- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:META

Meta (META): Exploring Valuation After Recent Unexplained Share Price Movement

Most Popular Narrative: 44.8% Overvalued

According to the most closely followed narrative, Meta Platforms appears significantly overvalued by nearly 45% compared to its intrinsic value. The narrative suggests that the current market price runs well ahead of underlying fundamentals based on projected growth and profitability.

Meta’s Threads app has grown strongly, reaching 320 million monthly active users by Q4 2024. This aligns with my expectations of a successful launch of a Twitter competitor. Meanwhile, WhatsApp continues to gain traction, particularly in the U.S., where it now boasts over 100 million monthly active users. These platforms are expected to contribute significantly to Meta’s revenue diversification, reducing reliance on its core advertising business. However, the challenge remains in monetizing these platforms effectively, as WhatsApp’s revenue growth, while impressive, still represents a small fraction of Meta’s overall revenue.

Ever wondered what assumptions push Meta’s estimated fair value far below its stock price? One crucial factor behind this major disconnect is that the narrative builds in aggressive growth across new platforms but questions real profitability. Which business bets are assumed to pay off, and what growth rates support the math? The hidden drivers just might surprise you. Is your curiosity piqued?

Result: Fair Value of $538.09 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, regulatory hurdles or an economic downturn could quickly test the company's ambitious growth assumptions and change investors’ expectations for Meta's future.

Find out about the key risks to this Meta Platforms narrative.Another View: SWS DCF Model Offers a Contrasting Perspective

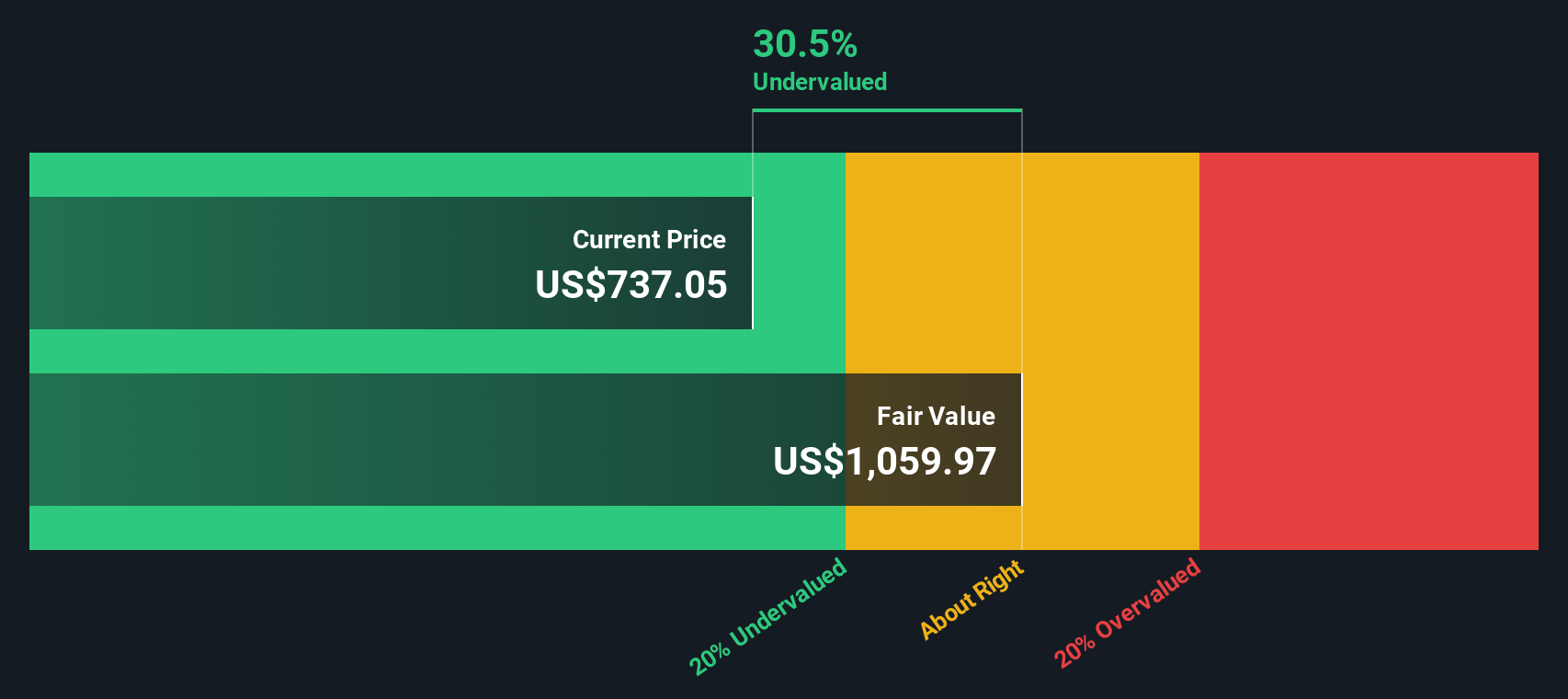

While the most popular belief is that Meta is overvalued, our SWS DCF model arrives at a starkly different result. This suggests the stock may actually offer value at current levels. Does this competing outlook signal hidden upside, or highlight just how uncertain fair value can be?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Meta Platforms for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Meta Platforms Narrative

If you have a different perspective or want to dive deeper into the numbers yourself, you can craft your own Meta Platforms narrative in just minutes. Do it your way

A great starting point for your Meta Platforms research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t miss your chance to level up your portfolio by targeting unique opportunities outside the headlines. Smart investors look beyond the obvious, and so should you.

- Unlock untapped growth by scanning penny stocks with strong financials for companies making bold moves in emerging markets: penny stocks with strong financials.

- Tap into tomorrow’s technology leaders by tracking AI-powered upstarts reshaping industries: AI penny stocks.

- Boost your income potential by finding high-yield opportunities with dividend stocks boasting yields above 3 percent: dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:META

Meta Platforms

Engages in the development of products that enable people to connect and share with friends and family through mobile devices, personal computers, virtual reality (VR) headsets, and AI glasses in the United States, Canada, Europe, Asia-Pacific, and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

TSMC will drive future growth with CoWoS packaging and N2 rollout

Beyond 2026, Beyond a Double

A case for TSXV:AUMB to reach USD$2.69 (CAD$3.70) by 2030 (15X).

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

Nedbank please contact me,l need guidance step by step, please

CEO comp looks high on the surface, but context matters. Cognyte is approaching profitability — losses narrowed 23% YoY and they’re now guiding positive adjusted EBITDA of $47M for FY26. Revenue is growing 12-14% annually with a debt-free balance sheet. The board is compensating for execution on a turnaround, not rewarding stagnation. If they hit their $500M revenue / 20%+ EBITDA margin target by FY28, today’s comp will look like a bargain in hindsight. Imagine if everyone that has invested in Tesla 10 years ago had the same mentality...