- United States

- /

- Entertainment

- /

- NasdaqGS:ROKU

Overwhelmed by Streaming Choices - A Great Time to Reevaluate Roku, Inc. (NASDAQ:ROKU)

There are multiple reasons why investors have found Roku, Inc. (NASDAQ:ROKU) attractive in the past, unfortunately as the price slumped, investors started pulling out, and the company is now trading at early 2020 levels. With the stock reaching new lows today, we decided to reevaluate the intrinsic value of the stock, and look at potential advantages against competitors.

View our latest analysis for Roku

Streaming VS Ads

Nobody likes ads, especially the attention-grabbing extra exaggerated ones. So, when the ad-free streaming services like Netflix (NASDAQ:NFLX) started entering the market, people were relieved to have a service that was affordable, shareable and ad-free. But fast-forward to today, and there are multiple competitors actively fighting for a market share in the streaming revenues. While the executive decision to go after streaming margins was a good one, the companies started to form closed content ecosystems, for which people would need multiple subscriptions in order to watch their favorite shows.

On the side of consumer budgets, we should also consider that people are facing inflation pressures, which motivates them to switch to more affordable alternatives like Roku. Ultimately, this may end-up being a user growth catalyst for the company, while consumers save on expenses at the same time.

Roku is still in the expansion and growth phase, so they are doing their best not to pass on costs to the consumers, even though input prices for manufacturing the devices are rising. In a way, a potential increase in organic growth, can offset the needed marketing expenses and make the company come out on top.

We will consider one more aspect - Roku is the low-cost alternative that allows consumers to buy a premium subscription from a third party like Amazon Prime (NASDAQ:AMZN) and watch high quality shows. However, there is a good portion of people that watch TV passively. A Roku device, with an ad-based model, is at an advantage for people that just need something to run in the background.

All of the above, may contribute to retaining or even stimulating growth in a time when companies are starting to worry about the future.

Asset Light Model

Looking at the financials, there is one more key distinction when it comes to Roku's business model.

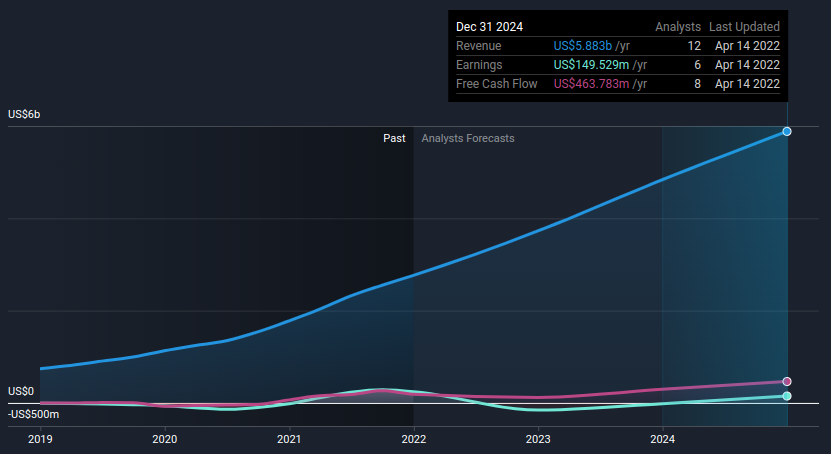

The company already has positive free cash flows of US$188m, and while profit is expected to dip in 2023, the cash flows are expected to rise consistently, up to US$463.8 in 2024.

This is partly because the company is focused on providing access to content, and not creating it. While they may allocate a small budget to original content, it is meant to be a small "featured" choice for consumers, rather than a continuous content stream. This alleviates some risk from expensive content creation that can ultimately be a "hit or miss".

As a result, while the company will still need to reinvest in order to grow, the CapEx will be a lot less than companies producing content such as Netflix and Disney (NYSE:DIS).

The model is also more flexible, as the company can focus on ad revenue when times are tight and deliver content when the economy picks up.

Now, in order to put this into perspective, we need to reevaluate our cash flow model and see what the intrinsic value of the future cash flows is for this company. While parts of the market are sinking, some companies may have dropped back to value and we will explore if Roku is a candidate.

Intrinsic Valuation

We use what is known as a 2-stage free cash flow to equity model. Generally the first stage is higher growth, and the second stage is a mature (lower) growth phase.

