- United States

- /

- Media

- /

- NasdaqGS:NWSA

Can the Murdoch TikTok Deal Buzz Justify News Corp’s Recent Price Surge?

Reviewed by Bailey Pemberton

If you’ve been watching News stock lately, you’re probably wondering whether you should double down, cash out, or simply ride out the headlines. It’s the kind of question you ask after seeing a stock turn in an impressive 87.3% return over three years, but then slide 6.8% in just the past week. That volatility isn’t random. Big news around the Murdoch family possibly joining forces on a high-profile TikTok deal has fueled a burst of speculation. Further reports clarify their roles might not be as direct as some first thought. Still, these headlines create real ripples, shifting how investors price in future risk and opportunity.

Despite the recent ups and downs, News stock is up a substantial 108.3% over the past five years and 9.3% over the past year, even with a somewhat bumpy ride in the shorter term. This pattern, steadily gaining ground despite short-term turbulence, is a clue that investors are weighing both past performance and fresh uncertainty about future deals. But here’s where things get especially interesting: according to a six-point valuation framework, News only scores a 1. In plain English, that means the company currently appears undervalued in just one of six possible ways analysts typically check for a bargain.

With that in mind, let’s dig into each of the main valuation methods so you can see for yourself where News stands. Stick around, because there’s a smarter way to think about valuation that makes all the difference.

News scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: News Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by projecting its future free cash flows and discounting them back to today’s dollars. This approach aims to capture the present value of all the cash News is expected to generate in the years ahead, taking future uncertainty and opportunity into account.

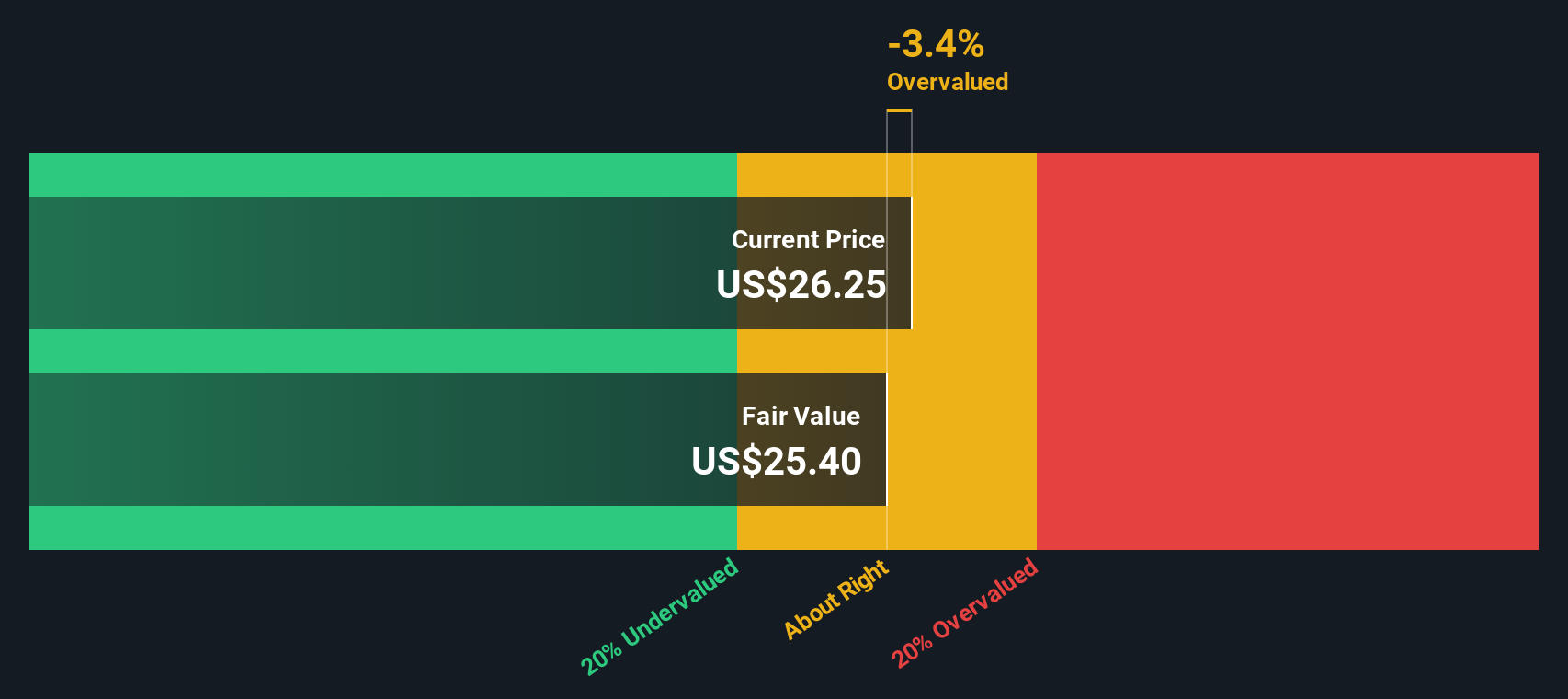

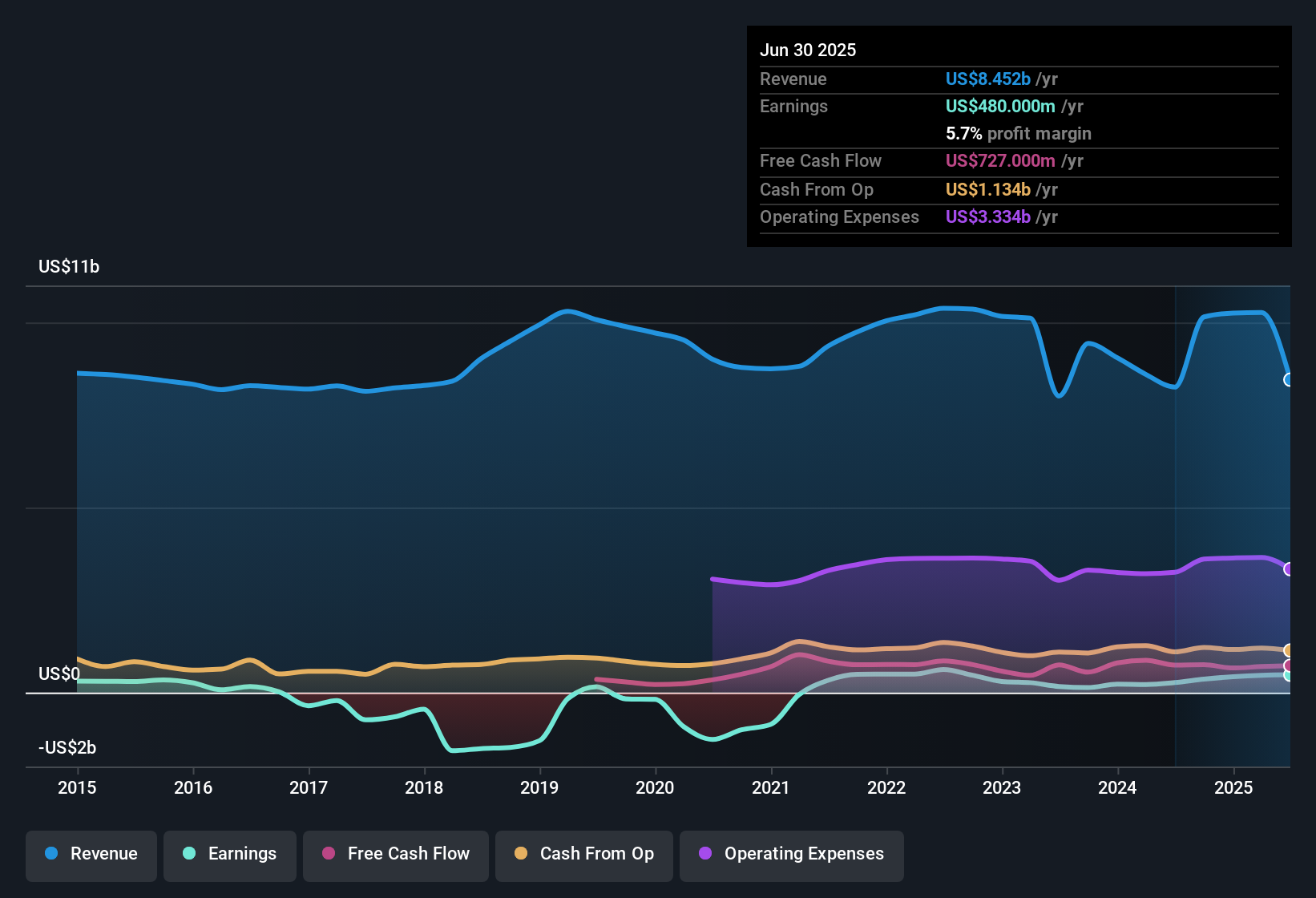

For News, the most recent reported Free Cash Flow stands at $754 million. Analyst estimates extend five years forward, indicating that annual cash flow could grow to $1.03 billion by 2026. Looking further out, extrapolated by Simply Wall St, projections suggest cash flow could be around $944 million by 2030. These numbers reflect steady, though not explosive, growth as analysts see it and as the model expects.

Based on this DCF analysis, News has an estimated intrinsic value of $25.42 per share. Against the current share price, this means the stock is trading at an 11.6% premium, suggesting it is somewhat overvalued according to these cash flow projections.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests News may be overvalued by 11.6%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: News Price vs Earnings (PE Ratio)

For profitable companies like News, the Price-to-Earnings (PE) ratio is often the go-to metric for investors. It provides a straightforward sense of how much you’re paying for each dollar the company earns today, and it is especially helpful when there is a long, stable earnings record.

It is important to remember that there is no single “normal” PE ratio for all companies. Higher growth prospects often justify a higher ratio, while greater risks or less consistent earnings typically push it lower. This is why it is useful to compare a company’s PE ratio not just in isolation, but also against industry averages and close peers.

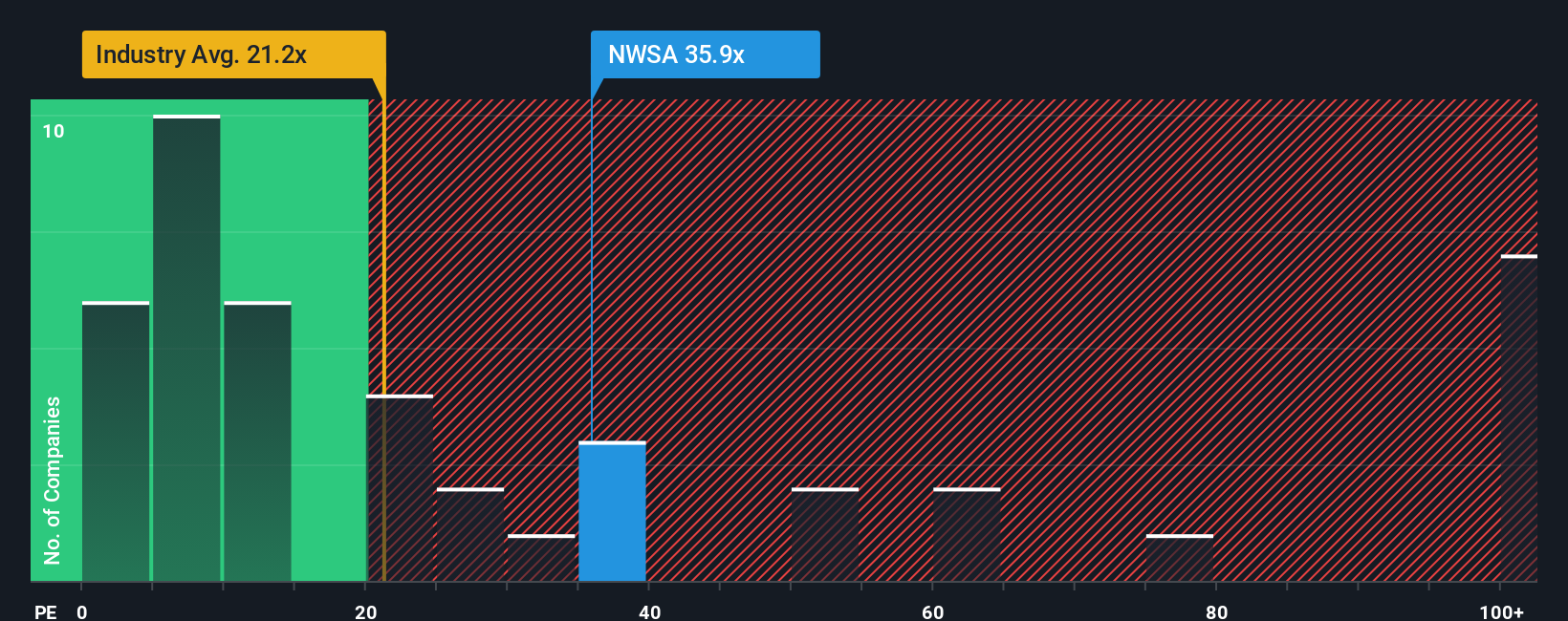

- News current PE ratio: 33.3x

- Peer average PE ratio: 16.5x

- Media industry average PE: 20.8x

However, direct comparisons can miss key nuances. Simply Wall St's “Fair Ratio” adjusts the benchmark by considering factors such as News’ growth outlook, profit margins, risk profile, industry sector, and market cap. For News, the Fair Ratio is 22.1x, which is much closer to the industry average than the current price and is tailored to the company’s actual characteristics.

When comparing the Fair Ratio to the current PE, News trades at a premium. With a PE of 33.3x compared to a Fair Ratio of 22.1x, the stock appears more expensive than its fundamentals would suggest according to this method.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your News Narrative

Earlier we mentioned there is a smarter way to approach valuation, so let’s introduce you to Narratives. A Narrative is simply your story about where you see News going, a way to back up your opinion with numbers by estimating future revenue, profit margins, and a fair value grounded in your unique expectations. Instead of relying solely on static models or strict ratios, Narratives connect the company’s big-picture story with your own assumptions and a forecast, making it far easier to compare your conviction with the current market price.

Narratives are easy to explore and build within the Simply Wall St platform’s Community page, where millions of investors share their perspectives and projections. By putting the story front and center alongside key numbers, Narratives help you decide if it is time to buy or sell, all by comparing your Fair Value estimate to where the stock currently trades. Plus, when new headlines or results come in, Narratives update dynamically, keeping your viewpoint relevant and informed in real time.

For example, around News stock, the most optimistic investors set fair values as high as $45 per share thanks to digital expansion and improved profit margins, while the most cautious see just $28, citing industry disruptions and macro risks. This shows how Narratives let you anchor your own decisions in both data and belief.

Do you think there's more to the story for News? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if News might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NWSA

News

A media and information services company, creates and distributes authoritative and engaging content, and other products and services for consumers and businesses.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives