- United States

- /

- Entertainment

- /

- NasdaqGS:PLTK

Is Playtika (PLTK) Using Licensed Brands Like Garfield to Reinvent Its User Engagement Strategy?

Reviewed by Simply Wall St

- Bingo Blitz, a hit title from Playtika Holding, recently launched a limited-time collaboration event with Garfield, adding themed bingo rooms and a new social Collaboration Room to the game experience.

- This crossover capitalizes on Garfield's enduring global appeal and aims to boost user engagement through nostalgia and enhanced interactive features for both existing players and new audiences.

- We'll explore how leveraging the Garfield brand in Bingo Blitz may influence Playtika's investment narrative and future user engagement strategy.

Find companies with promising cash flow potential yet trading below their fair value.

Playtika Holding Investment Narrative Recap

To believe in Playtika as a shareholder, you need confidence in its ability to refresh aging flagship games and expand its user base through brand partnerships and new features. The Bingo Blitz x Garfield event attempts to energize user engagement and foster new audience growth, but with core titles like Slotomania under continued revenue pressure, the event's impact on the company's most immediate revenue risk may not be material in the short term. Earnings headwinds remain the biggest concern until meaningful new releases offset core declines.

Looking back, the May launch of Slotomania’s Wheel of Fortune Lucky Coins On Stage signals Playtika’s ongoing efforts to revitalize its legacy franchises, a strategy that directly relates to short-term catalysts and user retention challenges. These types of collaborations highlight how ongoing product innovation is intended to help counter persistent user fatigue and declining engagement in maturing titles.

Yet, in sharp contrast, investors also need to be mindful of just how much ongoing revenue depends on...

Read the full narrative on Playtika Holding (it's free!)

Playtika Holding's narrative projects $3.0 billion revenue and $249.2 million earnings by 2028. This requires 3.6% yearly revenue growth and a $162.8 million earnings increase from $86.4 million currently.

Uncover how Playtika Holding's forecasts yield a $6.30 fair value, a 83% upside to its current price.

Exploring Other Perspectives

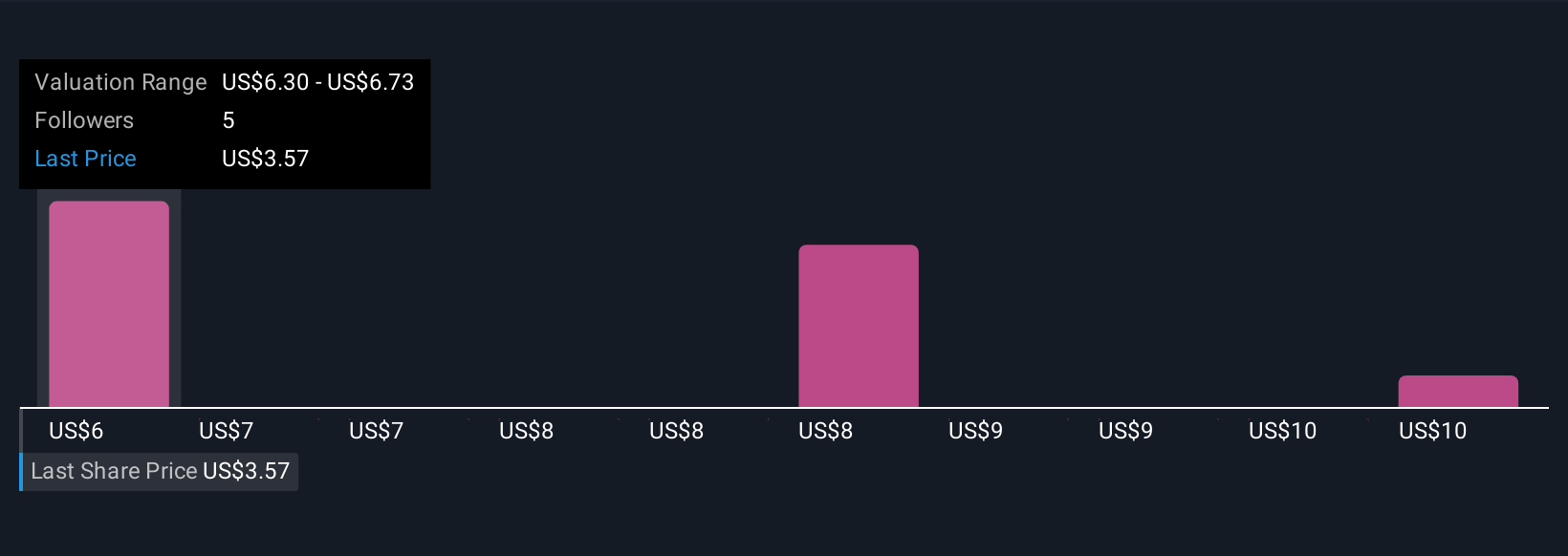

The Simply Wall St Community shared fair value views for Playtika from US$6.30 to US$10.57, based on three unique estimates. While some see significant undervaluation, others may see risk in the company's concentrated reliance on aging titles, which could affect future returns.

Explore 3 other fair value estimates on Playtika Holding - why the stock might be worth just $6.30!

Build Your Own Playtika Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Playtika Holding research is our analysis highlighting 2 key rewards and 5 important warning signs that could impact your investment decision.

- Our free Playtika Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Playtika Holding's overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PLTK

Playtika Holding

Develops mobile games in the United States, Europe, the Middle East, Africa, the Asia Pacific, and internationally.

Moderate risk and good value.

Similar Companies

Market Insights

Community Narratives