Remember though, that there are many ways to estimate a company's value, and a DCF is just one method. Anyone interested in learning a bit more about intrinsic value should have a read of the Simply Wall St analysis model.

To begin with, we have to get estimates of the next ten years of cash flows, and we use analysts' estimates for this purpose.

10-year free cash flow (FCF) forecast

| 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | |

| Levered FCF ($, Millions) | US$119.5m | US$295.7m | US$463.8m | US$424.5m | US$632.6m | US$730.9m | US$814.7m | US$884.7m | US$943.0m | US$992.0m |

| Growth Rate Estimate Source | Analyst x10 | Analyst x11 | Analyst x8 | Analyst x2 | Analyst x2 | Est @ 15.55% | Est @ 11.46% | Est @ 8.6% | Est @ 6.59% | Est @ 5.19% |

| Present Value ($, Millions) Discounted @ 6.0% | US$113 | US$263 | US$389 | US$336 | US$473 | US$515 | US$542 | US$555 | US$558 | US$554 |

("Est" = FCF growth rate estimated by Simply Wall St)

Present Value of 10-year Cash Flow (PVCF) = US$4.3b

After calculating the present value of future cash flows in the initial 10-year period, we need to calculate the Terminal Value. We discount the terminal cash flows to today's value at a cost of equity of 6.0%.

Terminal Value (TV)= FCF2031 × (1 + g) ÷ (r – g) = US$992m× (1 + 1.9%) ÷ (6.0%– 1.9%) = US$25b

Present Value of Terminal Value (PVTV)= TV / (1 + r)10= US$25b÷ ( 1 + 6.0%)10= US$14b

The total value, or equity value, is the sum of the present value of the future cash flows, which in this case is US$18b.

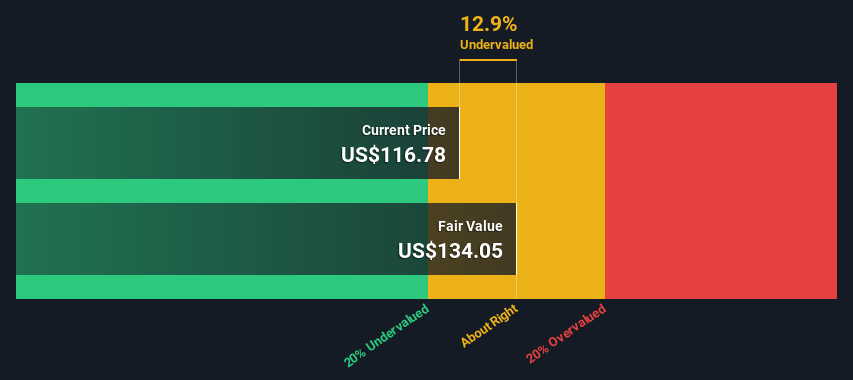

To get the intrinsic value per share, we divide this by the total number of shares outstanding. Compared to the current share price of US$117, the company appears about fair value at a 13% discount.

Given that this is not a precise model, it looks like the stock is trading around value, rather than with a large upside.

Considering the stock price, when investors have entered a growing company around fair value, and it delivers consistent returns, then the stock may slowly grow over a longer period simply because the value of the cash flows increases as time passes.

Conclusion

The ad-based model for Roku is a flexible, asset light operation, that can deliver increasing free cash flows for investors.

Given the large choice of premium streaming services and increased costs of living, consumers may opt to switch to a low-cost alternative with upgrade options. This way they can enjoy passive TV and buy quality shows when they want.

The intrinsic value model indicates that the stock may be back to fair value, and it might be worth considering for investors that can hold some time for the company to reach maturity.

For your investment journey, we've compiled three relevant aspects you should consider:

- Risks: You should be aware of the 2 warning signs for Roku we've uncovered before considering an investment in the company.

- Insider Ownership: explore to what extent Roku is a founder-led company, rather than in control of managers.

- Other Solid Businesses: Low debt, high returns on equity and good past performance are fundamental to a strong business. Why not explore our interactive list of stocks with solid business fundamentals to see if there are other companies you may not have considered!

PS. The Simply Wall St app conducts a discounted cash flow valuation for every stock on the NASDAQGS every day. If you want to find the calculation for other stocks just search here.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NasdaqGS:ROKU

Roku

Operates a TV streaming platform in the United States and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026