- United States

- /

- Entertainment

- /

- NasdaqGS:ROKU

Assessing Roku Value After 34% Price Surge and New Content Distribution Deals

Reviewed by Bailey Pemberton

- Thinking about Roku and whether now is the right time to buy, sell, or hold? You are not alone, as many investors are trying to pin down Roku’s real value amidst plenty of headlines and price action.

- Roku’s share price has taken investors on a wild ride recently. It has surged 34.3% so far this year and 34.6% over the last 12 months, though it pulled back 4.6% in the past week. That kind of volatility gets attention and suggests shifting market sentiment about growth and risk for the stock.

- News around stronger streaming platform adoption and industry partnerships has been a big driver. Investors have reacted to fresh announcements about new content distribution deals and the company's expanding advertising reach. These updates help explain both Roku’s sharp gains and the recent bout of volatility.

- On the numbers, Roku scores a 3 out of 6 on our valuation checks, meaning there are both opportunities and red flags to consider. Next, we will break down how Roku stacks up under a range of valuation approaches, and at the end, reveal an even more insightful way to assess whether Roku is a bargain.

Approach 1: Roku Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today's dollars. This method helps investors determine what a business is truly worth based on its potential to generate cash over time, rather than relying solely on current market prices or earnings multiples.

For Roku, the most recent Free Cash Flow stands at approximately $395 Million. Analyst forecasts suggest rapid expansion, with projections reaching around $1.31 Billion in Free Cash Flow by 2029. Analysts provide direct estimates for the next five years. For subsequent years, estimates are extrapolated. This highlights expectations for significant growth in Roku's streaming and advertising businesses over the coming decade.

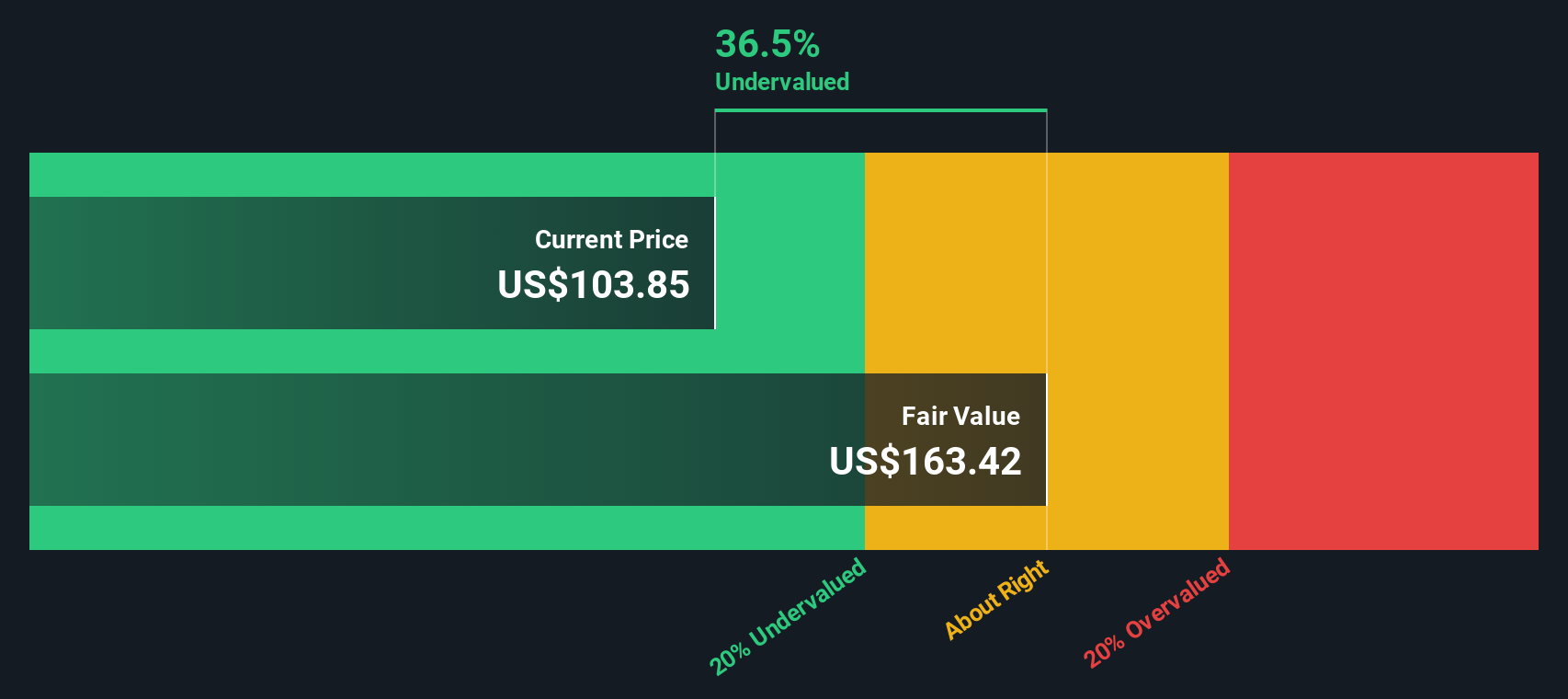

Based on these projections and discounting them back to present value, the DCF model arrives at an intrinsic value of $153.50 per share. Comparing this to the current market price, Roku appears to be 34.8% undervalued. According to this valuation, Roku's shares may offer considerable upside potential for investors seeking growth at a bargain price.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Roku is undervalued by 34.8%. Track this in your watchlist or portfolio, or discover 868 more undervalued stocks based on cash flows.

Approach 2: Roku Price vs Sales

The Price-to-Sales (PS) ratio is often used to value companies like Roku, especially when they are reinvesting heavily for growth or not yet generating consistent profits. This metric is particularly helpful for tech and media businesses where sales growth is a key driver and earnings may be less reliable due to upfront investments.

Investors generally look to the PS ratio to gauge whether a stock is trading at a reasonable value relative to its revenue. This "fair" level can vary. Companies expected to grow revenue quickly or facing less risk typically command higher PS multiples. In contrast, slower growth or higher risk firms tend to be valued lower.

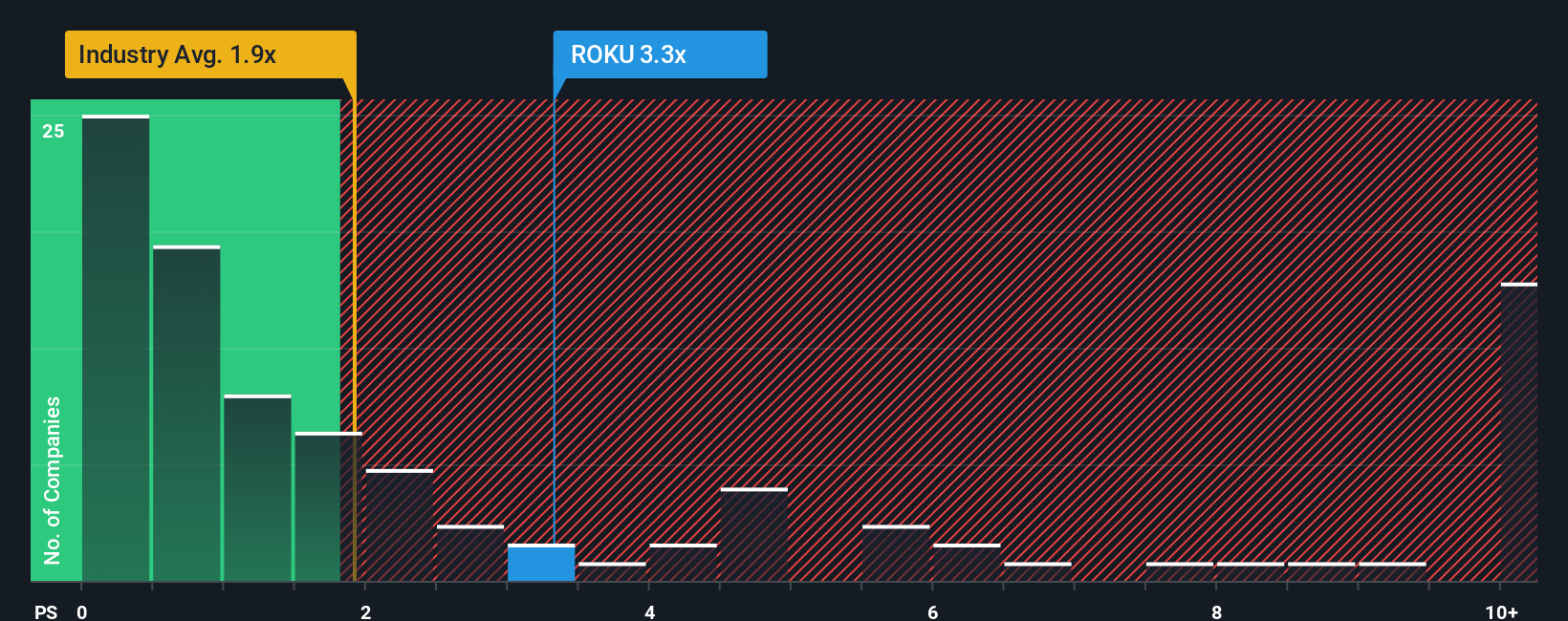

Roku currently trades at a PS ratio of 3.25x. For comparison, the broader entertainment industry average sits at 1.66x, while Roku’s peers average 4.15x. Benchmarks like these provide context, but do not always reflect Roku’s specific prospects and risks.

This is where Simply Wall St’s proprietary “Fair Ratio” comes in. For Roku, it is calculated as 2.69x. Unlike simple averages, the Fair Ratio incorporates forecasts for sales growth, profit margin potential, industry dynamics, company size, and risk factors, making it a more tailored benchmark for fair value assessment.

Comparing Roku’s current PS ratio of 3.25x to its Fair Ratio of 2.69x, the stock appears slightly overvalued based on this approach. The difference is greater than 0.10, suggesting that investors are paying a premium for Roku’s growth prospects right now.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1398 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Roku Narrative

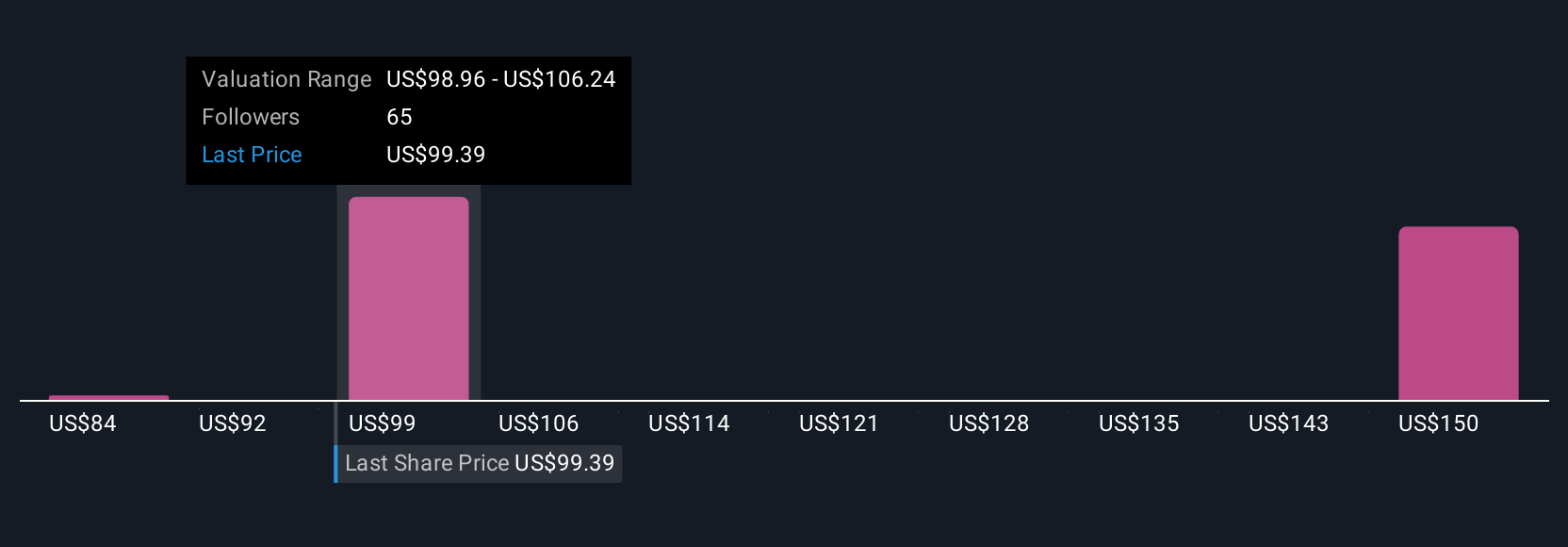

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your unique investment story for a company. It is where you connect your view of Roku's business, the trends you believe in, and your outlook for its future, and then see how these beliefs translate into numbers like future revenue, profit margins, and an estimated fair value.

Unlike static models, Narratives link the big-picture story (such as platform growth, profitability, or competitive pressures) directly to a financial forecast, making it easy to see exactly how your expectations drive your fair value. You can also see how that compares to the current share price. Narratives are intuitive and accessible through Simply Wall St's Community page, used by millions of investors and updated dynamically as new news or financial results emerge, so your view always reflects the latest information.

This approach empowers you to make buy or sell decisions based on what you believe is probable, not just what analysts or averages suggest. For example, some investors believe Roku's evolving ad platform and global partnerships will support a bullish price target of $130, while others focus on risks like competition and assign a more conservative target of $70. Your Narrative helps you clarify and track your own conviction.

Do you think there's more to the story for Roku? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ROKU

Roku

Operates a TV streaming platform in the United States and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives