- United States

- /

- Entertainment

- /

- NasdaqGS:NFLX

Are New Partnerships Enough to Justify Netflix’s 39% Rally in 2025?

Reviewed by Bailey Pemberton

- Wondering if Netflix is as good a value as its popularity and streaming dominance suggest? You are not alone, and digging into the numbers now might surprise you.

- Netflix’s stock has delivered an impressive 30.5% jump so far this year, even after a recent 5.0% dip over the past month, and has climbed a remarkable 39.4% in the last year.

- Shares have been buzzing since Netflix announced new international partnerships and secured exclusive content deals, fueling speculation about its growth runway. Media chatter over streaming competition and pricing changes have also helped drive recent price swings.

- While Netflix earns a value score of 1 out of 6 on our checks for undervalued opportunities, a closer look at different valuation methods could be even more revealing. There is one approach you will want to see by the end of this article.

Netflix scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Netflix Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting future cash flows and discounting them back to today’s value, offering an analytical lens on where the business might be headed financially.

For Netflix, the current Free Cash Flow stands at $9.06 Billion. Analysts provide projections for the next five years, forecasting that Netflix’s annual Free Cash Flow could reach $20.57 Billion by 2029. Beyond these analyst estimates, additional future cash flows have been extrapolated to capture longer-term performance potential.

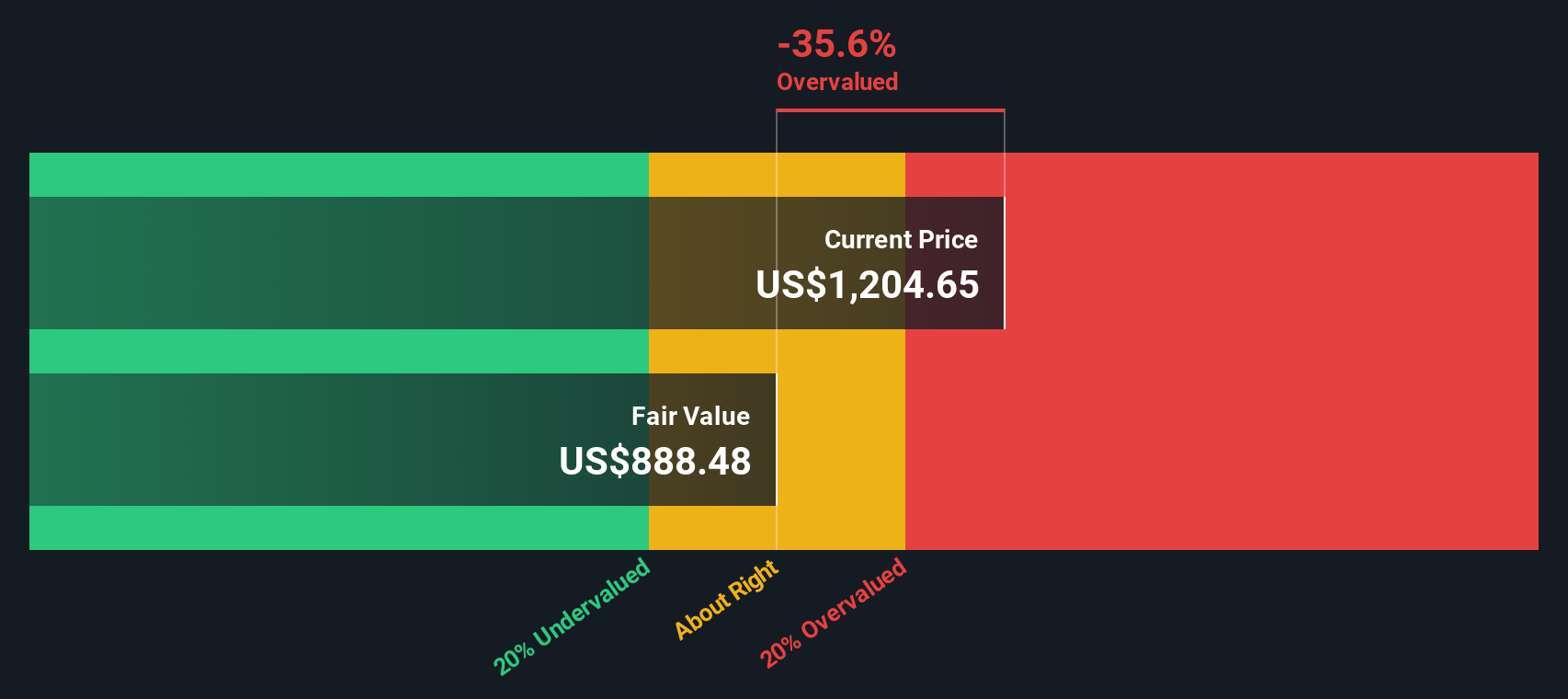

According to these projections, Netflix’s intrinsic value based on the DCF model is $863.77 per share. However, when compared to Netflix’s current market price, this analysis signals that the stock trades at a 34.0% premium to its calculated intrinsic value. This suggests it is overvalued by a significant margin.

The DCF model’s findings rest on the latest available analyst and extrapolated projections, bringing both rigor and market context together in assessing Netflix’s valuation.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Netflix may be overvalued by 34.0%. Discover 864 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Netflix Price vs Earnings

The Price-to-Earnings (PE) ratio is a reliable metric for valuing established, profitable companies like Netflix, since it directly compares a company's share price to its earnings. This helps investors gauge how much they are paying for each dollar of profit. A "normal" or "fair" PE ratio varies between industries and companies, often reflecting expectations for future growth and the level of risk. Higher growth prospects or lower perceived risk typically justify a higher PE ratio, while slow-growth or higher-risk companies usually trade at lower multiples.

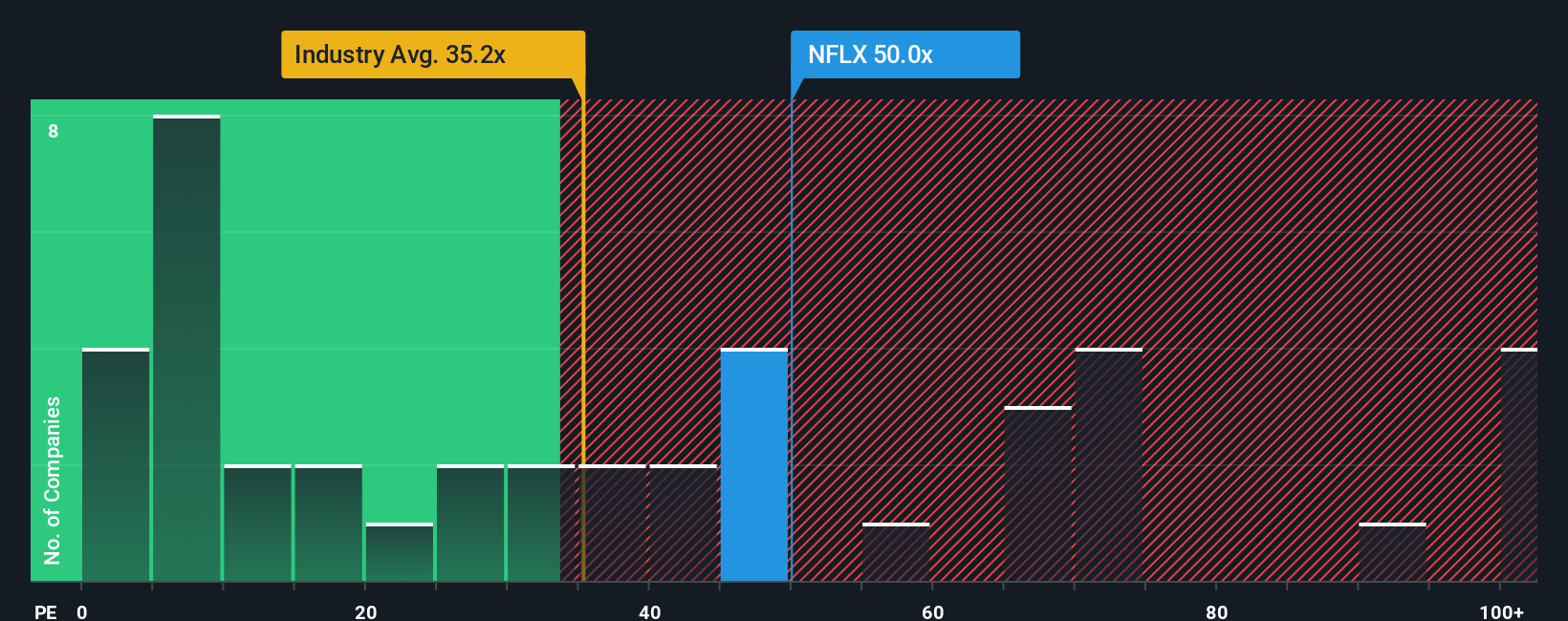

Currently, Netflix trades at a PE ratio of 47.02x. This stands well above the entertainment industry average of 20.90x and is also notably lower than the peer group average of 78.46x. This indicates the market ascribes a premium to Netflix, but not to the extent of some direct competitors.

To determine a more tailored benchmark, Simply Wall St calculates a unique “Fair Ratio” for Netflix, which is 36.39x. This proprietary metric weighs factors beyond industry averages or peer groups, integrating Netflix’s expected earnings growth, profit margins, market cap, industry dynamics, as well as its risk profile. Because it adapts to company-specific traits and the competitive landscape, the Fair Ratio serves as a more context-aware and nuanced reference point for valuation.

Comparing Netflix’s actual PE ratio of 47.02x to its Fair Ratio of 36.39x shows the stock is priced significantly above what these company-tailored factors justify. As a result, this multiple-based analysis reinforces the view that Netflix shares appear overvalued at current levels.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1370 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Netflix Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal story or perspective on a company like Netflix, connecting what you believe about its future, such as how revenues, earnings, and margins might evolve, to a financial forecast and a calculated fair value.

Narratives make the "story behind the numbers" clear, letting you combine your own expectations or assumptions with current data. On Simply Wall St's Community page, you can easily create or explore Narratives, seeing how millions of other investors interpret the same stock through their unique lenses. This means you can compare Netflix’s potential fair value, based on your own thinking or community insights, directly to the latest market price. This approach may help you decide whether to buy, sell, or hold.

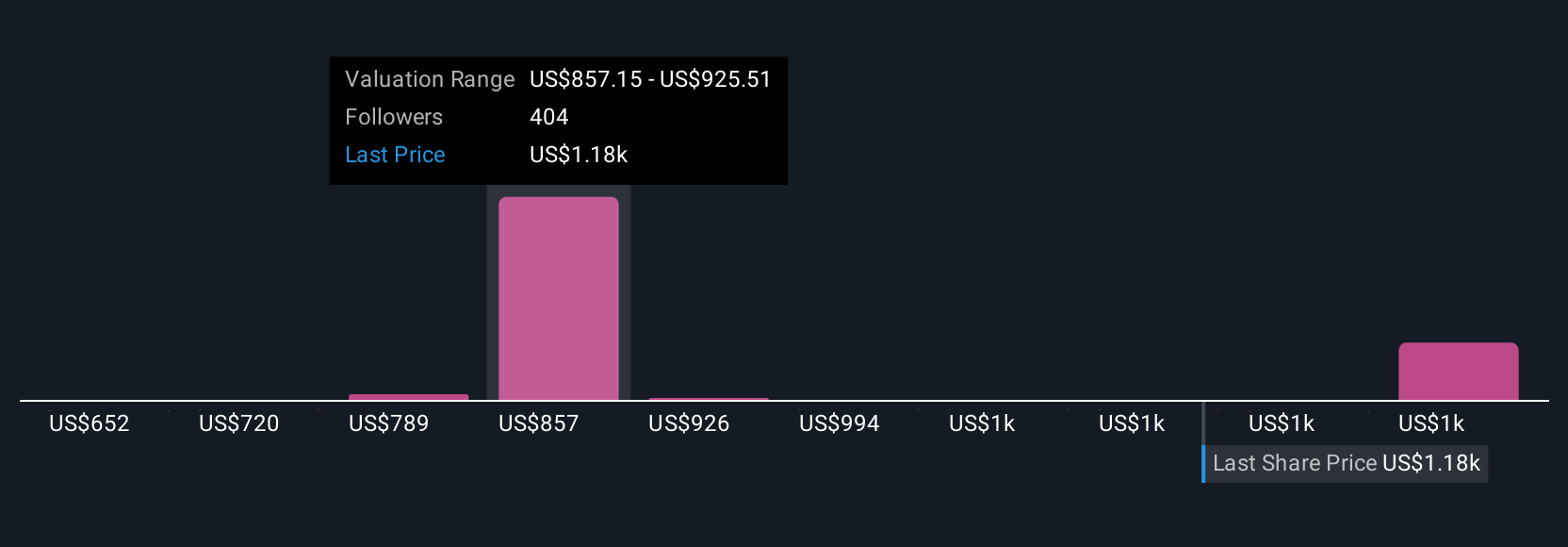

Unlike static analyses, Narratives update automatically with each new earnings release or key news event, so your view stays current. For example, some Netflix Narratives forecast a bullish price target as high as $1,600 based on ambitious revenue and margin assumptions, while others estimate a fair value near $750 if growth slows or costs outpace expectations. Narratives empower you to invest with confidence, using both data and your story.

For Netflix, however, we'll make it really easy for you with previews of two leading Netflix Narratives:

- 🐂 Netflix Bull Case

Fair Value: $1,350.32

Current price is 14.29% below this fair value

Forecast Revenue Growth: 12.5%

- Expansion of in-house ad tech and new international content partnerships is expected to drive robust subscriber and revenue growth, unlocking higher monetization potential.

- Strategic investments in local content, generative AI-powered user experiences, and production efficiencies boost engagement, retention, and operating margins despite competitive pressures.

- Key risks include rising content costs, mature market saturation in the US and Europe, new regulatory requirements, and intensified competition challenging revenue and profitability.

- 🐻 Netflix Bear Case

Fair Value: $797.74

Current price is 45.42% above this fair value

Forecast Revenue Growth: 13%

- Netflix’s ad-supported plans and paid sharing are unlocking new growth but may cause short-term dips in average revenue per member and require strong execution to deliver sustainable benefits.

- Sustained outperformance versus peers stems from Netflix’s scale, operating efficiency, and cost discipline; however, continued strong member and revenue growth is necessary to justify current valuations.

- Risks clouding the outlook include intensifying competition, rising production and content costs, and the need for flawless execution on new business initiatives internationally and in advertising.

Do you think there's more to the story for Netflix? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Netflix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NFLX

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives