- United States

- /

- Media

- /

- NasdaqGS:MGNI

Magnite (MGNI): Evaluating Valuation After Major AI-Driven ClearLine Platform Upgrade and streamr.ai Integration

Reviewed by Kshitija Bhandaru

Magnite (MGNI) just announced a major update to its ClearLine platform, introducing advanced AI-powered assistance and streamlined workflows following its recent streamr.ai acquisition. This move is designed to make premium inventory access and campaign activation significantly simpler for buyers and curators.

See our latest analysis for Magnite.

Magnite’s announcement comes as the stock has seen only modest short-term moves, but its long-term momentum is quietly building. While the share price has held near $20, the one-year total shareholder return sits at 0.65%, and multi-year shareholders have seen steady compounding gains thanks to recent product launches and tech integrations such as ClearLine’s upgrade.

If you’re watching the evolution of digital advertising, it could be an ideal moment to broaden your search and discover fast growing stocks with high insider ownership

Yet with shares trading at a notable discount to analyst price targets and recent upgrades driving growth, is Magnite undervalued right now, or is the market already factoring in its next surge?

Most Popular Narrative: 28% Undervalued

Magnite's fair value in the most widely followed narrative sits meaningfully above the latest close. This suggests a significant gap between the current price and what analysts believe the company could be worth. This context shapes the reasoning behind the latest market optimism and makes one key business shift stand out.

The ongoing increase in global internet penetration and mobile device usage is expanding the digital advertising addressable market, with Magnite seeing growth across CTV, mobile, and new publisher partners (e.g., Spotify, T-Mobile, Redfin). This supports both top-line revenue and diversified inventory supply.

Hungry for the whole story? The engine behind this projected fair value is built on forecasted revenue expansion, rapidly ballooning margins, and a future profit multiple that could surprise even seasoned sector watchers. Want to know exactly which financial levers drive such aggressive upside? Only the full narrative reveals the bold assumptions fueling this valuation gap.

Result: Fair Value of $28.19 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, major customer concentration and regulatory outcomes remain unpredictable factors that could quickly change Magnite’s growth trajectory and market positioning.

Find out about the key risks to this Magnite narrative.

Another Perspective: Reading Between the Ratios

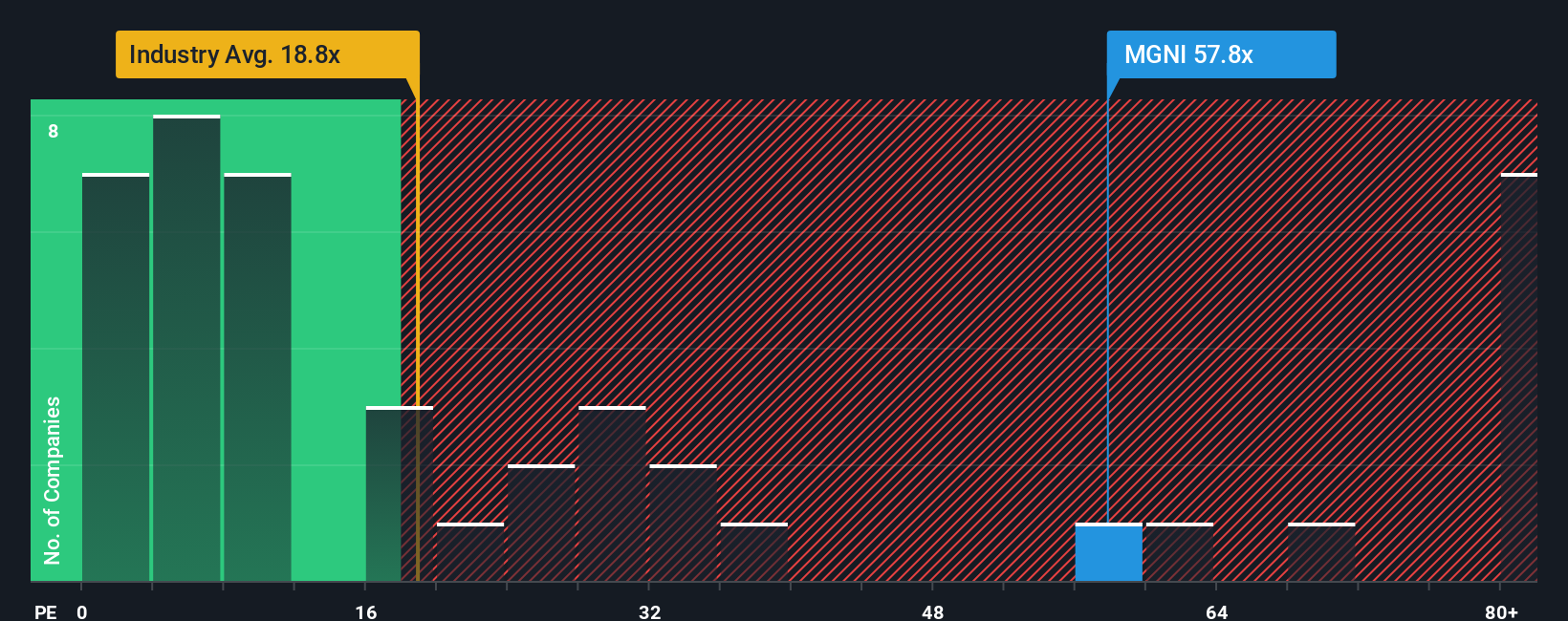

While analyst forecasts look upbeat, a closer look at the price-to-earnings ratio tells a different story. Magnite trades at 67x earnings, substantially higher than its peer average of 49.3x and the US Media industry at just 20.8x. The current multiple is also well above the fair ratio of 36.4x, signaling a valuation risk investors can’t ignore. Does this premium suggest the market expects even faster growth, or could it become a stumbling block ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Magnite Narrative

If you want to dig into the numbers and build your own view, you can easily create a custom narrative in just a few minutes: Do it your way

A great starting point for your Magnite research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Why settle for just one opportunity when you could broaden your horizons? Take advantage of these handpicked screeners and don’t let the next big winner slip away.

- Tap into sector-defining growth by tracking these 24 AI penny stocks, which are based on artificial intelligence breakthroughs and emerging business models.

- Unlock hidden gems with steady income potential using these 19 dividend stocks with yields > 3%, offering yields above 3% for powerful long-term compounding.

- Get ahead of the curve by catching value opportunities through these 896 undervalued stocks based on cash flows, which trade below their intrinsic cash flow estimates.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MGNI

Magnite

Operates an independent omni-channel sell-side advertising platform in the United States and internationally.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives