- United States

- /

- Media

- /

- NasdaqGM:NEXN

Nexxen (NEXN) Reduces 2025 Guidance After Earnings—Is Market Optimism Outpacing Programmatic Reality?

Reviewed by Sasha Jovanovic

- Nexxen International Ltd. recently reported third quarter 2025 earnings, showing sales of US$94.79 million and net income of US$4.21 million, both compared to the same period last year.

- Despite increased year-to-date sales and improved nine-month net income, the company lowered its full-year 2025 financial guidance, highlighting shifts in its programmatic revenue outlook.

- We'll examine how Nexxen's reduced full-year earnings guidance alters the company's investment narrative and future business expectations.

Find companies with promising cash flow potential yet trading below their fair value.

Nexxen International Investment Narrative Recap

Owning Nexxen International stock requires confidence in the company’s ability to leverage its exclusive data and programmatic advertising solutions, even as current industry headwinds slow expected near-term growth. Nexxen’s recent decision to lower its full-year 2025 financial guidance draws attention to softer programmatic revenue trends, a factor that now weighs more heavily on the most important short-term catalyst: expanding programmatic market share; it also re-emphasizes the ongoing risk of secular declines in some legacy business lines and potential for capital allocation missteps, though the impact is material mainly for short-term expectations.

Among recent announcements, the lowered full-year guidance directly addresses the latest financial results, linking the cautious outlook to updated programmatic growth forecasts. This remains the most relevant development because programmatic revenue growth is central to Nexxen’s investment story, both as a primary driver of future scale and as an indicator of competitive strength amid changing advertiser demands.

However, what many investors may not realize is that while Nexxen continues to tout its data partnerships, there remains a long-term risk that...

Read the full narrative on Nexxen International (it's free!)

Nexxen International is projected to achieve $473.9 million in revenue and $50.5 million in earnings by 2028. This outlook is based on an assumed annual revenue growth rate of 8.4% and represents a modest earnings increase of $0.8 million from current earnings of $49.7 million.

Uncover how Nexxen International's forecasts yield a $16.14 fair value, a 151% upside to its current price.

Exploring Other Perspectives

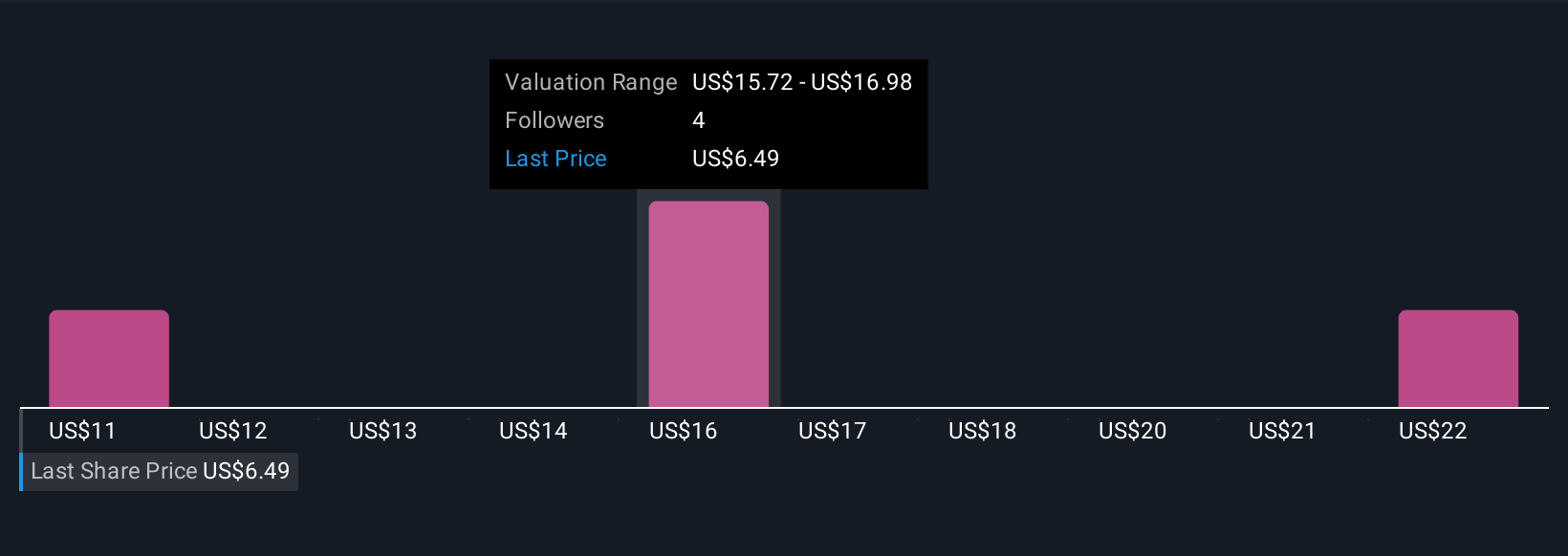

Three Simply Wall St Community fair value estimates for Nexxen range widely from US$10.64 to US$23.33 per share. As market participants weigh ongoing risks to legacy revenue streams, it’s clear that investor expectations for future performance can differ dramatically.

Explore 3 other fair value estimates on Nexxen International - why the stock might be worth just $10.64!

Build Your Own Nexxen International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nexxen International research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Nexxen International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nexxen International's overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nexxen International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:NEXN

Nexxen International

Provides end-to-end and video-first platform that engages advertising campaigns for brands, agencies, media groups, and content creators worldwide.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives