- United States

- /

- Interactive Media and Services

- /

- NasdaqCM:IPM

Paltalk (NASDAQ:PALT) Is Posting Healthy Earnings, But It Is Not All Good News

Despite posting strong earnings, Paltalk, Inc.'s (NASDAQ:PALT) stock didn't move much over the last week. We decided to have a deeper look, and we believe that investors might be worried about several concerning factors that we found.

See our latest analysis for Paltalk

Examining Cashflow Against Paltalk's Earnings

As finance nerds would already know, the accrual ratio from cashflow is a key measure for assessing how well a company's free cash flow (FCF) matches its profit. To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. The ratio shows us how much a company's profit exceeds its FCF.

That means a negative accrual ratio is a good thing, because it shows that the company is bringing in more free cash flow than its profit would suggest. That is not intended to imply we should worry about a positive accrual ratio, but it's worth noting where the accrual ratio is rather high. That's because some academic studies have suggested that high accruals ratios tend to lead to lower profit or less profit growth.

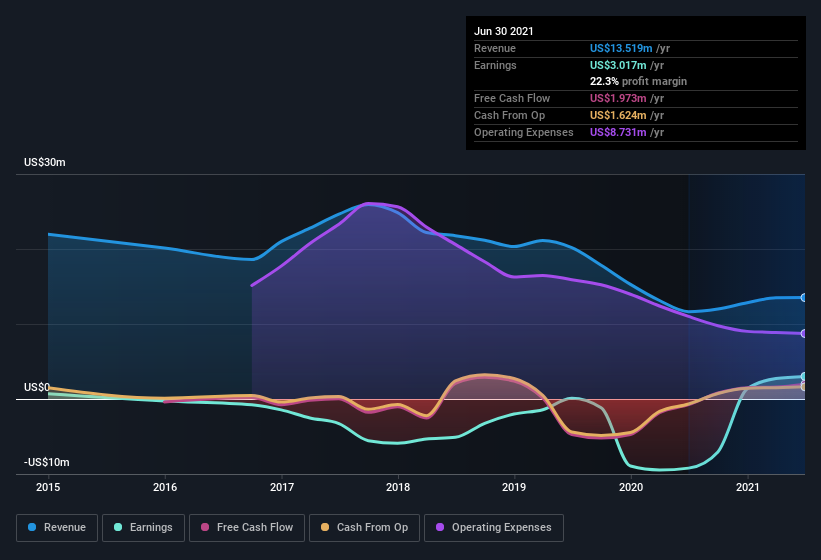

For the year to June 2021, Paltalk had an accrual ratio of 0.24. Therefore, we know that it's free cashflow was significantly lower than its statutory profit, which is hardly a good thing. In fact, it had free cash flow of US$2.0m in the last year, which was a lot less than its statutory profit of US$3.02m. Given that Paltalk had negative free cash flow in the prior corresponding period, the trailing twelve month resul of US$2.0m would seem to be a step in the right direction. However, that's not the end of the story. We can look at how unusual items in the profit and loss statement impacted its accrual ratio, as well as explore how dilution is impacting shareholders negatively. The good news for shareholders is that Paltalk's accrual ratio was much better last year, so this year's poor reading might simply be a case of a short term mismatch between profit and FCF. Shareholders should look for improved cashflow relative to profit in the current year, if that is indeed the case.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Paltalk.

One essential aspect of assessing earnings quality is to look at how much a company is diluting shareholders. In fact, Paltalk increased the number of shares on issue by 20% over the last twelve months by issuing new shares. Therefore, each share now receives a smaller portion of profit. To talk about net income, without noticing earnings per share, is to be distracted by the big numbers while ignoring the smaller numbers that talk to per share value. You can see a chart of Paltalk's EPS by clicking here.

A Look At The Impact Of Paltalk's Dilution on Its Earnings Per Share (EPS).

Paltalk was losing money three years ago. Zooming in to the last year, we still can't talk about growth rates coherently, since it made a loss last year. But mathematics aside, it is always good to see when a formerly unprofitable business come good (though we accept profit would have been higher if dilution had not been required). And so, you can see quite clearly that dilution is influencing shareholder earnings.

If Paltalk's EPS can grow over time then that drastically improves the chances of the share price moving in the same direction. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

How Do Unusual Items Influence Profit?

Given the accrual ratio, it's not overly surprising that Paltalk's profit was boosted by unusual items worth US$826k in the last twelve months. While it's always nice to have higher profit, a large contribution from unusual items sometimes dampens our enthusiasm. When we crunched the numbers on thousands of publicly listed companies, we found that a boost from unusual items in a given year is often not repeated the next year. And that's as you'd expect, given these boosts are described as 'unusual'. Paltalk had a rather significant contribution from unusual items relative to its profit to June 2021. All else being equal, this would likely have the effect of making the statutory profit a poor guide to underlying earnings power.

Our Take On Paltalk's Profit Performance

Paltalk didn't back up its earnings with free cashflow, but this isn't too surprising given profits were inflated by unusual items. Meanwhile, the new shares issued mean that shareholders now own less of the company, unless they tipped in more cash themselves. On reflection, the above-mentioned factors give us the strong impression that Paltalk'sunderlying earnings power is not as good as it might seem, based on the statutory profit numbers. Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. Every company has risks, and we've spotted 4 warning signs for Paltalk (of which 1 is significant!) you should know about.

Our examination of Paltalk has focussed on certain factors that can make its earnings look better than they are. And, on that basis, we are somewhat skeptical. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

If you’re looking to trade Paltalk, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:IPM

Intelligent Protection Management

Provides cloud infrastructure, cybersecurity, and managed services in the United States.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives