- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:META

Is Meta Still Attractively Priced After AI Spending Surge and 458% Three Year Rally?

Reviewed by Bailey Pemberton

- If you are wondering whether Meta Platforms is still worth buying after its huge run, or if you would just be paying up for yesterday's growth story, this breakdown is designed to give you a clear, valuation first answer.

- After a 458.4% gain over the last 3 years and a 144.6% rise over 5 years, the stock has cooled a little recently, with an 8.7% gain over 30 days, 8.4% year to date and a modest 9.4% move over the last year.

- Recent price action has been shaped by big strategic moves, from Meta's ramp up in AI infrastructure spending, including its custom Meta Training and Inference Accelerator chips, to ongoing investment in Reels and the metaverse. At the same time, regulatory headlines around data privacy, competition scrutiny and social media content policies continue to influence investor perceptions of long term risk and reward.

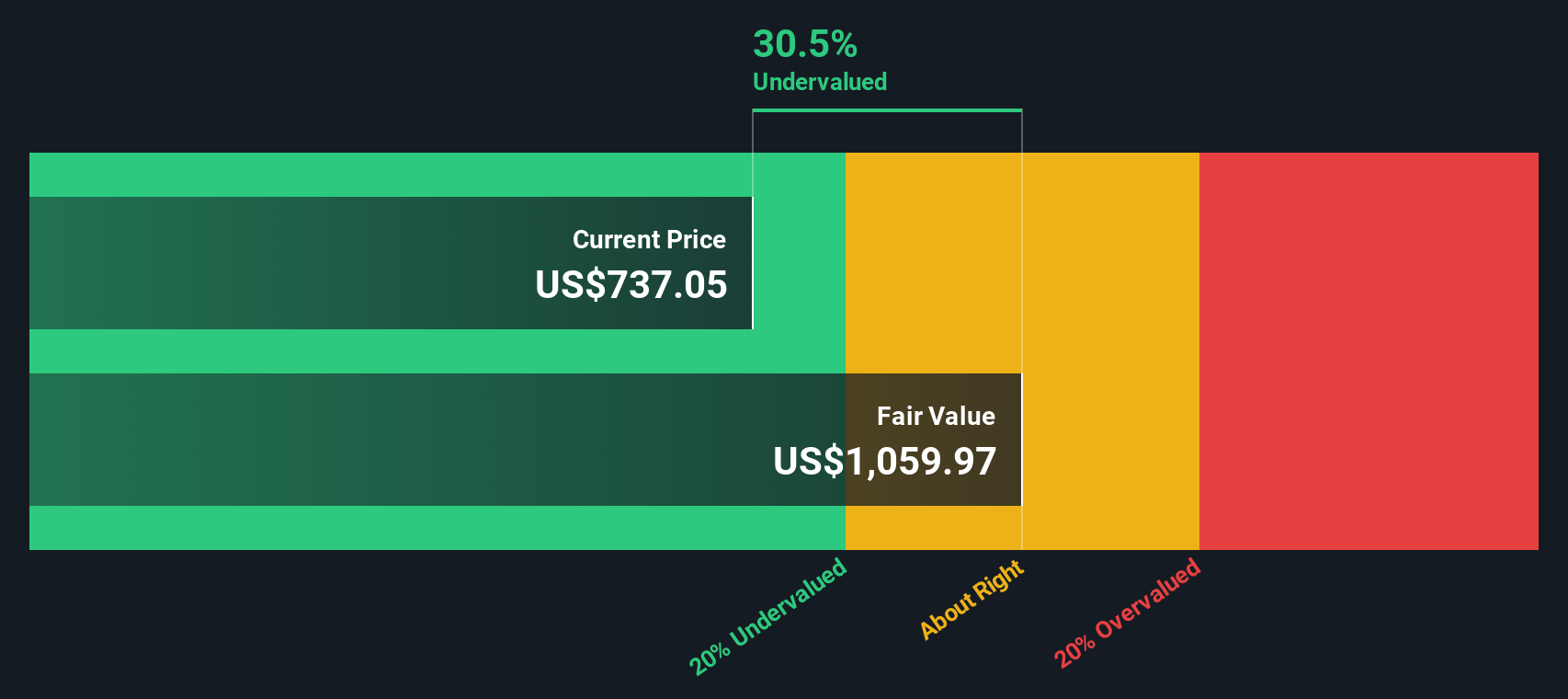

- Even after that history, Meta scores a solid 5/6 on our valuation checks, suggesting the market may not be fully pricing in its cash flow and asset strength. Next, we will walk through different valuation approaches, before finishing with a potentially more effective way to judge what the stock is really worth.

Find out why Meta Platforms's 9.4% return over the last year is lagging behind its peers.

Approach 1: Meta Platforms Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth by projecting its future cash flows and discounting them back to today, using a required return to reflect risk and the time value of money.

For Meta Platforms, the model starts with last twelve month Free Cash Flow of about $58.8 billion and uses analyst forecasts for the next few years, then extends the trend further out. By 2029, annual Free Cash Flow is projected to reach around $90.1 billion, and further extrapolations out to 2035 suggest continued, but moderating, growth in cash generation, all in $.

Combining these projected cash flows in a two stage Free Cash Flow to Equity model gives an estimated intrinsic value of about $840.64 per share. This comparison with the current share price implies the shares may be trading at roughly a 22.7% discount to that value, based on this specific DCF framework and its assumptions.

Result: UNDERVALUED (DCF-based estimate)

Our Discounted Cash Flow (DCF) analysis suggests Meta Platforms is undervalued by 22.7%. Track this in your watchlist or portfolio, or discover 912 more undervalued stocks based on cash flows.

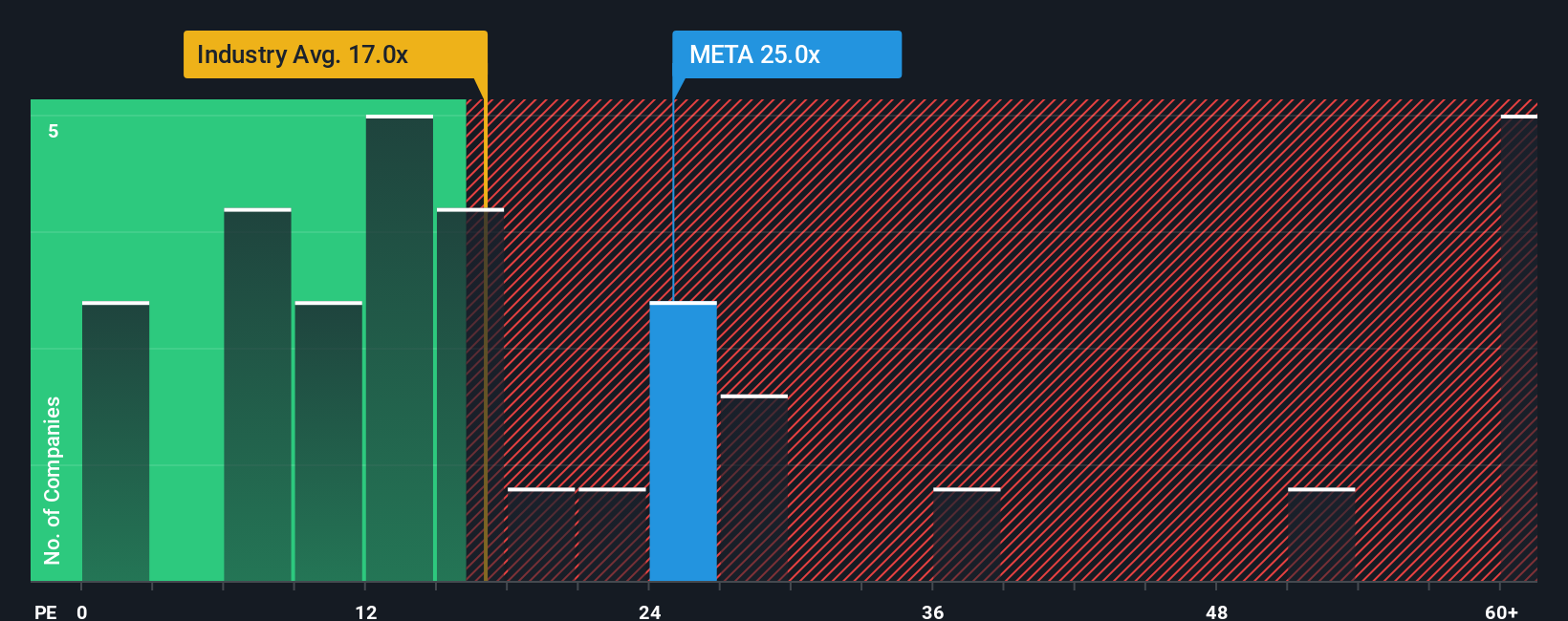

Approach 2: Meta Platforms Price vs Earnings

For profitable, mature businesses like Meta, the price to earnings ratio is a practical way to judge valuation because it compares what investors pay today with the profits the company is already generating. A higher or lower PE can be reasonable depending on how fast earnings are expected to grow, how stable those earnings are, and how much risk investors see in the business.

Meta currently trades on a PE of about 28x, which is well above the Interactive Media and Services industry average of roughly 16.3x, but below the peer group average of about 35.0x. To go a step further, Simply Wall St calculates a Fair Ratio of around 37.2x, which is the PE you might expect given Meta's earnings growth outlook, profitability, size, industry and specific risk profile.

This Fair Ratio is more informative than a simple comparison with industry or peers, because those benchmarks can be skewed by slower growing incumbents, unprofitable disruptors or very different risk profiles. Against this tailored 37.2x benchmark, Meta's current 28x multiple suggests the market is still applying a discount relative to what its fundamentals may warrant.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1463 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Meta Platforms Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to attach a clear story about a company to the numbers you care about, like its fair value, and your expectations for future revenue, earnings and margins.

A Narrative on Simply Wall St links three pieces together: the business story you believe, the financial forecast that follows from that story, and the fair value estimate that falls out of that forecast, so you can see exactly why a company might be cheap or expensive to you.

These Narratives are easy to use and live inside the Community page on Simply Wall St, where millions of investors share their views and where the platform automatically updates each Narrative when new data, news or earnings are released.

Narratives can help you clarify your own view by comparing your fair value estimate to the current price. For example, if you believe Meta’s AI and metaverse investments will drive higher margins and support a fair value near the top end of recent estimates, or you are more cautious and anchor closer to the low end, you can make more informed decisions based on your own numbers rather than someone else’s target.

For Meta Platforms however we will make it really easy for you with previews of two leading Meta Platforms Narratives:

Fair value: $841.42

Implied undervaluation vs current price: 22.8%

Forecast revenue growth: 16.45%

- Sees Meta’s heavy AI and infrastructure investments as the key driver of higher engagement, stronger ad performance and durable long term revenue growth.

- Expects faster monetization across Reels, messaging and commerce to create new revenue streams and support strong, though slightly lower, future profit margins.

- Acknowledges higher capex, Reality Labs losses and regulatory pressure as real risks, but believes long term upside outweighs these headwinds at today’s price.

Fair value: $538.09

Implied overvaluation vs current price: 20.7%

Forecast revenue growth: 10.5%

- Argues that while Meta can maintain social media and AI leadership, the stock already prices in much of that success, leaving limited upside.

- Highlights execution and monetization risks around Reality Labs, metaverse and AR or VR, alongside very large ongoing AI capex that could constrain margins.

- Stresses vulnerability to regulation, ad cycle slowdowns and competitive threats, suggesting investors may be overpaying for future growth and diversification.

Do you think there's more to the story for Meta Platforms? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:META

Meta Platforms

Engages in the development of products that enable people to connect and share with friends and family through mobile devices, personal computers, virtual reality and mixed reality headsets, augmented reality, and wearables worldwide.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion