- United States

- /

- Interactive Media and Services

- /

- NasdaqCM:IPM

Paltalk, Inc. (NASDAQ:PALT) May Have Run Too Fast Too Soon With Recent 30% Price Plummet

Paltalk, Inc. (NASDAQ:PALT) shares have had a horrible month, losing 30% after a relatively good period beforehand. Still, a bad month hasn't completely ruined the past year with the stock gaining 35%, which is great even in a bull market.

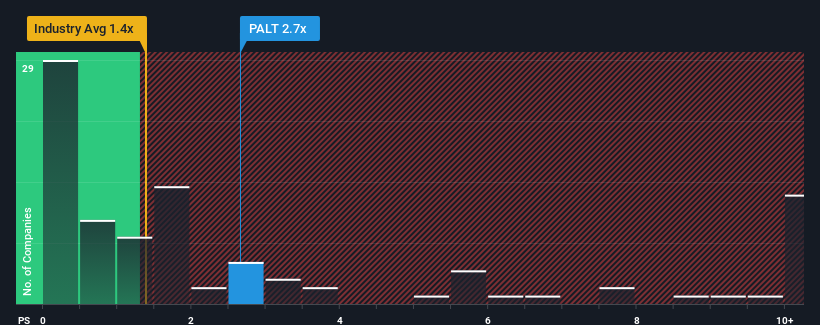

Although its price has dipped substantially, given close to half the companies operating in the United States' Interactive Media and Services industry have price-to-sales ratios (or "P/S") below 1.4x, you may still consider Paltalk as a stock to potentially avoid with its 2.7x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

See our latest analysis for Paltalk

What Does Paltalk's Recent Performance Look Like?

Paltalk hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Paltalk will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Paltalk would need to produce impressive growth in excess of the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 6.0%. The last three years don't look nice either as the company has shrunk revenue by 24% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 7.9% as estimated by the sole analyst watching the company. Meanwhile, the broader industry is forecast to expand by 13%, which paints a poor picture.

With this information, we find it concerning that Paltalk is trading at a P/S higher than the industry. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh heavily on the share price eventually.

The Bottom Line On Paltalk's P/S

Despite the recent share price weakness, Paltalk's P/S remains higher than most other companies in the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Paltalk currently trades on a much higher than expected P/S for a company whose revenues are forecast to decline. In cases like this where we see revenue decline on the horizon, we suspect the share price is at risk of following suit, bringing back the high P/S into the realms of suitability. At these price levels, investors should remain cautious, particularly if things don't improve.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for Paltalk (1 doesn't sit too well with us) you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:IPM

Intelligent Protection Management

Provides cloud infrastructure, cybersecurity, and managed services in the United States.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives