- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:META

Meta Platforms (NasdaqGS:META) Teams Up With UFC For Global Fan Engagement Initiative

Reviewed by Simply Wall St

Meta Platforms (NasdaqGS:META) has recently engaged in a significant partnership with UFC to enhance fan engagement through its various technology platforms, including Meta AI and Meta Glasses. During the last quarter, the company's stock remained flat, despite several noteworthy events. The declaration of a cash dividend and robust earnings report showcased strong financial performance, even as rumors circulated about Meta's bid rejection by FuriosaAI. Concurrently, the broader market exhibited volatility, influenced by impending tariff announcements from President Trump, yet Meta's strategic expansions and solid revenue forecasts positioned it steadily amidst fluctuating market trends.

Buy, Hold or Sell Meta Platforms? View our complete analysis and fair value estimate and you decide.

Over the last 5 years, Meta Platforms has delivered substantial total returns of 248.73%, a performance reflecting the company's considerable progress in AI-driven innovations and strategic business decisions. Notably, its substantial investment in AI, including initiatives like Meta AI, and Llama 4, has not only sought to enhance personalization but also aimed at broader user engagement and advertising revenue diversification. Additionally, Meta's expansion of its Family of Apps further bolsters user interaction, which underpins its earnings growth.

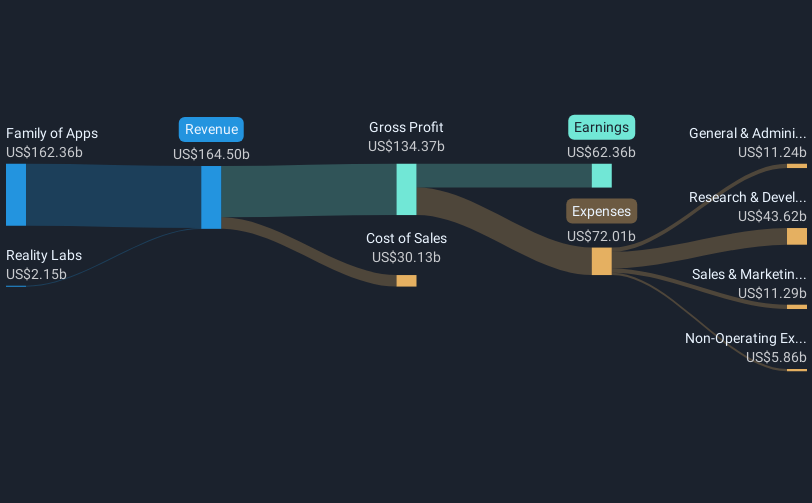

These efforts paid off as evident in Meta's impressive earnings growth rate of 59.5% over the past year, significantly surpassing the Interactive Media and Services industry's modest increase of 0.9%. Despite some M&A activity, such as the unsuccessful bid for FuriosaAI, the company's client partnerships, including multiyear collaborations with entities like UFC, underscore its commitment to leveraging cutting-edge technologies, driving further revenue growth as highlighted in its fiscal 2024 earnings of US$62.36 billion.

Explore Meta Platforms' analyst forecasts in our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:META

Meta Platforms

Engages in the development of products that enable people to connect and share with friends and family through mobile devices, personal computers, virtual reality and mixed reality headsets, augmented reality, and wearables worldwide.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.