- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:META

Meta Platforms (META) Enhances Nonprofit Fundraising With New Facebook And Instagram Integration

Reviewed by Simply Wall St

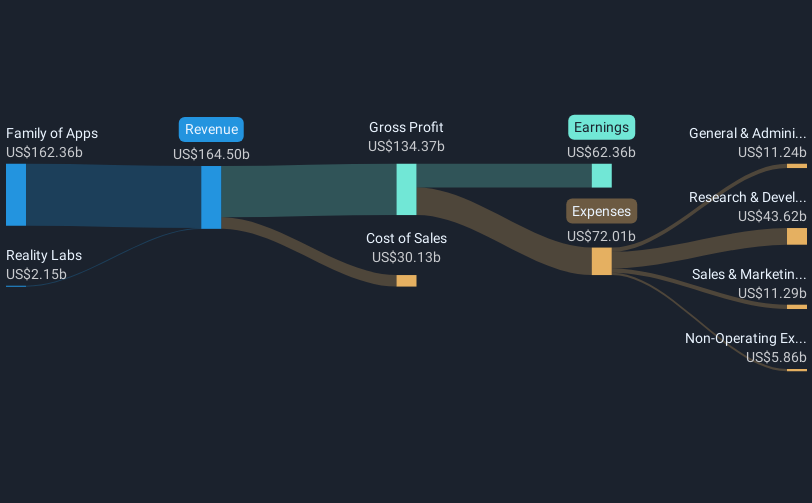

Meta Platforms (META) saw its stock price increase by 28% over the last quarter, with several events potentially adding weight to this movement. Among these, the integration of Bonterra's DonorDrive with Instagram and Facebook aimed to enhance nonprofit fundraising, garnering substantial attention. Additionally, Meta's focus on AI advancements and its anticipated second-quarter earnings played a pivotal role, aligning with positive tech market trends. Despite the company's involvement in potential acquisitions and legal matters, these did not divert attention from its core strategic objectives. Overall, these factors collectively influenced Meta's stock performance amidst broader market gains.

Be aware that Meta Platforms is showing 1 weakness in our investment analysis.

The recent news around Meta Platforms, particularly the integration of Bonterra's DonorDrive and advancements in AI, could have significant implications on the company's revenue and earnings forecasts. AI's potential to enhance ad targeting and creativity aligns with expectations for advertising growth, potentially leading to increased revenues. Similarly, business messaging developments using WhatsApp and Messenger may expand Meta's commerce capabilities, potentially impacting profit margins positively. However, the substantial investment in AI and other strategic areas may introduce pressure on profitability if expected enhancements don't materialize timely.

Looking at a longer-term perspective, Meta's shares have seen a total return of over 339.38% during the past three years, showcasing exceptional growth. This performance surpasses the broader Interactive Media and Services industry, which delivered a 27.4% return over the past year. Against the overall market, Meta also excelled, outpacing the larger US market's 17.5% one-year return.

In terms of price movement, with a current share price of US$700.00, the stock shows a slight discount to the consensus price target of US$756.13. The relatively small gap between the current price and the price target suggests that analysts view the stock as fairly priced, factoring in expected earnings and AI advancements. Overall, the ongoing developments in AI and business messaging are poised to continue influencing Meta's financial trajectory and investor sentiment.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:META

Meta Platforms

Engages in the development of products that enable people to connect and share with friends and family through mobile devices, personal computers, virtual reality and mixed reality headsets, augmented reality, and wearables worldwide.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives