- United States

- /

- Entertainment

- /

- NasdaqGS:ROKU

Roku (ROKU): Assessing Valuation After Launch of 14 New Channels and Pro Remote 2 Updates

Reviewed by Simply Wall St

Roku (ROKU) recently expanded its ad-supported streaming platform by launching 14 new free channels and introduced the Roku Pro Remote 2. These updates reflect the company’s ongoing drive to deepen user engagement and adapt to shifting viewer habits.

See our latest analysis for Roku.

Momentum around Roku has picked up in 2024, with a 29% share price return year-to-date and a 26.6% total shareholder return over the past twelve months, fueled by a steady string of product launches, content expansions, and international moves. While some volatility surfaced recently from sector-wide sentiment, the long-term total return of 73% across three years tells a story of resilience and growing market relevance even as the streaming landscape evolves.

If Roku’s blend of innovation and recovery makes you wonder what else is gaining traction, now’s the perfect chance to discover fast growing stocks with high insider ownership

With momentum building and innovation on display, the debate now turns to valuation. Has Roku’s recent progress left the stock undervalued and primed for further upside, or is the market already pricing in the next wave of growth?

Most Popular Narrative: 8.6% Undervalued

Roku’s current fair value, according to the most popular narrative, sits higher than its recent closing price. This sets the stage for a closer look at what is driving that bullish vantage and what assumptions are in play.

The accelerating shift away from traditional linear TV toward streaming continues to expand Roku's total addressable market, supporting long-term growth in active users and increasing demand for its connected TV platform. This trend is expected to drive sustained double-digit platform revenue growth.

Want to know the growth blueprint behind this bold target? The narrative hinges on rising engagement, surging advertising potential, and profit margins moving sharply higher. Discover the exact projections that fuel these expectations in the full breakdown.

Result: Fair Value of $105.32 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, fierce competition in the streaming market and Roku’s reliance on ad revenue could quickly shift the narrative if current growth trends slow.

Find out about the key risks to this Roku narrative.

Another View: Multiples Send a Different Signal

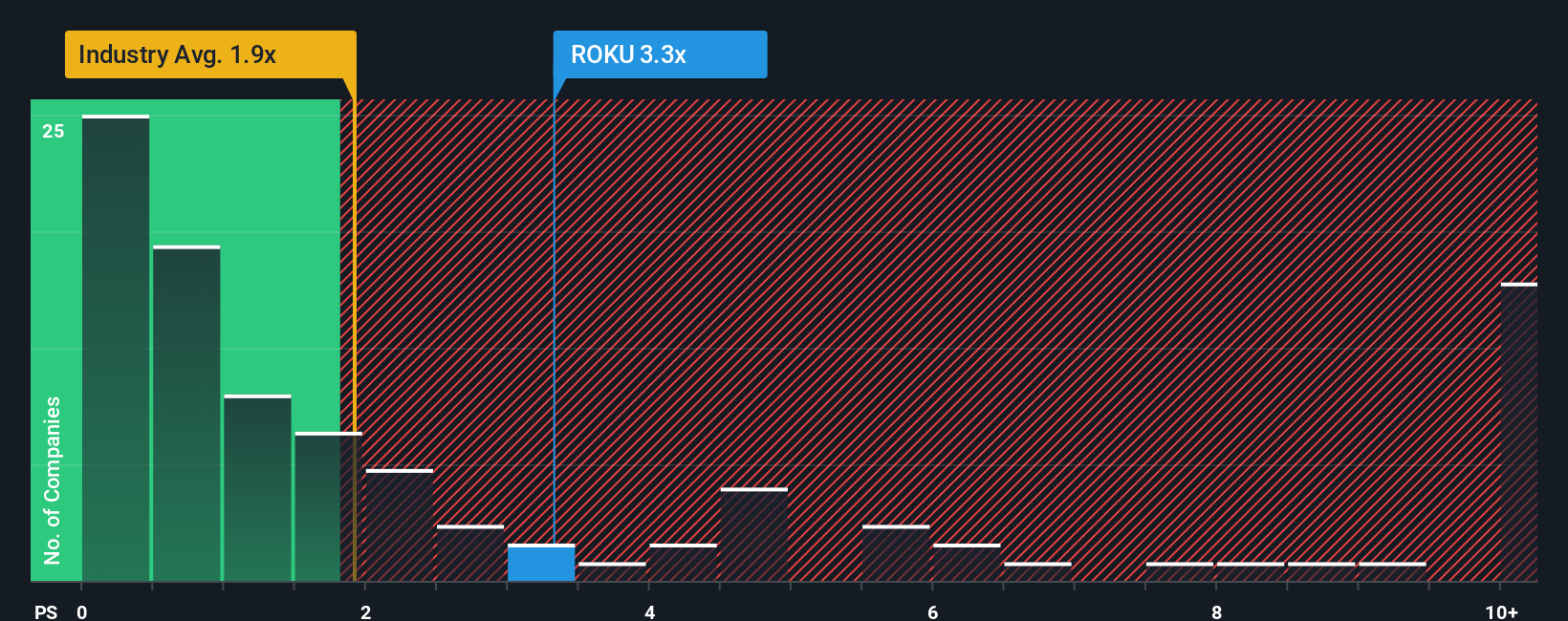

Our price-to-sales comparison shows Roku trades at 3.2 times its sales, which is notably higher than the US Entertainment industry average of 2 times and above the fair ratio of 2.6 times. This means the market is pricing Roku at a premium, posing a valuation risk if growth stalls. Is that premium justified? Could sentiment shift?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Roku Narrative

If you have a different perspective or enjoy digging into the details yourself, the tools are here for you to craft your own narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Roku.

Looking for more investment ideas?

Don’t just stop at Roku. Unlock a world of opportunity by checking out other high-potential stocks and strategies trusted by seasoned investors on Simply Wall St.

- Unlock the potential of emerging tech and find tomorrow’s industry leaders by browsing these 27 AI penny stocks on the cutting edge of artificial intelligence.

- Tap into overlooked gems poised for growth and seize your chance to get ahead in the market with these 872 undervalued stocks based on cash flows before others catch on.

- Capture powerful gains from passive income by finding reliable payers with these 17 dividend stocks with yields > 3% offering yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ROKU

Roku

Operates a TV streaming platform in the United States and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives