- United States

- /

- Media

- /

- NasdaqGS:NWSA

A Look at News Corporation (NWSA) Valuation Following Its Recent Equity Offering

Reviewed by Kshitija Bhandaru

Most Popular Narrative: 18.4% Undervalued

According to the most widely followed narrative, News is viewed as significantly undervalued, trading at a meaningful discount to its calculated fair value by analysts.

"News Corp's growing portfolio of digital and professional information services (e.g., Dow Jones Risk & Compliance and new B2B data analytics acquisitions) positions it to capture expanding demand for high-quality, business-critical information. This approach may help maintain revenue growth and earnings stability through higher recurring digital subscription and data licensing income."

Get ready for a deep dive into the engine behind this bullish valuation. Want to know what powers the analyst target? It's a blend of aggressive profit expansion and recurring digital revenues that are usually reserved for tech giants. Could this be the financial playbook that redefines News's future? Stay tuned. The details behind these high expectations may surprise you.

Result: Fair Value of $37.52 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, rising challenges in legacy media and declining digital engagement could quickly change the outlook if growth in new segments does not deliver as expected.

Find out about the key risks to this News narrative.Another View: The Multiples Perspective

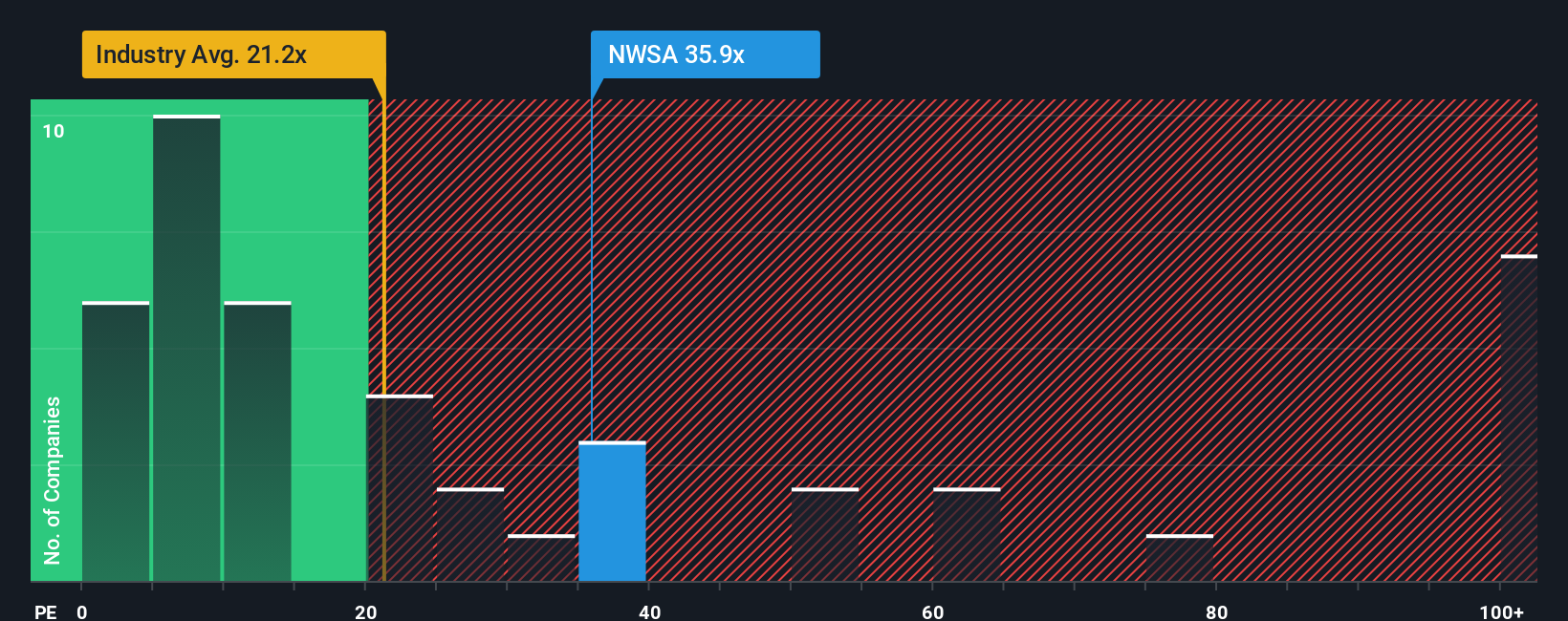

While analysts see opportunity, a look at the price-to-earnings ratio tells a different story. Compared to the industry, News trades at a noticeably higher multiple. This suggests the market may already be pricing in much of the optimism. Could this signal that shares are less of a bargain than they appear?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding News to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own News Narrative

If the consensus views do not quite match your perspective, you can dig into the numbers and shape your own story in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding News.

Looking for More Smart Investment Ideas?

Don’t let standout opportunities slip past you. Use Simply Wall Street’s powerful tools to spot emerging trends and promising stocks others might be missing.

- Identify rising tech pioneers by analyzing the latest in AI penny stocks, which are shaping tomorrow’s industries and redefining what is possible.

- Unlock potential value by reviewing undervalued stocks based on cash flows and discover which companies are flying under Wall Street’s radar but have strong fundamentals.

- Boost your income stream with dividend stocks with yields > 3% to find stocks offering yields above 3% and the potential to build wealth through consistent returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if News might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NWSA

News

A media and information services company, creates and distributes authoritative and engaging content, and other products and services for consumers and businesses.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives