- United States

- /

- Media

- /

- NasdaqGS:MGNI

Magnite (MGNI): Evaluating Valuation After Landmark Acxiom Integration and Recent Stock Surge

Reviewed by Simply Wall St

Most Popular Narrative: 14.3% Undervalued

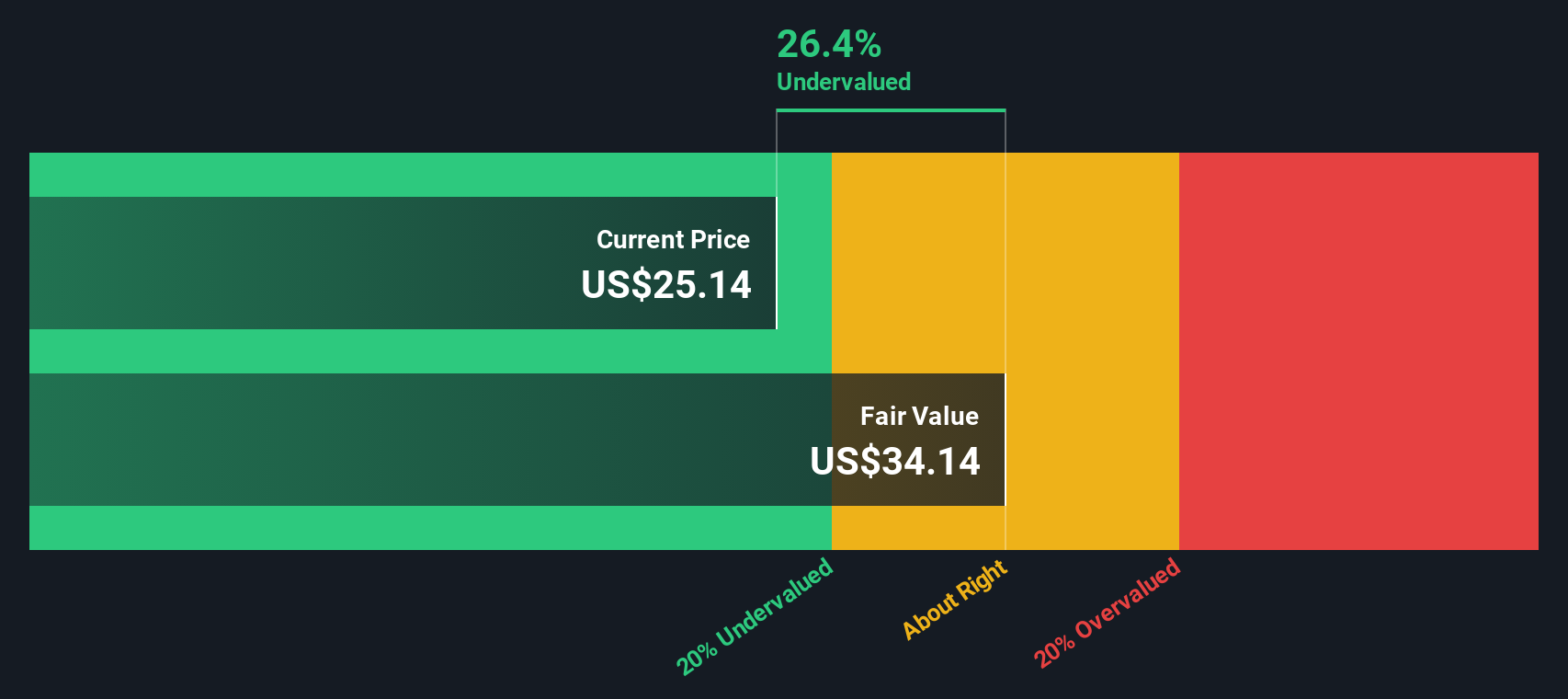

According to community narrative, Magnite's current share price is trading at a meaningful discount to its assessed fair value. Analysts see significant upside driven by shifting industry forces and Magnite's platform expansion.

"Magnite is positioned to benefit from the accelerating shift of ad spend from traditional TV to digital and connected TV (CTV) platforms. This is evidenced by deepened partnerships with top streamers including Roku, Netflix, LG, Warner Bros. Discovery, and Paramount, along with expanding SMB participation in CTV. These factors are expected to drive sustained revenue growth and a higher-margin business mix."

Want to know what's powering this bullish target? The reasoning behind this narrative combines growth assumptions and profit forecasts that could expand what is possible for Magnite. Which surprising financial factors are behind the analysts' fair value? The full narrative reveals the details behind these projections.

Result: Fair Value of $28.19 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, factors such as heavy reliance on major CTV partners or tighter industry regulation could create significant headwinds for Magnite’s continued momentum.

Find out about the key risks to this Magnite narrative.Another View: What Does the SWS DCF Model Show?

While analysts highlight Magnite’s upside based on its expected growth and margins, our DCF model tells a similar story and suggests the stock is still undervalued. Could this consensus be overlooking hidden risks?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Magnite Narrative

If you see things differently or want to dig deeper into the numbers yourself, you can easily create your own narrative in just a few minutes. do it your way.

A great starting point for your Magnite research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Take your research to the next level by searching beyond Magnite. You could be missing out on standout opportunities. Access unique stock ideas that match your goals and give your portfolio an edge. Here are three smart places to begin right now:

- Uncover high-yield potential and secure your future with companies offering dividend stocks with yields > 3%, which reward shareholders with strong and steady income.

- Find fast-growing innovators at the forefront of technology by checking out AI penny stocks, shaping industries through artificial intelligence breakthroughs.

- Pounce on value by assessing undervalued stocks based on cash flows. These companies combine robust fundamentals with attractive prices, giving you a head start on tomorrow’s winners.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MGNI

Magnite

Operates an independent omni-channel sell-side advertising platform in the United States and internationally.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives