reaction to Rumble’s recent announcements raises an important question: is the stock now trading at a bargain given its strategic moves, or have investors already priced in the future growth story?

Most Popular Narrative: 61.1% Undervalued

Rumble’s most widely followed valuation narrative points to a fair value well above its last close. This suggests that current levels may leave plenty of room for upside if the story plays out. With momentum in international deals and AI infrastructure, the narrative hinges on ambitious assumptions about user growth and monetization.

Expanding commercial partnerships (e.g., with Tether, Cumulus Media, leading AI players, and MoonPay) creates diversified revenue streams and unlocks new ad inventory and creator monetization opportunities. This supports both revenue and ARPU growth while mitigating reliance on a niche user base.

Want to know the bold projections baked into this valuation? The narrative’s fair value is driven by big gains in users and margins, plus a future profit multiple rarely seen outside of high-growth tech. Curious which financial levers analysts expect Rumble to pull? Click through and see why the consensus thinks this cloud disruptor stands out.

Result: Fair Value of $14.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy investments in AI and the Northern Data deal could pressure margins, especially if Rumble fails to scale revenue or diversify beyond its core users.

Find out about the key risks to this Rumble narrative.

Another View: What Do the Numbers Say?

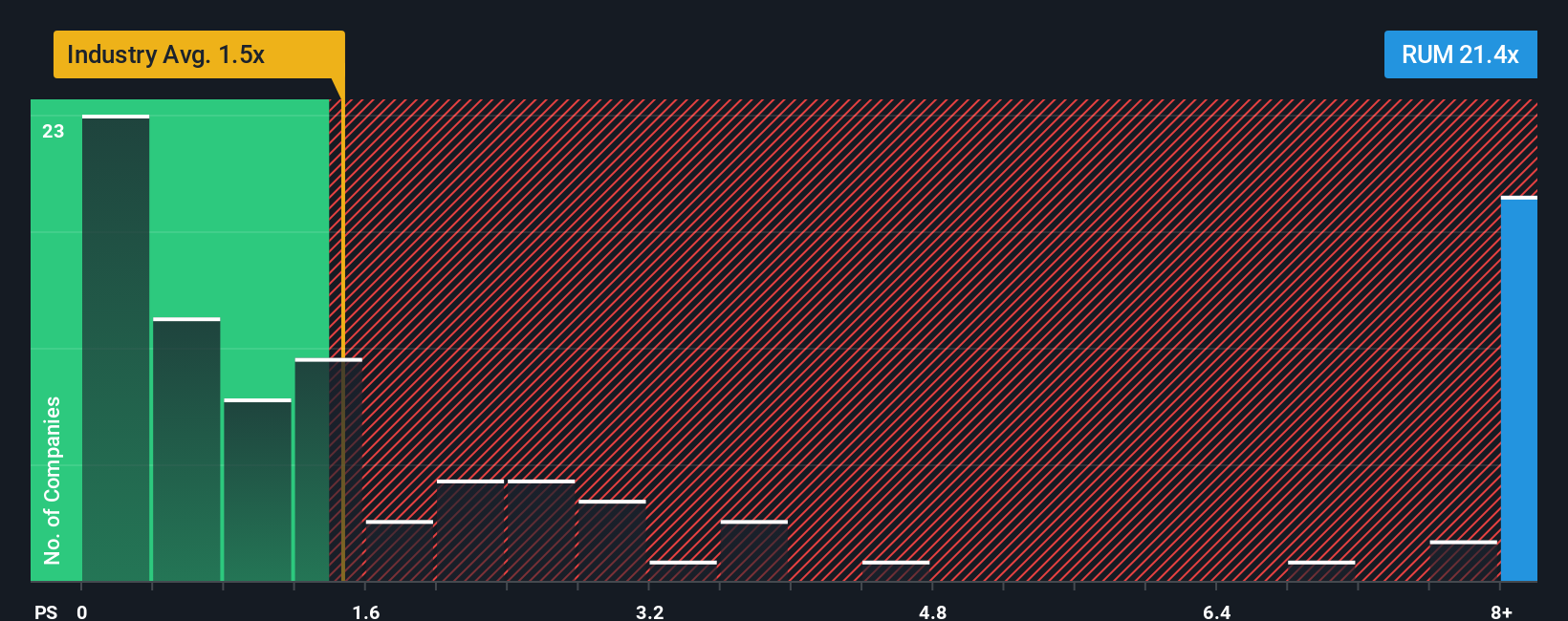

Looking through a different lens, Rumble’s price-to-sales ratio stands at 18.4x. This is much higher than both its peers (2.3x) and the industry average (1.3x), and it is also well above the market’s fair ratio of 1.4x. Such a steep premium means high expectations are already priced in and signals significant valuation risk if growth falls short. Could these lofty multiples be justified, or are investors paying too much for future hopes?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Rumble Narrative

If you see things differently or prefer your own analysis, you can build a personalized view in just a few minutes, your way. Do it your way.

A great starting point for your Rumble research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let your next opportunity pass by. Amazing investments take action, so check out these handpicked themes making headlines in the market today.

- Boost your income strategy and maximize yields by checking out these 16 dividend stocks with yields > 3% that consistently deliver strong dividends above 3%.

- Get ahead of the curve with these 24 AI penny stocks as they transform industries through cutting-edge artificial intelligence and disruptive growth.

- Spot the next potential winner with these 878 undervalued stocks based on cash flows based on real cash flow metrics, not just hype.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:RUM

Rumble

Operates video sharing platforms and cloud services in the United States, Canada, and internationally.

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives