- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:MOMO

Hello Group (NASDAQ:MOMO) Has A Pretty Healthy Balance Sheet

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Hello Group Inc. (NASDAQ:MOMO) does use debt in its business. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for Hello Group

What Is Hello Group's Net Debt?

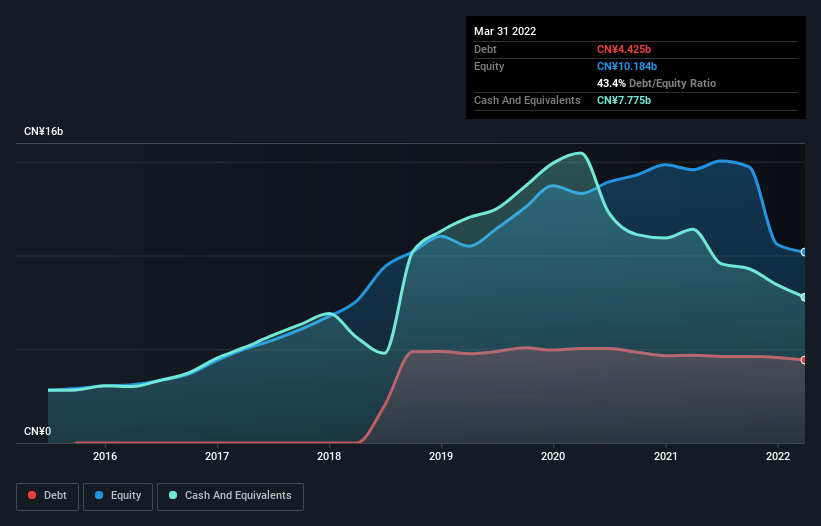

The image below, which you can click on for greater detail, shows that Hello Group had debt of CN¥4.42b at the end of March 2022, a reduction from CN¥4.68b over a year. But it also has CN¥7.78b in cash to offset that, meaning it has CN¥3.35b net cash.

A Look At Hello Group's Liabilities

According to the last reported balance sheet, Hello Group had liabilities of CN¥3.05b due within 12 months, and liabilities of CN¥4.76b due beyond 12 months. Offsetting this, it had CN¥7.78b in cash and CN¥202.4m in receivables that were due within 12 months. So it actually has CN¥167.1m more liquid assets than total liabilities.

This short term liquidity is a sign that Hello Group could probably pay off its debt with ease, as its balance sheet is far from stretched. Simply put, the fact that Hello Group has more cash than debt is arguably a good indication that it can manage its debt safely.

It is just as well that Hello Group's load is not too heavy, because its EBIT was down 22% over the last year. When it comes to paying off debt, falling earnings are no more useful than sugary sodas are for your health. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Hello Group's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. While Hello Group has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Over the last three years, Hello Group actually produced more free cash flow than EBIT. That sort of strong cash conversion gets us as excited as the crowd when the beat drops at a Daft Punk concert.

Summing up

While we empathize with investors who find debt concerning, you should keep in mind that Hello Group has net cash of CN¥3.35b, as well as more liquid assets than liabilities. The cherry on top was that in converted 106% of that EBIT to free cash flow, bringing in CN¥1.0b. So we don't have any problem with Hello Group's use of debt. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. For instance, we've identified 2 warning signs for Hello Group that you should be aware of.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

Valuation is complex, but we're here to simplify it.

Discover if Hello Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:MOMO

Hello Group

Provides mobile-based social and entertainment services in the People’s Republic of China and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives