- United States

- /

- Entertainment

- /

- NasdaqGS:NFLX

Does a Ten-for-One Stock Split Make Netflix (NFLX) More Accessible or Signal Strategic Shifts?

Reviewed by Sasha Jovanovic

- Netflix has approved a ten-for-one stock split, aiming to make shares more accessible to individual investors and employees, with the stock split effective from November 17, 2025, and record date of November 10, 2025.

- This move comes as Netflix is expanding both its content library, through partnerships like its new collaboration with Yash Raj Films, and its ad-supported tier, reflecting ongoing momentum in subscriber and revenue growth.

- We'll examine how the stock split and growing global partnerships influence Netflix's outlook for future growth and investor accessibility.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

Netflix Investment Narrative Recap

To be a Netflix shareholder, you need to believe in the company’s ability to keep leading global streaming, supported by its scale, high-quality content, and ongoing innovation across distribution models. The recent ten-for-one stock split raises accessibility but does not materially shift the key catalyst of global subscriber and advertising revenue growth, or the main risk, escalating content and customer acquisition costs as competition intensifies. Among the recent developments, Netflix’s alliance with Yash Raj Films stands out. This partnership adds a rich slate of iconic Bollywood films, helping to deepen Netflix’s library, strengthen its brand in India, and improve engagement in international markets, which is central to both present catalysts and long-term growth ambitions. On the other hand, investors should keep in mind the risk that, even as Netflix adds more localized content and new partners, intensifying competition could force the company to...

Read the full narrative on Netflix (it's free!)

Netflix's outlook anticipates $59.4 billion in revenue and $17.7 billion in earnings by 2028. Achieving this requires a 12.5% annual revenue growth rate and a $7.5 billion increase in earnings from the current $10.2 billion.

Uncover how Netflix's forecasts yield a $1350 fair value, a 22% upside to its current price.

Exploring Other Perspectives

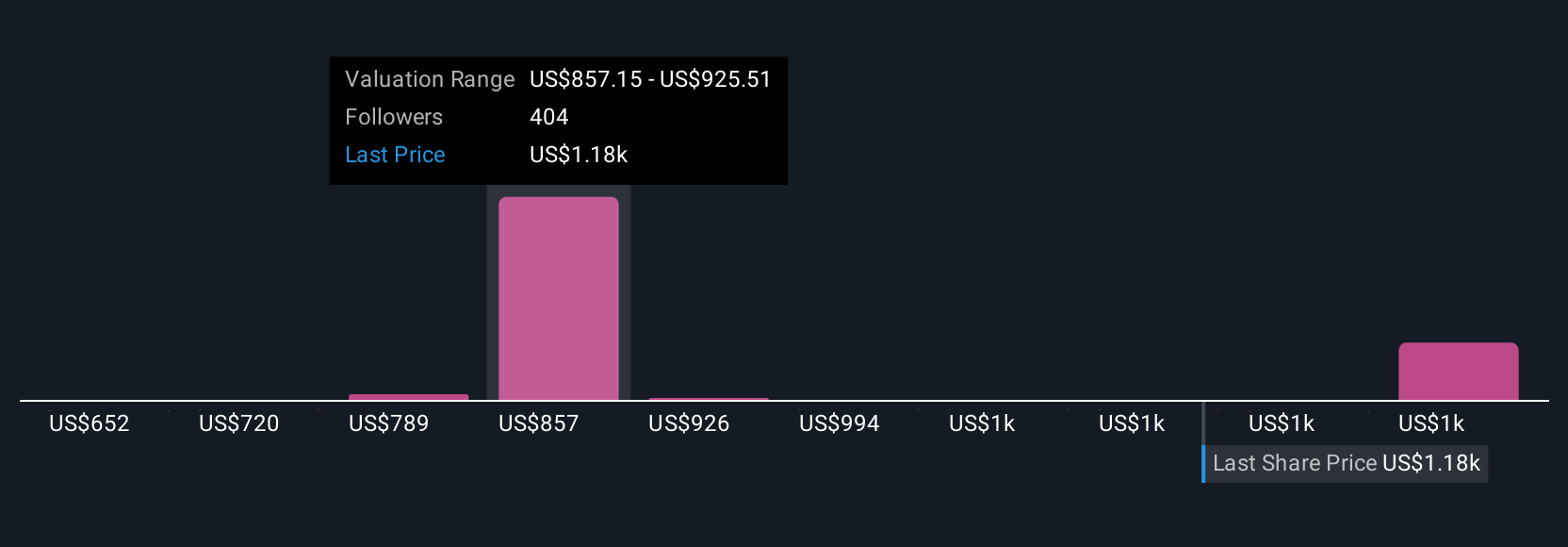

Fifty unique fair value forecasts from the Simply Wall St Community put Netflix’s worth between US$798 and US$1,825 a share. While opinions diverge sharply, many are weighing global expansion through partnerships as a factor that could significantly drive or limit Netflix’s future performance.

Explore 50 other fair value estimates on Netflix - why the stock might be worth as much as 65% more than the current price!

Build Your Own Netflix Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Netflix research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Netflix research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Netflix's overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Netflix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NFLX

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives