- United States

- /

- Entertainment

- /

- NasdaqGS:ROKU

Does Roku’s Smart TV Expansion Signal a Key Opportunity for Investors in 2025?

Reviewed by Bailey Pemberton

- Ever wondered if Roku stock is really living up to the streaming hype, or if there is untapped value hidden beneath the headlines?

- Shares have jumped 2.7% in the last week and are up a strong 32.4% for the year to date. However, they remain well below their five-year highs.

- Recent news has centered on Roku's continued expansion into smart TV partnerships and significant moves to secure new advertising deals, both of which have attracted investor attention. Along with market speculation over streaming industry shakeups, these updates have contributed to increased volatility in the stock's performance.

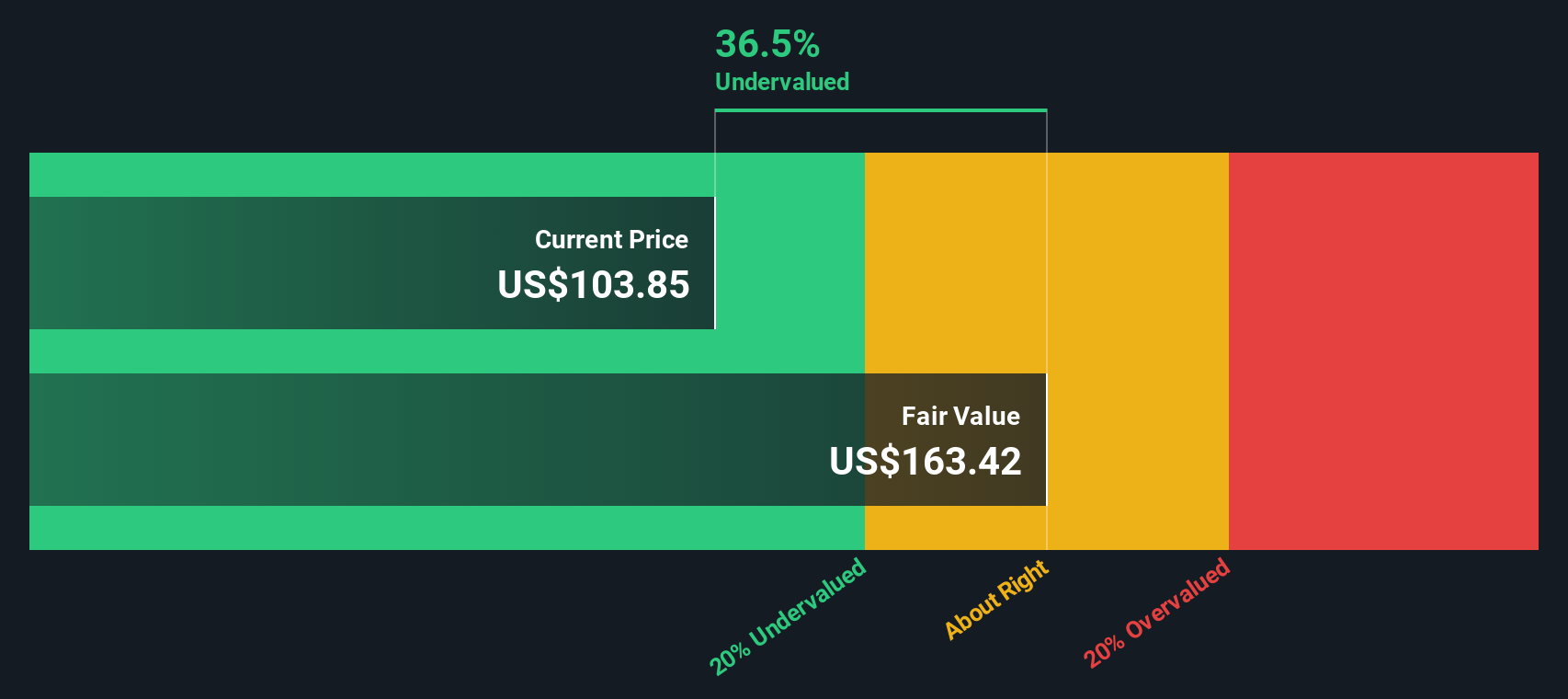

- According to our valuation checks, Roku scores 3 out of 6 for being undervalued. This is decent but leaves room for improvement. We will break down what that score really means with different valuation approaches and explore a smarter way to pinpoint Roku’s value by the end of this article.

Find out why Roku's 27.2% return over the last year is lagging behind its peers.

Approach 1: Roku Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates what a company is really worth by projecting its future cash flows and then discounting those amounts back to today's value. This technique helps investors separate short-term market trends from a company's longer-term, fundamental value.

For Roku, the latest DCF uses the 2 Stage Free Cash Flow to Equity approach. The model starts with its current Free Cash Flow of $318.9 Million. Analyst estimates only extend five years into the future, with projected Free Cash Flow steadily rising to $1.26 Billion by 2029. After that, future cash flows are extrapolated based on current trends.

All cash flows used are denominated in US dollars, aligning with Roku's reporting. According to this model, Roku's intrinsic fair value stands at $146.31 per share, which is about 32.6% higher than its current market price. This implies that Roku stock is presently undervalued, offering a significant discount compared to analysts' long-term expectations.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Roku is undervalued by 32.6%. Track this in your watchlist or portfolio, or discover 854 more undervalued stocks based on cash flows.

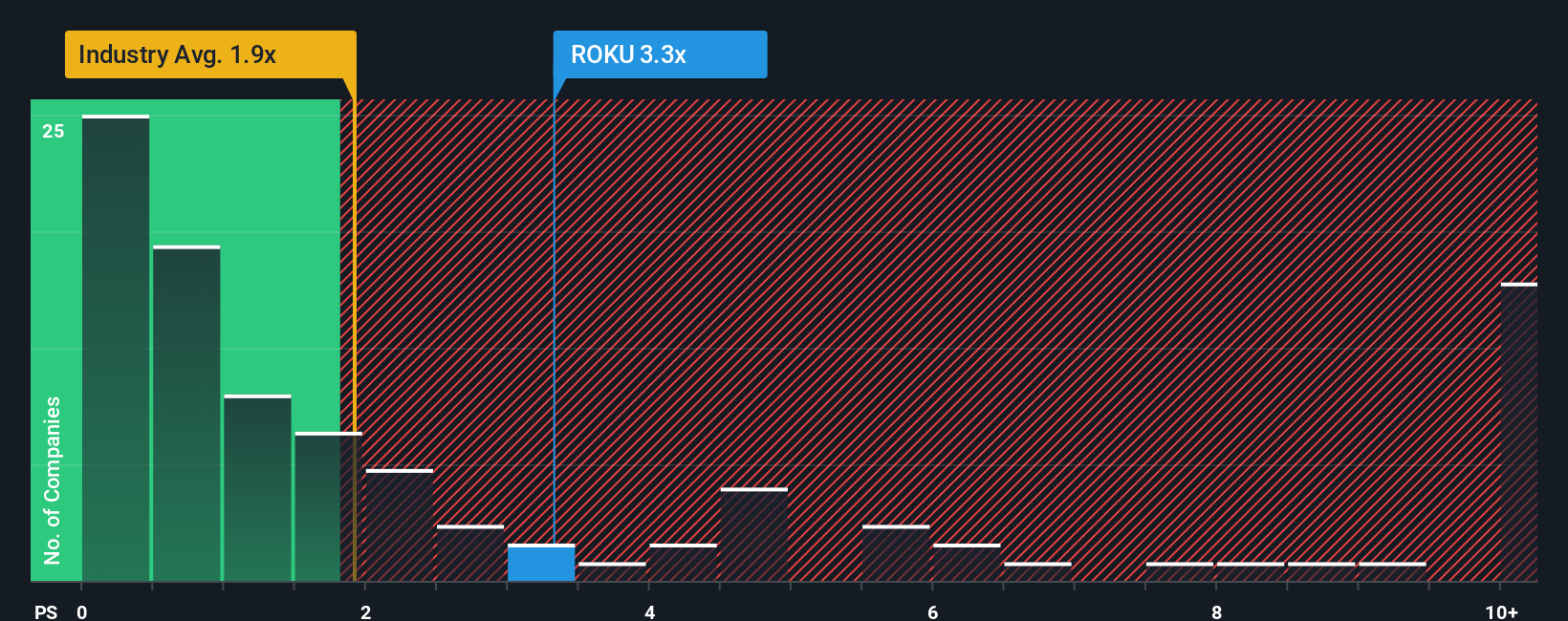

Approach 2: Roku Price vs Sales (P/S)

The Price-to-Sales (P/S) ratio is a popular metric for valuing companies like Roku, especially those that are growing quickly but may not yet be consistently profitable. Since Roku is reinvesting heavily to drive top-line expansion and its earnings fluctuate, P/S offers important context by focusing on how much investors are paying for each dollar of sales rather than earnings.

Growth expectations and risk play a significant role in shaping what a "normal" or "fair" P/S ratio should be. Companies with higher sales growth or lower risk often command a higher P/S ratio, while slower-growing or riskier firms typically trade at a discount.

Roku currently trades at a P/S ratio of 3.31x. For comparison, the entertainment industry average is around 1.69x, and Roku’s direct peers average 3.85x. Simply Wall St's proprietary "Fair Ratio," which takes into account Roku’s growth prospects, market risks, profit margins, and scale, stands at 2.61x.

The Fair Ratio provides a more accurate benchmark than simply comparing to peers or the industry because it incorporates Roku-specific factors such as its sales trajectory, profitability outlook, sector characteristics, and relative market capitalization. This holistic view minimizes the noise from generic averages.

With Roku’s actual P/S ratio of 3.31x moderately above its Fair Ratio of 2.61x, the stock appears to be somewhat overvalued by this measure.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1395 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Roku Narrative

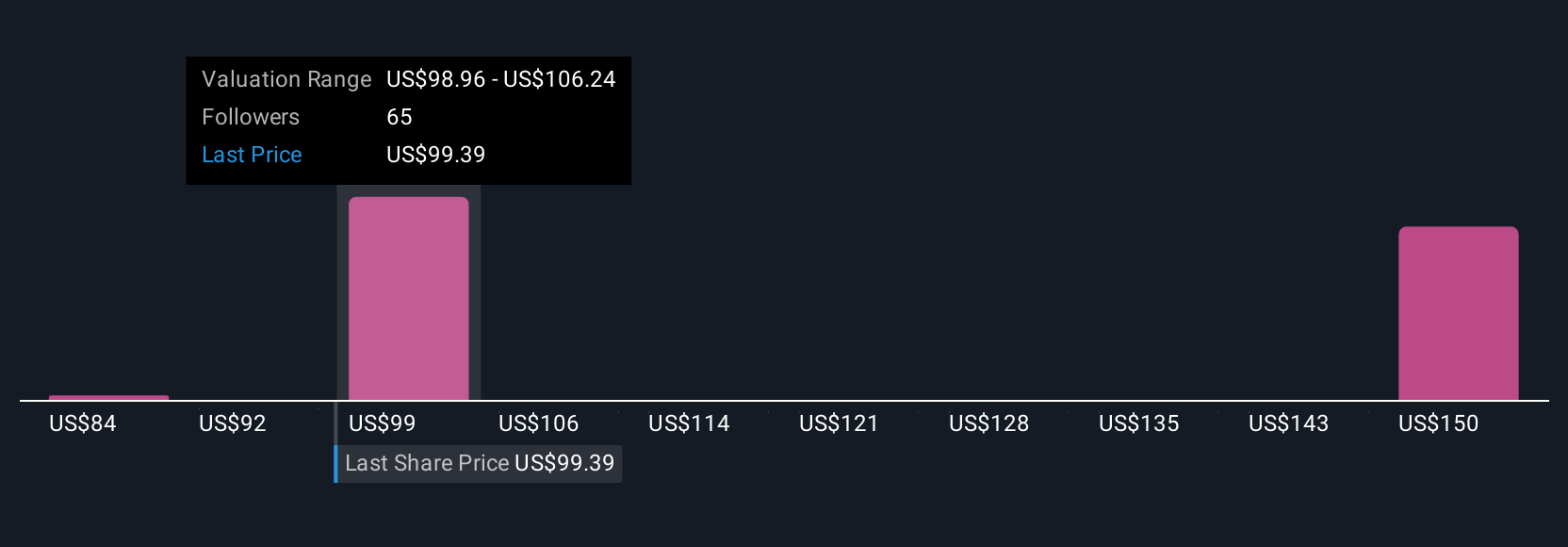

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your own story or perspective about a company. It ties your view of Roku's business prospects, risks, and industry trends directly to a forecast of future sales, earnings, and ultimately a fair value estimate.

With Narratives, you connect the dots from what you believe will drive Roku’s future (like new partnerships, streaming adoption, or changing ad markets) through to numbers. These include your own assumptions around growth, margins, and financial results. This makes the process less about generic ratios and more about making informed investment decisions built on your unique insights and real data.

On Simply Wall St’s Community page, which is used by millions of investors, Narratives are easy to try and update anytime. They empower you to decide when Roku’s stock is a buy or sell by comparing your Narrative Fair Value to the current share price.

As new news or earnings roll in, Narratives automatically refresh, helping you stay current and adjust your stance with evolving information.

For example, on Roku, some investors in the Community see massive upside and set fair values as high as $130, driven by optimism around international expansion and growing ad revenue. Others are more cautious, with fair values as low as $70, reflecting concerns about heavy competition and margin pressure.

Do you think there's more to the story for Roku? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ROKU

Roku

Operates a TV streaming platform in the United States and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives