- United States

- /

- Media

- /

- NasdaqGS:NXST

Nexstar Media Group, Inc.'s (NASDAQ:NXST) Subdued P/E Might Signal An Opportunity

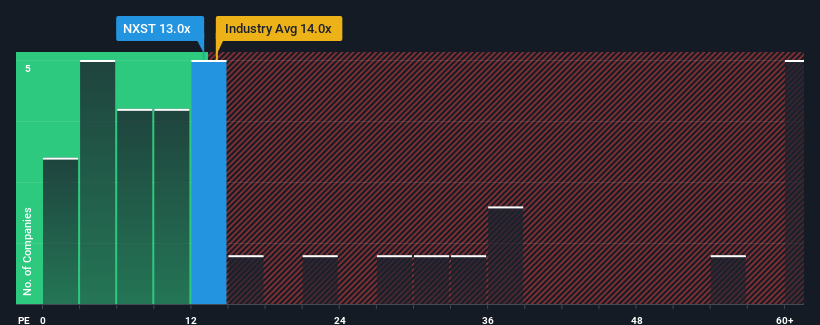

With a price-to-earnings (or "P/E") ratio of 13x Nexstar Media Group, Inc. (NASDAQ:NXST) may be sending bullish signals at the moment, given that almost half of all companies in the United States have P/E ratios greater than 19x and even P/E's higher than 35x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Recent times haven't been advantageous for Nexstar Media Group as its earnings have been falling quicker than most other companies. The P/E is probably low because investors think this poor earnings performance isn't going to improve at all. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Check out our latest analysis for Nexstar Media Group

What Are Growth Metrics Telling Us About The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like Nexstar Media Group's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 32% decrease to the company's bottom line. The last three years don't look nice either as the company has shrunk EPS by 39% in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Turning to the outlook, the next three years should generate growth of 26% each year as estimated by the ten analysts watching the company. Meanwhile, the rest of the market is forecast to only expand by 10% each year, which is noticeably less attractive.

With this information, we find it odd that Nexstar Media Group is trading at a P/E lower than the market. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What We Can Learn From Nexstar Media Group's P/E?

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Nexstar Media Group's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

You need to take note of risks, for example - Nexstar Media Group has 3 warning signs (and 1 which makes us a bit uncomfortable) we think you should know about.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if Nexstar Media Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:NXST

Nexstar Media Group

Operates as a diversified media company that produces and distributes local and national news, sports, and entertainment contents on the television and digital platforms in the United States.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives