- United States

- /

- Interactive Media and Services

- /

- NasdaqCM:IPM

Paltalk, Inc.'s (NASDAQ:PALT) 28% Dip Still Leaving Some Shareholders Feeling Restless Over Its P/SRatio

To the annoyance of some shareholders, Paltalk, Inc. (NASDAQ:PALT) shares are down a considerable 28% in the last month, which continues a horrid run for the company. Looking at the bigger picture, even after this poor month the stock is up 32% in the last year.

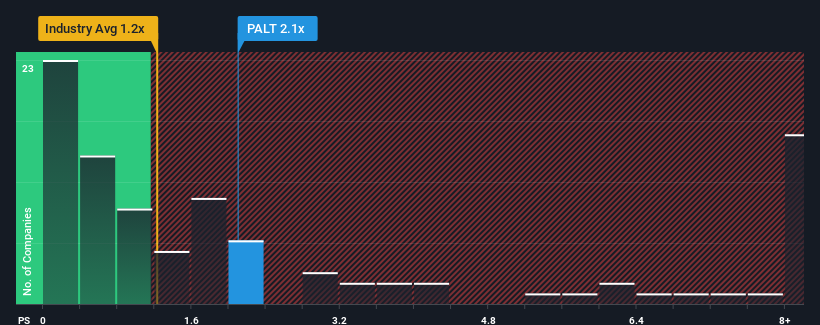

In spite of the heavy fall in price, when almost half of the companies in the United States' Interactive Media and Services industry have price-to-sales ratios (or "P/S") below 1.2x, you may still consider Paltalk as a stock probably not worth researching with its 1.9x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

View our latest analysis for Paltalk

How Paltalk Has Been Performing

While the industry has experienced revenue growth lately, Paltalk's revenue has gone into reverse gear, which is not great. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Paltalk's future stacks up against the industry? In that case, our free report is a great place to start.How Is Paltalk's Revenue Growth Trending?

In order to justify its P/S ratio, Paltalk would need to produce impressive growth in excess of the industry.

Retrospectively, the last year delivered a frustrating 6.0% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 24% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 7.9% as estimated by the sole analyst watching the company. With the industry predicted to deliver 13% growth, that's a disappointing outcome.

With this information, we find it concerning that Paltalk is trading at a P/S higher than the industry. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh heavily on the share price eventually.

What Does Paltalk's P/S Mean For Investors?

Despite the recent share price weakness, Paltalk's P/S remains higher than most other companies in the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Paltalk's analyst forecasts revealed that its shrinking revenue outlook isn't drawing down its high P/S anywhere near as much as we would have predicted. Right now we aren't comfortable with the high P/S as the predicted future revenue decline likely to impact the positive sentiment that's propping up the P/S. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Plus, you should also learn about these 4 warning signs we've spotted with Paltalk (including 2 which are potentially serious).

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:IPM

Intelligent Protection Management

Provides cloud infrastructure, cybersecurity, and managed services in the United States.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives