- United States

- /

- Entertainment

- /

- NasdaqGS:NFLX

Netflix (NFLX): Assessing Valuation After Recent Share Pullback and Cooling Momentum

Reviewed by Simply Wall St

Netflix (NFLX) shares have moved little over the past day, but the stock has dipped about 10% in the past month. Investors may be watching for fresh developments or catalysts to shift sentiment going forward.

See our latest analysis for Netflix.

Netflix’s recent pullback comes after a strong run earlier this year. This suggests that momentum is cooling, but underlying confidence remains. Despite the 1-month share price return of -9.6%, investors who held for the past year have seen a robust 46.1% total shareholder return. Gains are even more impressive over longer horizons.

If you’re curious about what else is driving growth across the market, it could be a prime moment to expand your search and discover fast growing stocks with high insider ownership

With shares coming off their highs but longer-term performance remaining strong, the question now is whether Netflix is undervalued after its recent dip or if the market has already factored in all of its growth prospects.

Most Popular Narrative: 18.9% Undervalued

Netflix’s narrative valuation sees room for meaningful upside versus its recent closing price, setting the stage for a contentious debate among bulls and bears. At the heart of this view are powerful business shifts believed to reshape growth and profitability potential.

The wider rollout and promising early metrics of Netflix's proprietary ad tech stack enables global expansion and increased monetization of the ad-supported tier. This positions Netflix to significantly accelerate ad revenues and improve margin leverage with scale as more advertising demand shifts to streaming.

What exactly are analysts betting on? The secret sauce driving this valuation isn’t just international deals or flashy new tech. Beneath it all are bold profit and revenue projections that could send traditional models spinning. Want to see just how ambitious the forecast gets? The next chapter reveals all.

Result: Fair Value of $1,350.32 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition and rising content costs could slow Netflix’s profit growth, which may make it harder to meet these ambitious analyst expectations.

Find out about the key risks to this Netflix narrative.

Another View: Take a Closer Look at Valuation Ratios

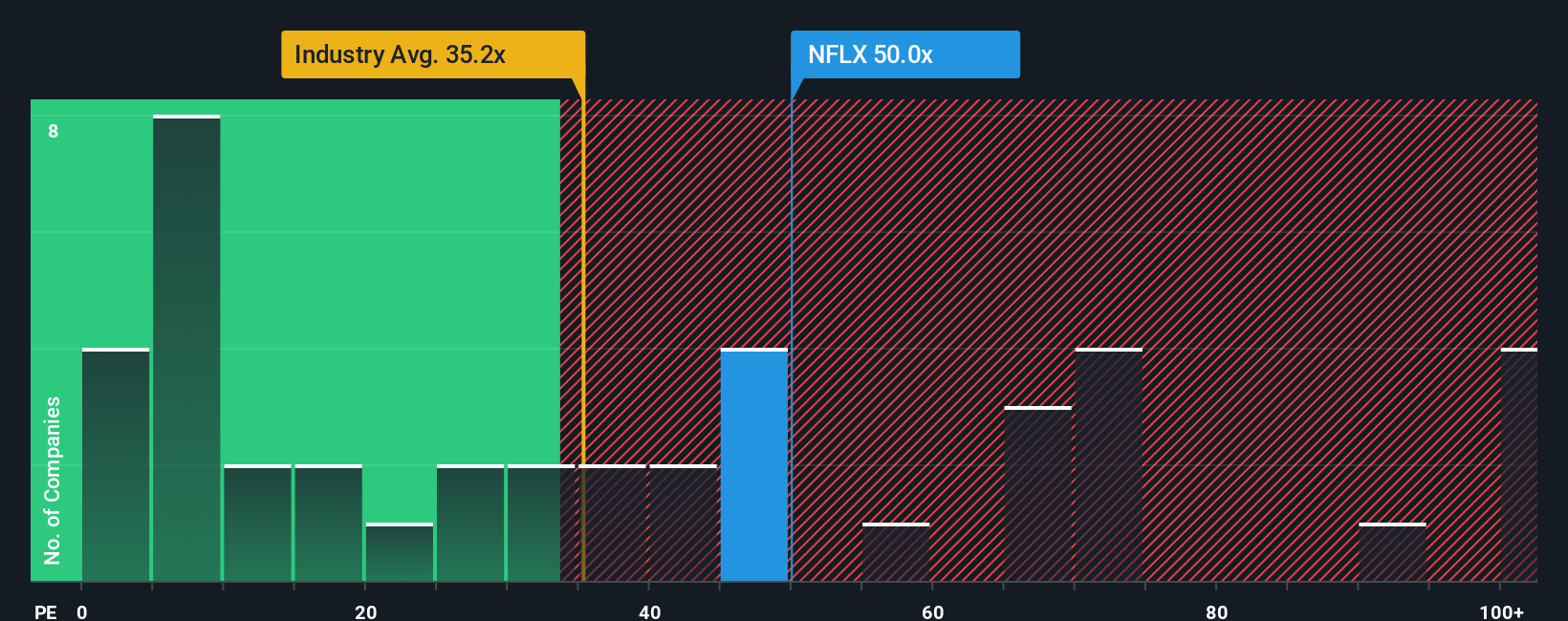

While the narrative case points to significant upside, looking at Netflix’s valuation through the lens of its price-to-earnings ratio tells a more cautious story. Shares are trading at around 44.5 times earnings, much higher than the US Entertainment industry’s average of 26.1 times and even above the estimated fair ratio of 38 times. This significant premium could mean the stock’s future growth is already baked in, leaving less room for error. Is the optimism warranted, or are expectations now a bit stretched?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Netflix Narrative

If you’re the type who likes to dig deeper or question the consensus, you can use our tools to build your own Netflix view in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Netflix.

Looking for More Compelling Investment Ideas?

Stay ahead of the crowd by using our powerful screener to pinpoint your next opportunity. Smart investing means not waiting for the headlines to catch up.

- Seize the chance to find underappreciated value with these 869 undervalued stocks based on cash flows, which might have strong upside potential based on robust cash flows.

- Target steady income streams by checking out these 19 dividend stocks with yields > 3%, offering attractive yields for those focused on building wealth over time.

- Ride the next wave of technology innovation by researching these 27 AI penny stocks, which have the power to reshape industries and unlock new growth opportunities.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Netflix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NFLX

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives