- United States

- /

- Interactive Media and Services

- /

- NasdaqCM:IPM

Here is why Paltalk (NASDAQ:PALT) is in a Great Financial Position, but Lacking Development

Paltalk ( NASDAQ:PALT ) is a videoconferencing technology company that recently experienced a sudden price jump. We were interested if this action merits a deeper review, so we reviewed the fundamentals and their business model. Needless to say that this is a very high risk stock, and potential investors should try to get as much information as possible before making a decision.

View our latest analysis for Paltalk

The Business

Paltalk's product portfolio includes Paltalk and Camfrog , which together host collections of video-based communities. Their products include Tinychat and Vumber. The Company has an over 20-year history of technology innovation and holds 18 patents.

Most of the company's revenues come from subscriptions that allow users to upgrade their Paltalk account, which expands access and unlocks status.

Although small, Paltalk is a profitable company, and in their latest quarterly report the CEO emphasized that this is their 4th consecutive quarter where they are making positive cash flows:

“Paltalk continued to post strong results in the first quarter of 2021; in fact, this marks the fourth consecutive quarter that we reported positive earnings and cash flow, continuing a trend first established in mid-2020 after our strategic shift to focus on our core multimedia social applications,” Jason Katz , CEO and Chairman of Paltalk, Inc.

The app itself if very reminiscent of older Skype-era technology. It seems that while the company has made development strides and holds technology patents, it will need quite a bit of extra development before it can contend with the conferencing competitors like Brave , Zoom ( NASDAQ:ZM ), MS Teams ( NASDAQ:MSFT ), Discord , Twitch ( NASDAQ:AMZN ) etc.

In our fundamental review, we will focus on the cash capacity of the company and revenue growth.

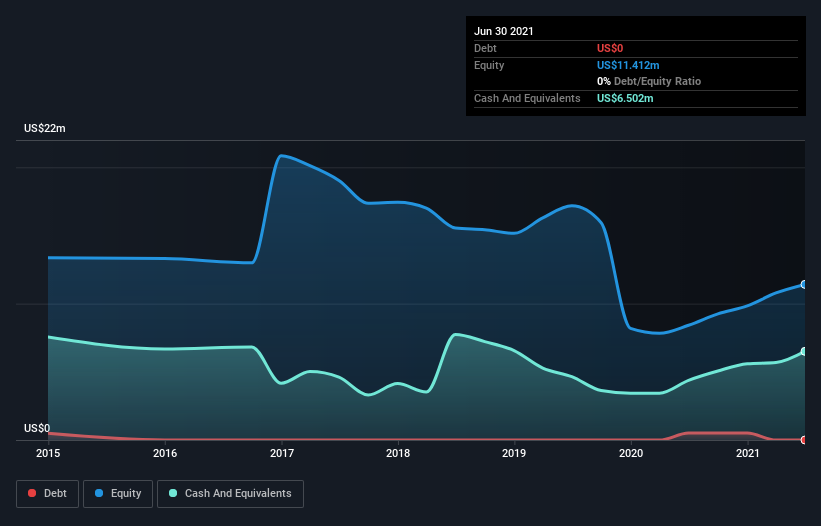

Cash Balance

The company has a very good asset structure, with no long term debt and US$6.5m in cash. Considering that their last twelve months revenue is at US$13.5m , it seems like they have a healthy cash portion.

The chart also outlines the stability of their cash balance over the years. This can be used to fund future projects, if management feels there is a branch worth pursuing.

Alternatively, the high cash position may make them an acquisition target by some entity that thinks it can improve the business.

Companies with high cash and little to no debt can become LBO or activism targets, if the acquirer feels: that the company is mismanaged, has a wrong capital structure or is inadequately pursuing profits.

This is not an analysis that can reveal whether Paltalk is an acquisition candidate, as that would require exploring the bylaws and checking for anti acquisition provisions and other repellents.

Is Paltalk's Revenue Growing?

While it's not that amazing, we still think that the 16% increase in revenue from operations was a positive.In reality, this article only makes a short study of the company's growth data. This graph of historic earnings and revenue shows how Paltalk is building its business over time.

How Easily Can Paltalk Raise Cash?

Notwithstanding Paltalk's revenue growth, it is still important to consider how it could raise more money, if it needs to.

Paltalk has a market capitalization of US$72m, which is highly volatile in the last few days. If the company issues new shares at the high market valuation, they will rise a lot more cash than they would have just a few days ago.

Key Takeaways

Investors need to be weary of quick price jumps, as they may not always be connected to fundamentals. In our analysis, we found Paltalk to be an interesting, yet somewhat outdated public videoconferencing technology company.

Paltalk is in a good cash position and profitable. However, the lack of progress in the last 5 years warrants caution as there may be long-standing barriers to meaningful growth that are present in the company.

An aggressive investor may decide to buy a larger part of the business, and we would have to carefully examine how can Paltalk contend with the companies that have successfully gained in the 2020 videoconferencing boom, before approaching it as a viable long-term investment.

That being said, the volatility may be great for short term traders.

Taking a deeper dive, we've spotted 4 warning signs for Paltalk you should be aware of, and 1 of them is significant.

If you would prefer to check out another company with better fundamentals, then do not miss this free list of interesting companies, that have HIGH return on equity and low debt or this list of stocks which are all forecast to grow .

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NasdaqCM:IPM

Intelligent Protection Management

Provides cloud infrastructure, cybersecurity, and managed services in the United States.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives