- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:META

Will Meta's (META) Multibillion-Dollar AI Push Redefine Its Long-Term Investment Narrative?

Reviewed by Simply Wall St

- In recent days, Meta Platforms has intensified its focus on artificial intelligence with a US$14 billion investment in Scale AI, the launch of a Super Intelligence team, and extensive hiring ahead of its second-quarter earnings report.

- This robust AI initiative is drawing heightened attention from analysts, who see the company’s advances as a potential catalyst for future advertising and revenue growth, despite increased operating expenses.

- With Meta’s multibillion-dollar AI expansion taking center stage, we’ll look at how these technology investments shape its investment narrative moving forward.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Meta Platforms Investment Narrative Recap

To own Meta Platforms stock, an investor needs to believe that the company’s aggressive investment in artificial intelligence will ultimately drive gains in advertising, user engagement, and new revenue streams, all while managing the inevitable costs. The recent acceleration in AI spending is clearly center stage and serves as both the key short-term catalyst and the biggest risk, since these substantial capital outlays are likely to pressure margins until higher revenues materialize; so far, the impact remains primarily financial rather than operational.

Among the latest announcements, Meta’s plan to invest US$14 billion in Scale AI stands out as most relevant. This bold move is part of a broader push to strengthen core AI capabilities, fueling analyst expectations for future growth and ensuring Meta remains highly competitive in both advertising and messaging, a direct link to what bulls see as the next wave of catalysts.

However, investors should also keep in mind that, if AI-related expenses keep rising faster than returns...

Read the full narrative on Meta Platforms (it's free!)

Meta Platforms is projected to reach $247.4 billion in revenue and $85.6 billion in earnings by 2028. This outlook assumes a 13.2% annual revenue growth rate and a $19 billion increase in earnings from the current $66.6 billion.

Uncover how Meta Platforms' forecasts yield a $747.06 fair value, a 4% upside to its current price.

Exploring Other Perspectives

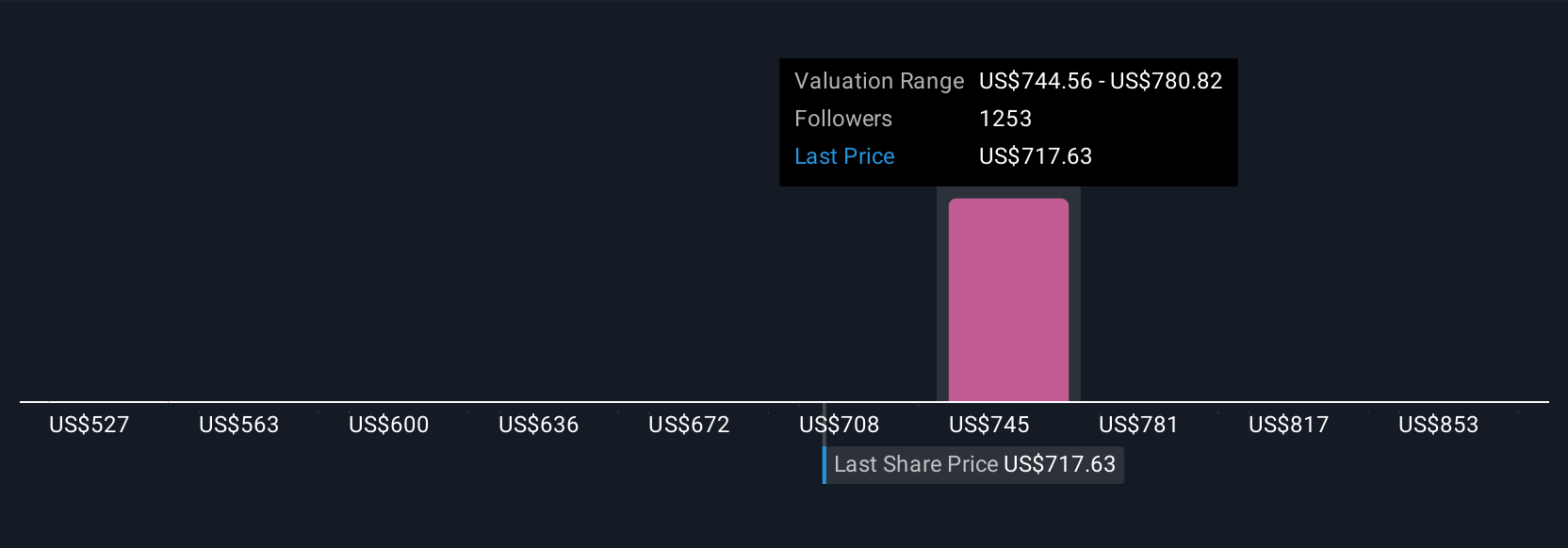

Seventy-six members of the Simply Wall St Community see Meta’s fair value from US$527.02 to US$889.59 per share. Many focus on how heavy AI investments could impact profit growth, underscoring just how much opinions on Meta’s future can differ.

Explore 76 other fair value estimates on Meta Platforms - why the stock might be worth as much as 24% more than the current price!

Build Your Own Meta Platforms Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Meta Platforms research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Meta Platforms research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Meta Platforms' overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 25 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 19 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:META

Meta Platforms

Engages in the development of products that enable people to connect and share with friends and family through mobile devices, personal computers, virtual reality and mixed reality headsets, augmented reality, and wearables worldwide.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives